Get the free Chapter 13 bankruptcy trustee dianne kerns

Show details

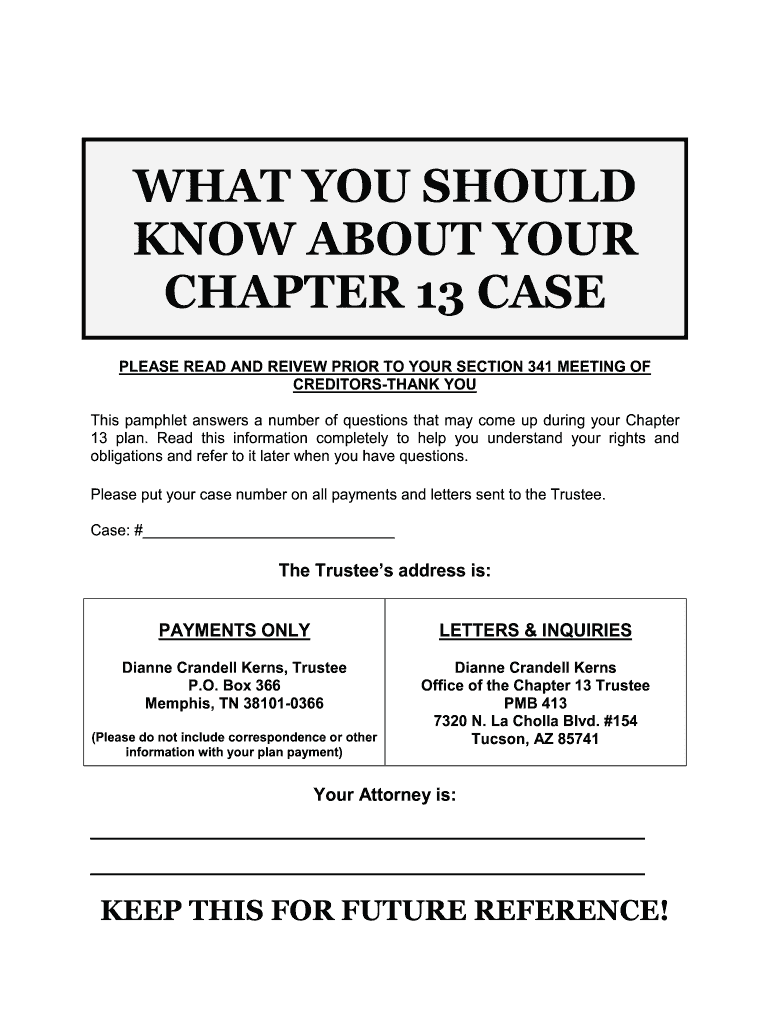

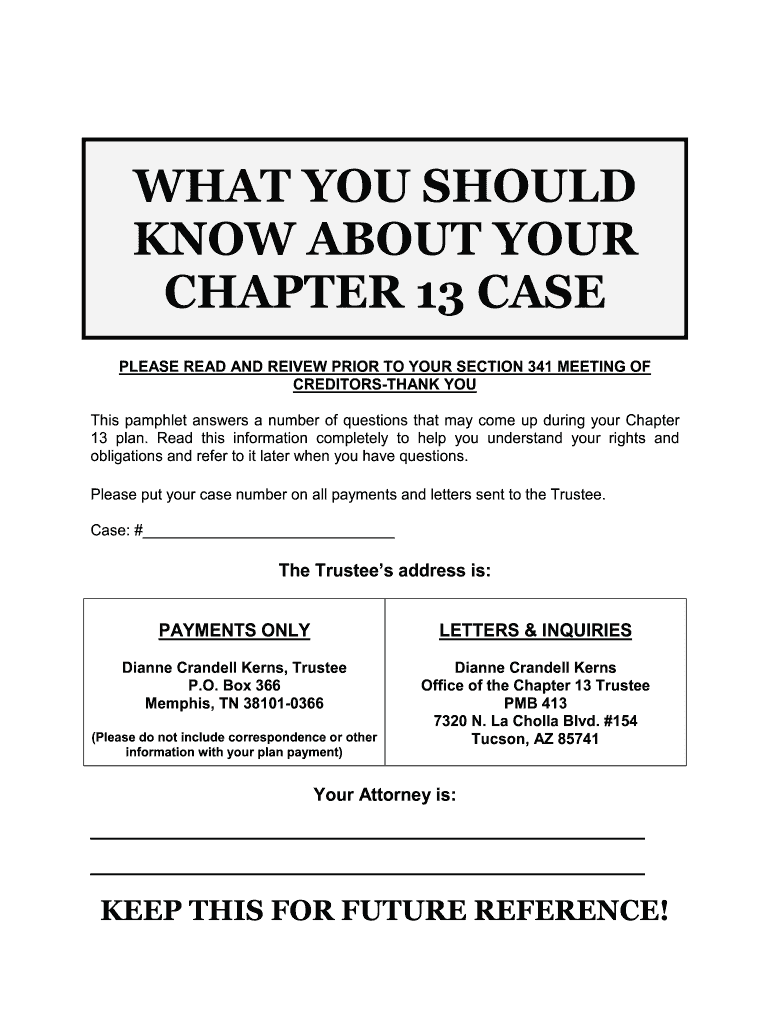

WHAT YOU SHOULD KNOW ABOUT YOUR CHAPTER 13 CASE PLEASE READ AND RIVER PRIOR TO YOUR SECTION 341 MEETING OF CREDITORSTHANK YOU This pamphlet answers a number of questions that may come up during your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 13 bankruptcy trustee

Edit your chapter 13 bankruptcy trustee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 13 bankruptcy trustee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chapter 13 bankruptcy trustee online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit chapter 13 bankruptcy trustee. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 13 bankruptcy trustee

How to Fill Out Chapter 13 Bankruptcy Trustee:

Gather all necessary documentation:

01

Collect all financial documents such as income records, bank statements, tax returns, and asset information.

02

Compile a list of all creditors, including the amount owed to each.

Complete the required bankruptcy forms:

01

Obtain the official bankruptcy forms from your local bankruptcy court or their website.

02

Fill out the necessary information accurately, including your personal details, income, expenses, assets, and liabilities.

03

Make sure to disclose all relevant financial information to the best of your knowledge.

Create a Chapter 13 repayment plan:

01

Work closely with your bankruptcy attorney to develop a feasible repayment plan based on your income and expenses.

02

Ensure that the plan provides for repayment of any secured debts (such as mortgages or car loans) and prioritizes priority debts (such as tax obligations or child support).

Consult with a credit counselor:

01

Before filing for Chapter 13 bankruptcy, you may need to complete a credit counseling course approved by the court.

02

This counseling session aims to assess your financial situation and provide guidance on budgeting and debt management.

File the bankruptcy forms:

01

Submit the completed bankruptcy forms to your local bankruptcy court.

02

Pay the required filing fee unless you qualify for a fee waiver or installment plan.

03

Keep copies of the forms for your records and ensure they are filed within the designated deadline.

Attend the meeting of creditors:

01

After filing for bankruptcy, you will be required to attend the meeting of creditors, also known as the 341 meeting.

02

This meeting allows the bankruptcy trustee, creditors and your attorney to ask questions regarding your financial situation and the proposed repayment plan.

Who Needs Chapter 13 Bankruptcy Trustee:

