Get the free BFormb ST-120111Resale CertificateST120 - Baby Banana Brush

Show details

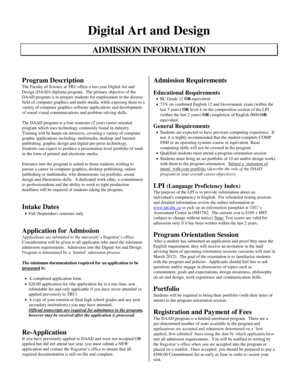

ST120 New York State Department of Taxation and Finance New York State and Local Sales and Use Tax (1/11) Resale Certificate Name of seller Name of purchaser MM ACCESSORIES CORP. MM ACCESSORIES CORP.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bformb st-120111resale certificatest120

Edit your bformb st-120111resale certificatest120 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bformb st-120111resale certificatest120 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bformb st-120111resale certificatest120 online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit bformb st-120111resale certificatest120. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bformb st-120111resale certificatest120

How to fill out bformb st-120111resale certificatest120:

01

Start by obtaining the form: The bformb st-120111resale certificatest120 can typically be obtained from the relevant government agency or department responsible for sales tax collection. It is important to use the most current version of the form.

02

Provide business information: Begin by filling out the required fields with your business information. This may include the legal name of your business, address, contact details, and other identifying information as requested on the form.

03

Indicate resale intention: The purpose of this certificate is to establish that you are purchasing the goods or services for resale rather than for personal use. Therefore, you will need to check the appropriate box or provide the necessary information to indicate that the certificate is being used for the purpose of resale.

04

Specify the type of goods/services: Provide details about the specific goods or services for which you are seeking resale exemption. This may include descriptions, product codes, or any other relevant information required by the form.

05

Sign and date the form: Once you have completed all the necessary fields, make sure to sign and date the form. This confirms the accuracy and authenticity of the information provided.

06

Keep a copy for your records: It is essential to keep a copy of the filled-out form for your own records. This will serve as a proof of exemption in case of any future audits or inquiries.

Who needs bformb st-120111resale certificatest120:

01

Businesses engaged in resale: Any business that intends to resell goods or services rather than use them for personal consumption may need to obtain and fill out the bformb st-120111resale certificatest120. This certificate helps establish their resale intentions and provides them with sales tax exemption for qualified transactions.

02

Wholesalers and retailers: Wholesalers and retailers who purchase goods from suppliers for the purpose of selling them to end consumers are among the primary recipients of the bformb st-120111resale certificatest120. It allows them to avoid paying sales tax on their purchases, as they will instead collect and remit the applicable sales tax when the goods are sold to the final consumers.

03

Resale businesses across various industries: The requirement for completing the bformb st-120111resale certificatest120 may apply to businesses operating in different sectors, such as automotive, electronics, clothing, furniture, and many others. As long as the business's intention is to resell the items purchased, they may need to utilize this certificate to claim the sales tax exemption.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is bformb st-120111resale certificatest120?

bformb st-120111resale certificatest120 is a resale certificate used for exemption from sales tax when purchasing goods for resale.

Who is required to file bformb st-120111resale certificatest120?

Retailers or businesses purchasing goods for resale are required to file bformb st-120111resale certificatest120.

How to fill out bformb st-120111resale certificatest120?

To fill out bformb st-120111resale certificatest120, you need to provide your business information, details of the goods being purchased for resale, and sign the certificate.

What is the purpose of bformb st-120111resale certificatest120?

The purpose of bformb st-120111resale certificatest120 is to claim exemption from sales tax on purchases made for resale.

What information must be reported on bformb st-120111resale certificatest120?

Information such as business name, address, seller's details, description of goods purchased, and a statement of resale intent must be reported on bformb st-120111resale certificatest120.

How can I manage my bformb st-120111resale certificatest120 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your bformb st-120111resale certificatest120 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send bformb st-120111resale certificatest120 for eSignature?

When you're ready to share your bformb st-120111resale certificatest120, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out the bformb st-120111resale certificatest120 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign bformb st-120111resale certificatest120 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your bformb st-120111resale certificatest120 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bformb St-120111resale certificatest120 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.