Get the free TDS ON SALARY AND OTHER PAYMENTS FINANCIAL YEAR 201011

Show details

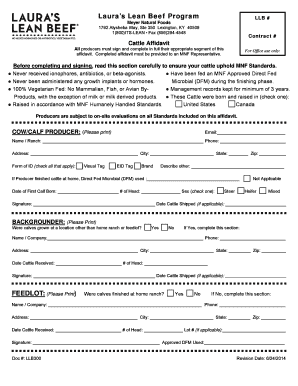

ANDHRA MARATHI GREEN BANK HEAD OFFICE :: ADAPT Circular No.39 2011BCSTF Date:14.02.2011 TDS ON SALARY AND OTHER PAYMENTS FINANCIAL YEAR 201011 *** For the F. Y 201011, TDS is to be deducted from salary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tds on salary and

Edit your tds on salary and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tds on salary and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tds on salary and online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tds on salary and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tds on salary and

How to fill out TDS on Salary and:

01

Obtain the correct Form 16: The employer should provide you with a Form 16, which is a document that summarizes the salary paid to you during the financial year. Make sure you have this form before proceeding.

02

Understand the TDS calculation: TDS (Tax Deducted at Source) is the amount deducted from your salary by the employer to fulfill the income tax liability. It is important to understand how TDS is calculated, taking into account factors such as income, allowances, deductions, and tax slabs.

03

Declare and calculate income: Determine your total income for the financial year from all sources and include it in the specified format. This should be the amount after deducting exemptions and deductions as per the Income Tax Act.

04

Enter taxable salary details: Enter your taxable salary, which includes basic salary, allowances, perquisites, and any other income that forms part of your salary package. Ensure accurate calculations and include relevant details such as rent-free accommodation, leave travel allowance, etc.

05

Include deductions and exemptions: Deduct the permissible deductions and exemptions from your taxable salary. These may include allowances like house rent allowance (HRA), medical reimbursements, and deductions under section 80C for investments such as provident fund, life insurance premium, or tuition fees.

06

Calculate tax liability: Use the applicable tax slabs to calculate your tax liability on the basis of the taxable salary and deductions/exemptions. Pay attention to the latest tax slab rates and follow the correct formula to determine the accurate tax amount.

07

Deduct existing TDS: If any TDS has already been deducted from your salary throughout the financial year, subtract it from your tax liability. Understand the TDS provisions and ensure that the deducted amount is correctly reflected in your Form 16.

Who needs TDS on Salary and:

01

Employees earning a salary: TDS on Salary applies to individuals who receive a salary income from an employer. This includes both government and private sector employees.

02

Employers: Employers are responsible for deducting TDS on Salary from their employees' income and remitting it to the government. They need to comply with the TDS provisions and ensure accurate calculations and timely payments.

03

Tax authorities: TDS on Salary is necessary for the tax authorities to ensure the collection of income tax. It helps to streamline the tax collection process and enforce compliance with the tax laws.

Note: It is always advisable to consult a tax professional or refer to the official income tax guidelines for specific details and personalized assistance regarding the filing of TDS on Salary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in tds on salary and?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your tds on salary and to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the tds on salary and electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your tds on salary and in seconds.

How do I complete tds on salary and on an Android device?

Use the pdfFiller mobile app and complete your tds on salary and and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is tds on salary and?

TDS on salary is tax deducted at source from an individual's salary.

Who is required to file tds on salary and?

Employers are required to file TDS on salary for their employees.

How to fill out tds on salary and?

TDS on salary can be filled out online through the TRACES portal or through tax software.

What is the purpose of tds on salary and?

The purpose of TDS on salary is to collect tax from individuals at the time of payment of income.

What information must be reported on tds on salary and?

Information such as PAN, salary details, TDS deduction details, etc. must be reported on TDS on salary.

Fill out your tds on salary and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tds On Salary And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.