Chapter 13 bankruptcy trustee is required for individuals who have decided to file for Chapter 13 bankruptcy. This type of bankruptcy is designed for individuals with regular income who are struggling with substantial debt and want to reorganize their finances.

The role of the bankruptcy trustee in Chapter 13 cases is to oversee the repayment plan, ensure that the plan is feasible, and distribute payments to creditors. They act as an intermediary between the debtor and the creditors, working to achieve a fair resolution for both parties.

The bankruptcy trustee plays a crucial role in reviewing the debtor's financial information, verifying the accuracy of the repayment plan, and monitoring the debtor's compliance throughout the process. They also handle any objections raised by creditors and assist in resolving disputes.

Overall, Chapter 13 bankruptcy trustees are essential in facilitating the restructuring of debts and helping individuals regain control of their financial situation while ensuring fairness and compliance with bankruptcy laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is chapter 13 bankruptcy trustee?

Chapter 13 bankruptcy trustee is a court-approved individual responsible for overseeing the repayment plan in Chapter 13 bankruptcy cases.

Who is required to file chapter 13 bankruptcy trustee?

Individuals who have a regular source of income and unsecured debts below a certain threshold are eligible to file for Chapter 13 bankruptcy.

How to fill out chapter 13 bankruptcy trustee?

To fill out Chapter 13 bankruptcy trustee, individuals must provide information about their income, expenses, assets, and debts, as well as propose a repayment plan.

What is the purpose of chapter 13 bankruptcy trustee?

The purpose of Chapter 13 bankruptcy trustee is to help individuals reorganize their debts and create a manageable repayment plan to satisfy creditors.

What information must be reported on chapter 13 bankruptcy trustee?

Information such as income, expenses, assets, debts, creditor information, and proposed repayment plan must be reported on Chapter 13 bankruptcy trustee.

How can I modify chapter 13 bankruptcy trustee without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like chapter 13 bankruptcy trustee, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send chapter 13 bankruptcy trustee for eSignature?

When your chapter 13 bankruptcy trustee is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find chapter 13 bankruptcy trustee?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific chapter 13 bankruptcy trustee and other forms. Find the template you need and change it using powerful tools.

Fill out your chapter 13 bankruptcy trustee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 13 Bankruptcy Trustee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.