Get the free IVA

Show details

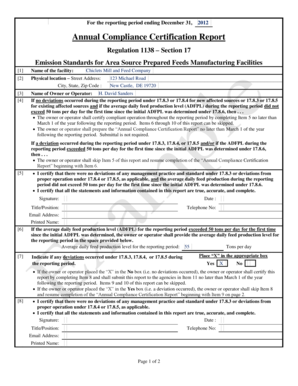

A / BG GPO/ 2515 /WPP-47/ 2009 – 2011 C P v V P n z z w P s U IV-A AU g, g, 4, 2009 (R 14, P 1931) A. 271 Revenue Secretariat NOTIFICATION TH No. RD 380 MUNOZ 2008, BANGALORE, Dated: 8 April 2009

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign iva

Edit your iva form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your iva form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing iva online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit iva. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out iva

How to fill out IVA:

01

Gather all necessary financial information, including your income, debt obligations, and assets.

02

Contact a licensed insolvency practitioner who specializes in IVAs to discuss your financial situation and eligibility for the program.

03

Provide the insolvency practitioner with the required information and documentation, such as bank statements, details of your debts, and proof of income.

04

Work with the insolvency practitioner to create a realistic budget that takes into account your monthly living expenses and debt repayment capabilities.

05

The insolvency practitioner will draft a proposal that outlines how much you can afford to pay towards your debts each month and presents it to your creditors.

06

Your creditors will vote on whether to accept the proposed IVA. If more than 75% of creditors (in terms of debt value) accept the proposal, it becomes legally binding for all parties involved.

07

Once the IVA is in place, you will make regular monthly payments to the insolvency practitioner, who will distribute the funds to your creditors according to the agreed-upon terms.

08

Throughout the duration of the IVA, typically five or six years, you must adhere to the terms and conditions, which may include restrictions on obtaining credit and providing regular updates on your financial situation to the insolvency practitioner.

09

After successfully completing the IVA, any remaining debts included in the program will be legally written off, giving you a fresh start financially.

Who needs IVA:

01

Individuals struggling with unmanageable debt and facing the possibility of bankruptcy.

02

People who have a regular income but cannot afford to repay their debts in full or within a reasonable timeframe.

03

Individuals who want to avoid the potential consequences of bankruptcy, such as losing assets or facing restrictions on future financial opportunities.

04

Those who are looking for a structured debt management solution that allows them to make affordable monthly payments based on their income and expenses.

05

Individuals who are willing to commit to a long-term repayment plan and work with a licensed insolvency practitioner to regain control of their finances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is iva?

IVA stands for Impuesto al Valor Agregado, which translates to Value Added Tax. It is a consumption tax imposed on goods and services.

Who is required to file iva?

Businesses and individuals who sell goods or services and meet a certain threshold are required to file IVA.

How to fill out iva?

IVA is typically filled out in the tax form provided by the tax authority, where you report the total sales made and the IVA collected.

What is the purpose of iva?

The purpose of IVA is to tax consumption and capture revenue for the government.

What information must be reported on iva?

The information to be reported on IVA includes total sales, IVA collected, and any IVA paid on purchases.

How can I edit iva on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing iva.

How can I fill out iva on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your iva, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out iva on an Android device?

Use the pdfFiller mobile app and complete your iva and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your iva online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Iva is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.