Get the free Charitable Donation of Securities in Kind

Show details

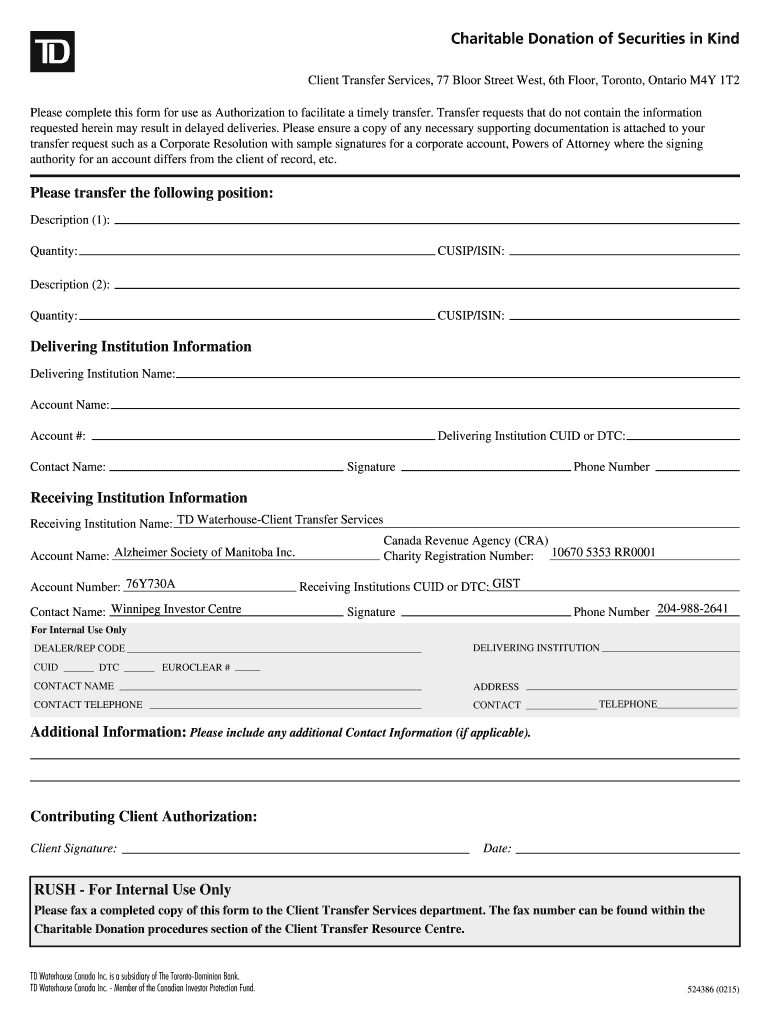

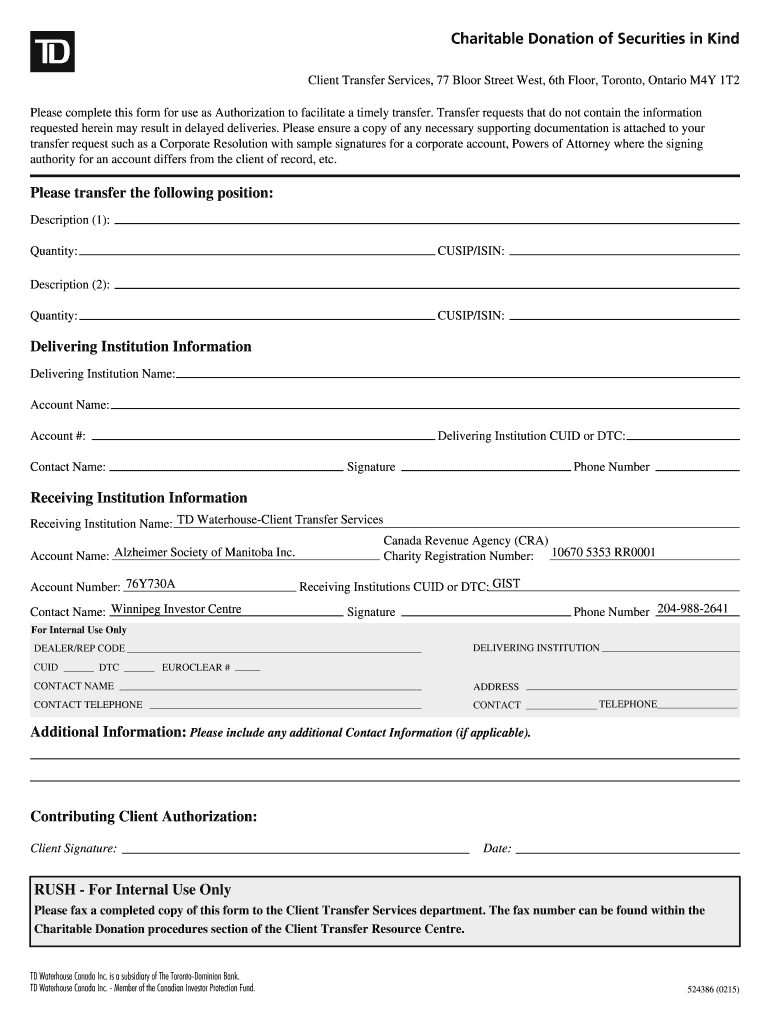

CLEAR BUTTON Charitable Donation of Securities in Kind Client Transfer Services, 77 Bloor Street West, 6th Floor, Toronto, Ontario M4Y 1T2 Please complete this form for use as Authorization to facilitate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable donation of securities

Edit your charitable donation of securities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable donation of securities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charitable donation of securities online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit charitable donation of securities. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable donation of securities

How to fill out charitable donation of securities?

01

Obtain the necessary forms: Start by contacting the charitable organization you wish to donate to and inquire about their process for accepting donated securities. They will provide you with the required forms and any instructions needed to complete them.

02

Gather information: Before filling out the forms, make sure you have all the necessary information readily available. This may include details about the securities you wish to donate, such as the name of the stock or mutual fund, the number of shares, and the date of acquisition.

03

Determine the fair market value: To accurately report the value of your donation, you will need to determine the fair market value of the securities on the date of the donation. This information can usually be obtained from your brokerage firm or financial advisor.

04

Fill out the forms: Carefully complete all the necessary sections of the donation forms provided by the charitable organization. This typically includes your personal information, information about the securities being donated, and the estimated value of the donation.

05

Seek professional advice: If you are unsure about any aspect of filling out the forms or determining the value of your securities, it is advisable to seek advice from a tax professional or financial advisor. They can guide you through the process and ensure that you are fulfilling all the necessary requirements.

06

Submit the forms: Once you have filled out the forms accurately, make copies for your records and submit the originals to the charitable organization. Follow their instructions for submission, which usually involve mailing or delivering the forms to a specific department or individual.

07

Retain documentation: Keep copies of all relevant documentation, including the completed forms, any acknowledgments or receipts provided by the charitable organization, and any supporting documentation related to the fair market value of the donation. These documents will be important for tax purposes and should be retained for your records.

