Get the free Tax Increment Financing Proposal 284 Elm Street Archgrove bb

Show details

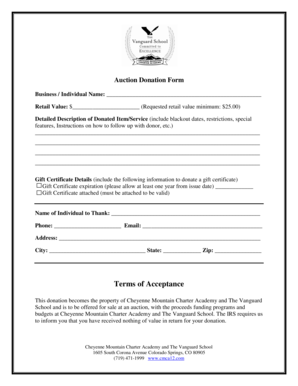

TaxIncrementFinancingProposal 284ElmStreetArchgroveHopsitialty HotelProject CityofAmesbury October2014 MayorKenGray William Scott Director OfficeofCommunityandEconomicDevelopment CityofAmesbury Scott

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax increment financing proposal

Edit your tax increment financing proposal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax increment financing proposal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax increment financing proposal online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax increment financing proposal. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax increment financing proposal

How to fill out a tax increment financing proposal?

01

Research and gather information: Start by researching the specific requirements and guidelines for tax increment financing in your area. Familiarize yourself with the purpose and objectives of the proposal and understand the criteria for eligibility.

02

Identify the project: Clearly define and describe the project for which you are seeking tax increment financing. Explain the objectives, scope, and expected outcomes of the proposed project.

03

Assess the financial impact: Conduct a comprehensive financial analysis to determine the potential costs and benefits of the project. This includes estimating the initial investment required, projected revenue streams, and anticipated impact on property values and tax revenues.

04

Prepare a detailed budget: Create a comprehensive budget that outlines all the anticipated expenses and revenues for the project. This includes construction costs, infrastructure improvements, operating expenses, and any other related costs. Make sure to include a breakdown of funding sources and how tax increment financing will be utilized.

05

Engage with stakeholders: Reach out to relevant stakeholders such as government officials, community leaders, and potential investors to gauge their interest and support for the proposal. Address any concerns they may have and demonstrate how tax increment financing will positively impact the community and spur economic growth.

06

Outline the implementation plan: Clearly outline the steps and timeline for implementing the project. This includes the construction schedule, key milestones, and any necessary permits or regulatory requirements.

Who needs a tax increment financing proposal?

01

Local governments: Tax increment financing proposals are typically initiated by local governments or agencies that aim to stimulate economic development within a specific area. They can utilize tax increment financing to attract private investment and finance infrastructure improvements that will promote growth and enhance the community.

02

Developers/Investors: Developers and investors who are planning large-scale projects that require significant investment may seek tax increment financing as a means of securing funding. This allows them to access additional resources and potentially reduce their financial risk.

03

Community organizations: Non-profit organizations and community groups may also benefit from tax increment financing if they have projects that align with the goals of the local government. This could include initiatives focused on affordable housing, job creation, or revitalizing underserved areas.

In summary, to fill out a tax increment financing proposal, you need to thoroughly research the requirements, clearly define your project, assess the financial impact, prepare a detailed budget, engage with stakeholders, and outline your implementation plan. Tax increment financing is typically sought by local governments, developers/investors, and community organizations who aim to stimulate economic growth and undertake projects that align with the community's objectives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax increment financing proposal?

Tax increment financing proposal is a tool used by municipalities to finance public infrastructure projects in a designated area by capturing the increase in property tax revenue resulting from the development or redevelopment of that area.

Who is required to file tax increment financing proposal?

Developers or municipalities looking to implement a tax increment financing district are required to file a proposal with the local government.

How to fill out tax increment financing proposal?

To fill out a tax increment financing proposal, you will need to provide detailed information about the proposed project, the expected increase in property values, estimated costs, and potential timelines for completion.

What is the purpose of tax increment financing proposal?

The purpose of a tax increment financing proposal is to spur economic development in blighted or underdeveloped areas by leveraging future increases in property tax revenues to fund current infrastructure improvements.

What information must be reported on tax increment financing proposal?

Information such as the project description, anticipated costs, estimated property value increases, timeline for completion, and the expected impact on the community are typically reported on a tax increment financing proposal.

How can I manage my tax increment financing proposal directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign tax increment financing proposal and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send tax increment financing proposal for eSignature?

Once your tax increment financing proposal is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I fill out the tax increment financing proposal form on my smartphone?

Use the pdfFiller mobile app to fill out and sign tax increment financing proposal on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your tax increment financing proposal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Increment Financing Proposal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.