Get the free Auto-enrolment payroll guide for employers - Standard Life

Show details

MEET NRL TOE AU E FOR GUID ROLL PAY S YER reform data O Suspension guide E exchange Data makes autoenrolment run smoothly Employers have a number of duties as part of autoenrolment including assessment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign auto-enrolment payroll guide for

Edit your auto-enrolment payroll guide for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your auto-enrolment payroll guide for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit auto-enrolment payroll guide for online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit auto-enrolment payroll guide for. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out auto-enrolment payroll guide for

How to fill out auto-enrolment payroll guide for?

01

Understand the requirements: Familiarize yourself with the auto-enrolment regulations and guidelines set by the government. This includes understanding who needs to be enrolled, what information needs to be included, and any deadlines that need to be met.

02

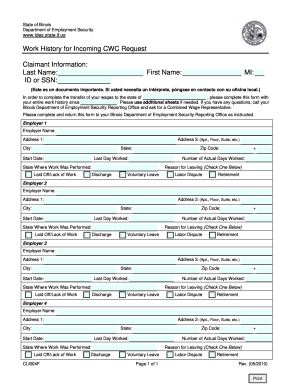

Gather necessary information: Collect all the relevant employee data required for auto-enrolment. This typically includes details such as employee names, addresses, national insurance numbers, and earnings.

03

Determine eligibility: Review each employee's eligibility for auto-enrolment based on their age and earnings. Make sure to identify eligible jobholders, non-eligible jobholders, and entitled workers as per the defined criteria.

04

Assess the pension scheme: Evaluate the existing pension scheme in place for your organization. Ensure it meets the minimum requirements set by the government. If necessary, make the necessary arrangements to enroll your employees in an approved scheme.

05

Communicate with employees: Inform your employees about the auto-enrolment process, their rights, and what it means for their pensions. Provide them with the necessary documentation, including a letter explaining auto-enrolment, pension scheme details, and opt-out options.

06

Update payroll systems: Modify your payroll software or system to accommodate the auto-enrolment process. This may involve configuring the system to deduct pension contributions automatically and generating accurate reports for record-keeping purposes.

07

Enroll employees: Once you have gathered all the essential information and made the necessary arrangements, enroll eligible employees into the pension scheme. This may involve submitting the necessary forms or online registrations to the pension provider.

Who needs auto-enrolment payroll guide for?

01

Small business owners: Employers who run small businesses and have employees working for them are required to comply with the auto-enrolment regulations. They need the guide to ensure they are meeting their legal obligations and properly enrolling eligible employees.

02

HR professionals: Professionals working in human resources departments of organizations need the auto-enrolment payroll guide to understand the intricacies of the process. They are responsible for managing the enrollment of employees, communicating with staff, and updating payroll systems accordingly.

03

Payroll administrators: Individuals responsible for managing and processing payroll within an organization also require the auto-enrolment payroll guide. They need to understand how to calculate and deduct pension contributions accurately, update employee records, and generate necessary reports.

Overall, the auto-enrolment payroll guide is essential for any employer or payroll professional who wants to comply with the auto-enrolment regulations and ensure their employees are enrolled in a suitable pension scheme.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is auto-enrolment payroll guide for?

Auto-enrolment payroll guide is a document that provides guidance on how to automatically enroll eligible employees in a workplace pension scheme.

Who is required to file auto-enrolment payroll guide for?

Employers are required to file auto-enrolment payroll guide for all eligible employees.

How to fill out auto-enrolment payroll guide for?

Auto-enrolment payroll guide should be filled out with accurate information about each employee's earnings, pension contributions, and other relevant details.

What is the purpose of auto-enrolment payroll guide for?

The purpose of auto-enrolment payroll guide is to ensure that eligible employees are enrolled in a workplace pension scheme in compliance with auto-enrolment regulations.

What information must be reported on auto-enrolment payroll guide for?

Information such as employee earnings, pension contributions, and other relevant details must be reported on auto-enrolment payroll guide.

Can I create an eSignature for the auto-enrolment payroll guide for in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your auto-enrolment payroll guide for and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I edit auto-enrolment payroll guide for on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing auto-enrolment payroll guide for.

How do I fill out auto-enrolment payroll guide for on an Android device?

Use the pdfFiller Android app to finish your auto-enrolment payroll guide for and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your auto-enrolment payroll guide for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Auto-Enrolment Payroll Guide For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.