Who needs charitable donation of securities?

01

Individuals interested in supporting a charitable cause: Anyone who is passionate about a particular charitable organization or cause may choose to make a charitable donation of securities as a way of showing support and making a positive impact.

02

Investors with appreciated securities: Donating appreciated securities can be advantageous for individuals who own stocks, bonds, or mutual funds that have significantly increased in value since their purchase. By donating these securities instead of selling them, investors can potentially avoid or minimize capital gains taxes while still making a valuable contribution.

03

Donors seeking tax benefits: Charitable donations of securities can offer tax benefits, such as deductions for the fair market value of the donated securities. For individuals looking to reduce their taxable income or mitigate their tax liability, donating securities can be a strategic option to consider.

04

Non-profit organizations: Charitable organizations often rely on the support of donors to fund their programs and activities. Accepting donations of securities allows these organizations to diversify their funding sources and can provide additional resources to further their mission.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is charitable donation of securities?

Charitable donation of securities refers to the act of donating stocks, bonds, or other investments to a charitable organization.

Who is required to file charitable donation of securities?

Individuals or entities who make charitable donations of securities are required to file.

How to fill out charitable donation of securities?

To fill out charitable donation of securities, one must provide details of the donated securities, including the type, quantity, and value.

What is the purpose of charitable donation of securities?

The purpose of charitable donation of securities is to support charitable organizations and receive tax benefits for the donation.

What information must be reported on charitable donation of securities?

Information such as the name of the charitable organization, date of donation, type and value of securities donated must be reported.

Where do I find charitable donation of securities?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific charitable donation of securities and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I execute charitable donation of securities online?

Filling out and eSigning charitable donation of securities is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit charitable donation of securities straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit charitable donation of securities.

Fill out your charitable donation of securities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Donation Of Securities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.