Get the free State Diesel fuel refund on non-taxable use

Show details

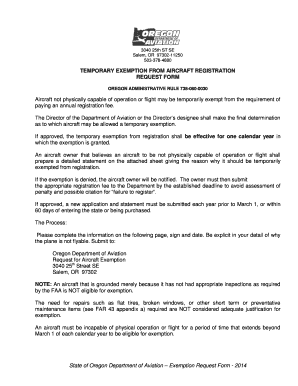

BOE770DU (S1) REV. 4 (403) STATE OF CALIFORNIA BOARD OF EQUALIZATION BOARD USE ONLY DIESEL FUEL CLAIM FOR REFUND ON NONTAXABLE USES / CLAIM PERIOD FOOD / THROUGH / RAB/A AUD REG RRQ / FILE REF YOUR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state diesel fuel refund

Edit your state diesel fuel refund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state diesel fuel refund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit state diesel fuel refund online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit state diesel fuel refund. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state diesel fuel refund

How to Fill Out State Diesel Fuel Refund:

01

Obtain the necessary forms: Start by visiting the website of your state's department of revenue or taxation to find the specific form for the diesel fuel refund. If you cannot find it online, contact the department directly and request a physical copy of the form.

02

Gather required documentation: Before filling out the form, gather all the necessary documentation, including fuel purchase receipts, invoices, and any other supporting documents required by your state. This may include detailed information on the number of gallons purchased, the type of fuel, and the date of purchase.

03

Fill out the form accurately: Carefully read the instructions provided with the refund form to ensure you complete it correctly. Enter all the required information accurately, including your personal or company details, such as name, address, taxpayer identification number, and any other requested information.

04

Provide supporting information: Attach all the supporting documentation requested by the form. This may include copies of fuel purchase receipts, invoices, or other relevant documents that prove your eligibility for the fuel refund. Make sure to organize these documents neatly and clearly label them to avoid any confusion.

05

Verify information and calculations: Once you have completed the form and attached all the required documents, double-check all the information provided. Verify that all calculations are accurate and there are no errors or omissions that could hinder your refund claim.

06

Submit the form: Once you are satisfied with the accuracy of your form and supporting documents, submit them according to the instructions provided. This may include mailing the form to the appropriate department or submitting it online through the department's website. Make sure to keep a copy of the form and supporting documents for your records.

Who Needs State Diesel Fuel Refund?

01

Commercial Fleets: Companies operating commercial fleets, such as delivery services, trucking companies, and public transportation agencies, often use diesel fuel extensively. These businesses may be eligible for a diesel fuel refund if they meet the specific requirements set by their state.

02

Farmers and Agricultural Businesses: Farmers and agricultural businesses that use diesel fuel for equipment, such as tractors or irrigation systems, may qualify for a state diesel fuel refund. This refund aims to support the agricultural sector and alleviate some of the financial burdens associated with fuel costs.

03

Other eligible entities: Apart from commercial fleets and farms, there may be other entities eligible for a state diesel fuel refund. This could include certain non-profit organizations, government agencies, or specific industries granted exemptions under state laws. It is essential to consult the guidelines provided by your state's department of revenue or taxation to determine if you qualify for a diesel fuel refund.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify state diesel fuel refund without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your state diesel fuel refund into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make edits in state diesel fuel refund without leaving Chrome?

state diesel fuel refund can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out state diesel fuel refund on an Android device?

Use the pdfFiller mobile app to complete your state diesel fuel refund on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is state diesel fuel refund?

State diesel fuel refund is a program that allows eligible entities to receive a refund for the state fuel tax paid on diesel fuel used for certain purposes.

Who is required to file state diesel fuel refund?

Entities that use diesel fuel for off-road purposes, such as farming or construction, may be required to file for state diesel fuel refund.

How to fill out state diesel fuel refund?

To fill out state diesel fuel refund, one needs to provide information about the amount of diesel fuel used for off-road purposes, as well as supporting documentation.

What is the purpose of state diesel fuel refund?

The purpose of state diesel fuel refund is to provide a refund for the state fuel tax paid on diesel fuel that is used for off-road purposes.

What information must be reported on state diesel fuel refund?

Information such as the amount of diesel fuel used for off-road purposes, the type of off-road activity, and supporting documentation must be reported on state diesel fuel refund.

Fill out your state diesel fuel refund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Diesel Fuel Refund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.