Get the free Equipment loan bapplicationb - Nizari Progressive Federal Credit Union

Show details

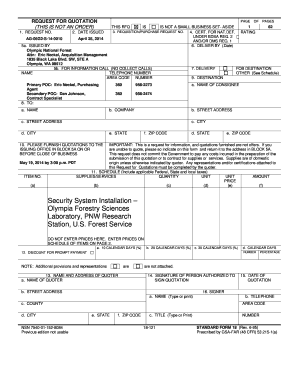

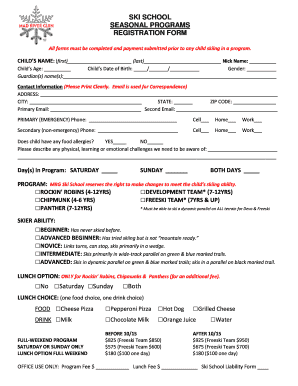

EQUIPMENT LOAN APPLICATION LOAN AMOUNT $49,900 MAXIMUM LOAN TERM INTEREST RATE QUALIFIED PRODUCTS LOAN COLLATERAL 60 MONTHS 6.99% APR NEW EQUIPMENT FIRST LIEN ON EQUIPMENT Applicant Criteria to be

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign equipment loan bapplicationb

Edit your equipment loan bapplicationb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your equipment loan bapplicationb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit equipment loan bapplicationb online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit equipment loan bapplicationb. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out equipment loan bapplicationb

How to Fill Out Equipment Loan Application:

01

Start by gathering all the necessary information and documents required to fill out the application. This may include your personal identification details, proof of income, and any additional information specific to the loan.

02

Carefully review the application form to understand the sections and questions being asked. Ensure that you have a clear understanding of the terms and conditions of the loan before proceeding.

03

Begin filling out the application by accurately providing your personal information, such as your full name, contact information, and social security number. Ensure that all the details are entered correctly and legibly.

04

Proceed to fill out the sections related to your employment and income. This may include your current employer's name, contact information, job title, salary, and any other relevant details. Be sure to provide accurate information to avoid any discrepancies.

05

If required, fill out the section related to your existing loans or outstanding debts. This information will help the lender assess your financial situation and ability to repay the loan.

06

Next, provide details about the equipment you wish to borrow and the purpose of the loan. Include information such as the equipment's make, model, value, and any other relevant details requested by the lender.

07

Double-check all the information you have entered to ensure accuracy and completeness. Reviewing the application form before submission helps to minimize errors and streamline the loan approval process.

08

If applicable, attach any supporting documents required by the lender, such as proof of income, identification documents, or documents related to the equipment being financed. Ensure that all attachments are labeled correctly for easy reference.

09

After completing all the necessary sections and reviewing the application, submit it as instructed by the lender. This may involve submitting a physical copy by mail or electronically through an online portal.

Who Needs Equipment Loan Application:

01

Small business owners: Business owners often require equipment loans to finance the purchase of essential tools, machinery, or technology needed to operate their businesses effectively.

02

Contractors: Professionals in the construction, manufacturing, or service industry may need equipment loans to acquire specialized tools, vehicles, or heavy machinery required for their projects.

03

Startups or entrepreneurs: Individuals starting new ventures or launching innovative products may require equipment loans to obtain the necessary equipment or technology needed to bring their ideas to life.

04

Agricultural sector: Farmers, ranchers, or agricultural businesses often require equipment loans to purchase tractors, harvesting machines, or other specialized equipment necessary for their operations.

05

Medical professionals: Healthcare providers, such as doctors or dentists, may need equipment loans to acquire medical equipment, technology, or software to enhance patient care and improve their practices.

06

Non-profit organizations: Charities or non-profit organizations may require equipment loans to obtain vehicles, computers, or other essential equipment needed to support their services or initiatives.

Remember, eligibility requirements may vary among lenders, so it's recommended to research and approach the appropriate financial institutions or lenders that specialize in equipment financing to ensure a smooth application process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is equipment loan application?

An equipment loan application is a formal request submitted by an individual or organization to borrow equipment for a specific purpose.

Who is required to file equipment loan application?

Anyone who wishes to borrow equipment from a lender or leasing company is required to file an equipment loan application.

How to fill out equipment loan application?

To fill out an equipment loan application, you typically need to provide information about the equipment you wish to borrow, the purpose of the loan, your contact information, and your financial details.

What is the purpose of equipment loan application?

The purpose of an equipment loan application is to formally request to borrow equipment for a specific purpose, such as business operations, event planning, or personal use.

What information must be reported on equipment loan application?

The information that must be reported on an equipment loan application typically includes details about the equipment, the borrower's contact information, the loan purpose, and any financial information required by the lender.

How can I edit equipment loan bapplicationb from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your equipment loan bapplicationb into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make changes in equipment loan bapplicationb?

With pdfFiller, it's easy to make changes. Open your equipment loan bapplicationb in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit equipment loan bapplicationb on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as equipment loan bapplicationb. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your equipment loan bapplicationb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Equipment Loan Bapplicationb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.