Get the free American retirement life insurance company - Aspire Benefit Services

Show details

... 0.60 http://www.aspirebenefits.com/gallery/docs/Aspire/2-9-RFP-Form.pdf ...... / docs/Cagney/Railcards/Cigna-Medicare-Supplement-Rate-Booklet-IN.pdf ...

We are not affiliated with any brand or entity on this form

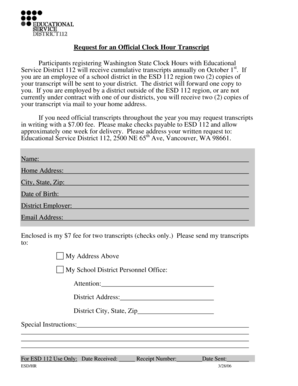

Get, Create, Make and Sign american retirement life insurance

Edit your american retirement life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your american retirement life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing american retirement life insurance online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit american retirement life insurance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out american retirement life insurance

How to fill out american retirement life insurance:

01

Research: Start by researching different American retirement life insurance providers and their policies. Compare the benefits, premiums, and coverage options to find a plan that suits your needs.

02

Gather necessary information: Collect all the required personal information, such as your full name, date of birth, address, social security number, and contact details. You may also need to provide details about your health, lifestyle, and financial situation.

03

Contact the insurance provider: Reach out to the chosen American retirement life insurance provider and set up an appointment to discuss your options. This can be done over the phone or through their website.

04

Schedule a medical examination: In most cases, American retirement life insurance requires a medical examination to assess your health and determine the premiums. The insurance provider will typically arrange for a licensed Examiner to visit your location or provide you with a location where you can complete the medical tests.

05

Fill out the application: Once you have all the necessary information and medical test results, you can proceed to fill out the application form. Take your time to read and understand all the questions, providing accurate and honest responses.

06

Review the policy terms: After completing the application, carefully review the policy terms and conditions. Make sure you understand the coverage, premiums, payout options, and any exclusions or limitations that may apply.

07

Submit the application: Once you are satisfied with the application and policy terms, submit the completed form to the American retirement life insurance provider. This can be done electronically through their website or by mailing the physical form.

08

Wait for approval: The insurance provider will review your application, medical test results, and other relevant information. It may take some time to receive a decision on your application, so be patient and follow up if necessary.

Who needs american retirement life insurance:

01

Individuals planning for retirement: American retirement life insurance can provide financial protection and support in your retirement years. If you are planning for your retirement and want to ensure a financially stable future for yourself and your loved ones, this insurance can be beneficial.

02

Self-employed individuals: If you are self-employed and do not have access to an employer-sponsored life insurance plan, American retirement life insurance can be a suitable option to secure your financial future.

03

Those with dependents: If you have dependents who rely on your income or financial support, having American retirement life insurance can offer peace of mind knowing that they will be financially protected in the event of your passing.

04

Individuals with limited savings: If you do not have significant savings or investments for retirement, having American retirement life insurance can help supplement your income and cover any outstanding debts or expenses.

Overall, American retirement life insurance is suitable for anyone who wants to ensure financial stability and protection during their retirement years.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in american retirement life insurance?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your american retirement life insurance to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an eSignature for the american retirement life insurance in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your american retirement life insurance right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit american retirement life insurance on an iOS device?

Create, modify, and share american retirement life insurance using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is american retirement life insurance?

American retirement life insurance is a type of insurance that provides financial protection to individuals during their retirement years.

Who is required to file american retirement life insurance?

Individuals who are planning for or are already in retirement are typically the ones required to purchase American retirement life insurance.

How to fill out american retirement life insurance?

To fill out American retirement life insurance, individuals need to provide personal and financial information, choose coverage options, and designate beneficiaries.

What is the purpose of american retirement life insurance?

The purpose of American retirement life insurance is to ensure financial stability during retirement by providing a lump sum payment or income stream to the policyholder or their beneficiaries.

What information must be reported on american retirement life insurance?

Information such as personal details, financial assets, desired coverage amount, and beneficiary information must be reported on American retirement life insurance.

Fill out your american retirement life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

American Retirement Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.