Get the free HSA Fundamentals Health Savings Account Disclosure Statement bb

Show details

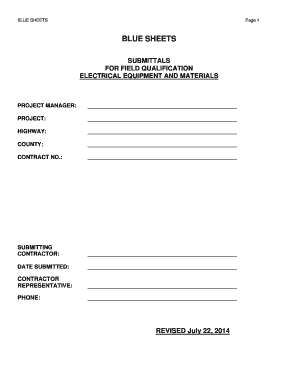

HSA Fundamentals Health Savings Account Disclosure Statement and Adoption Agreement HSA Fundamentals Disclosure Statement TAX DEDUCTIONS* HEALTH SAVINGS ACCOUNT* Contributions to an HSA are tax-deductible

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hsa fundamentals health savings

Edit your hsa fundamentals health savings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hsa fundamentals health savings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

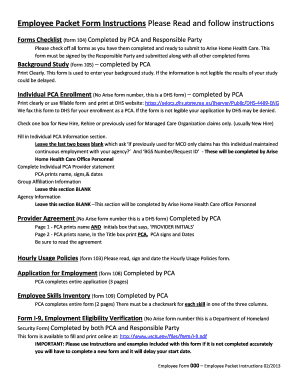

Editing hsa fundamentals health savings online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit hsa fundamentals health savings. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hsa fundamentals health savings

How to fill out HSA Fundamentals Health Savings:

01

Start by gathering all the necessary information and documents, such as your personal identification details, financial statements, and insurance information.

02

Research and select a suitable HSA provider or financial institution to open your HSA account with. Consider factors such as fees, investment options, and customer reviews.

03

Complete the account application either online or by filling out a paper form. Provide accurate and up-to-date information to ensure smooth processing of your HSA account.

04

Once your account is opened, you will typically receive a welcome package or email with important account details and instructions.

05

Review the terms and conditions of the HSA account, including the contribution limits, eligible expenses, and withdrawal rules. Familiarize yourself with any fees associated with the account.

06

Determine your contribution strategy based on your financial goals, healthcare expenses, and eligibility. Decide how much you can comfortably contribute to your HSA each year.

07

Set up automated contributions from your paycheck or make manual contributions to your HSA account regularly to maximize its benefits.

08

Keep track of your HSA contributions, expenses, and withdrawals throughout the year. It is crucial to maintain detailed records and receipts of qualified medical expenses for tax purposes.

09

Understand how to use your HSA funds to pay for eligible healthcare expenses. This may involve using a debit card linked to your HSA account or submitting reimbursement forms to your HSA provider.

10

Periodically review your HSA account statements, investment performance, and any changes to the HSA regulations to ensure you are making the most of your funds.

Who needs HSA Fundamentals Health Savings?

01

Individuals who anticipate high healthcare expenses, such as those with chronic conditions or who require regular medical treatments.

02

People who want to take control of their healthcare finances and have the ability to save and invest funds specifically designated for medical expenses.

03

Employees who have access to a high-deductible health insurance plan and want to take advantage of the tax advantages and savings potential offered by an HSA.

04

Self-employed individuals who are looking for a tax-efficient way to save for future healthcare costs.

05

Those who want to have a dedicated account to cover both current and future medical expenses, including eligible out-of-pocket costs, deductibles, and co-pays.

06

Individuals who want to build a healthcare nest egg and have flexibility in how they use their HSA funds, including the ability to use them in retirement for Medicare premiums or long-term care expenses.

07

Those who desire a portable healthcare savings option that remains with them, even if they change jobs or health insurance plans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is hsa fundamentals health savings?

HSA Fundamentals Health Savings is a type of savings account that allows individuals to save money for future medical expenses on a tax-advantaged basis.

Who is required to file hsa fundamentals health savings?

Individuals who have a High Deductible Health Plan (HDHP) and meet other eligibility criteria are required to file HSA Fundamentals Health Savings.

How to fill out hsa fundamentals health savings?

To fill out HSA Fundamentals Health Savings, individuals need to provide information about their contributions, withdrawals, and qualified medical expenses throughout the year.

What is the purpose of hsa fundamentals health savings?

The purpose of HSA Fundamentals Health Savings is to help individuals save and pay for qualified medical expenses without incurring taxes on the funds.

What information must be reported on hsa fundamentals health savings?

Information such as contributions, withdrawals, and qualified medical expenses must be reported on HSA Fundamentals Health Savings.

How do I make changes in hsa fundamentals health savings?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your hsa fundamentals health savings and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for the hsa fundamentals health savings in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I edit hsa fundamentals health savings on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as hsa fundamentals health savings. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your hsa fundamentals health savings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hsa Fundamentals Health Savings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.