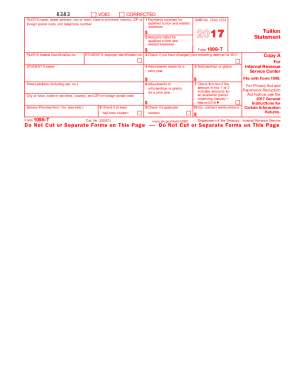

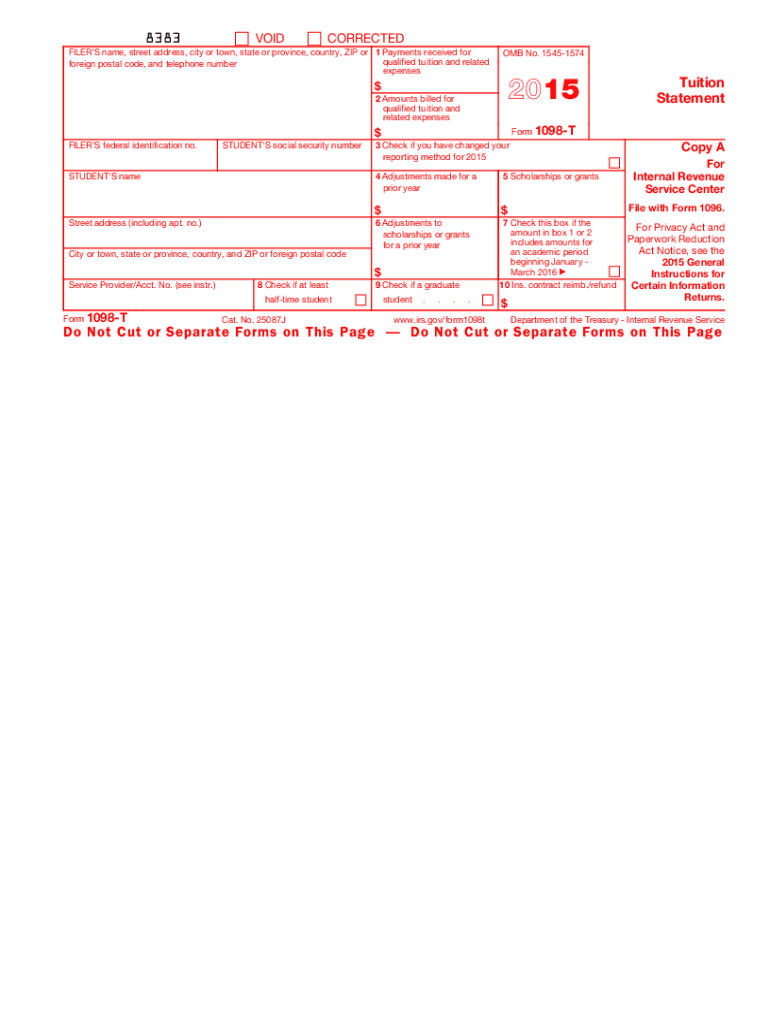

IRS 1098-T 2015 free printable template

Instructions and Help about IRS 1098-T

How to edit IRS 1098-T

How to fill out IRS 1098-T

About IRS 1098-T 2015 previous version

What is IRS 1098-T?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1098-T

How can I get [SKS]?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific [SKS] and other forms. Find the template you want and tweak it with powerful editing tools.

Can I sign the [SKS] electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your [SKS] and you'll be done in minutes.

How do I fill out [SKS] on an Android device?

Complete [SKS] and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is IRS 1098-T?

IRS 1098-T is a tax form used by eligible educational institutions to report information about their students' qualified tuition and related expenses, as well as scholarships and grants received.

Who is required to file IRS 1098-T?

Eligible educational institutions are required to file IRS 1098-T for each student who is enrolled and for whom they have received qualified tuition payments.

How to fill out IRS 1098-T?

To fill out IRS 1098-T, educational institutions need to enter the institution's information, the student's details, and report the amounts for qualified tuition and fees, any adjustments made, scholarships, and grants received during the tax year.

What is the purpose of IRS 1098-T?

The purpose of IRS 1098-T is to provide students and the IRS with information needed to claim education tax credits such as the American Opportunity Credit and the Lifetime Learning Credit.

What information must be reported on IRS 1098-T?

The information that must be reported on IRS 1098-T includes the institution's name, address, and EIN, the student's name, address, and taxpayer identification number, qualified tuition and related expenses, adjustments made, and any scholarships or grants received.

See what our users say