Get the free AutomAtic withdrAwAl income pAyment instruction - Old Mutual

Show details

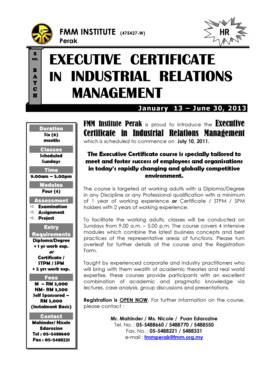

Client reference number For office use only Automatic withdrawal/ income payment instruction For the Individual Savings Account (ISA) and Collective Investment Account (CIA) With this form you can:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign automatic withdrawal income payment

Edit your automatic withdrawal income payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automatic withdrawal income payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit automatic withdrawal income payment online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit automatic withdrawal income payment. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out automatic withdrawal income payment

How to fill out automatic withdrawal income payment:

01

Gather necessary information: Before filling out the automatic withdrawal income payment form, make sure you have all the required information handy. This may include your bank account details, social security number, and any additional documents or identification needed.

02

Obtain the form: Contact your employer or financial institution to request the automatic withdrawal income payment form. In some cases, you may be able to find it online on their website. Ensure you have the most up-to-date version of the form.

03

Fill out personal details: Begin by entering your personal information accurately. This typically includes your full name, address, phone number, and email address.

04

Provide banking information: Proceed by entering the necessary banking details, such as your bank account number, routing number, and the financial institution's name. Double-check these details to ensure accuracy and avoid any payment issues.

05

Specify the withdrawal amount and frequency: Indicate the amount of income you would like to be automatically withdrawn from your employer or financial institution. Additionally, mention the frequency at which you would prefer these withdrawals to occur (e.g., weekly, bi-weekly, monthly).

06

Consent and Authorization: Read and understand any terms and conditions provided on the form. Give your informed consent and authorization to the employer or financial institution to initiate the automatic withdrawal income payments. This step may require your signature, date, and any other necessary verification.

07

Attach supporting documents: If requested, attach any supporting documents, such as a voided check or bank authorization form, as per the specific requirements of the form.

Who needs automatic withdrawal income payment?

01

Employees: Many employees opt for automatic withdrawal income payment to conveniently receive their salary or wages directly into their bank accounts without having to physically cash a check or visit the bank.

02

Retirees: Individuals who are retired and receive regular pension or retirement income may choose automatic withdrawal as a hassle-free method of receiving their payments.

03

Beneficiaries: People who receive government benefits, such as Social Security or disability payments, often prefer automatic withdrawal to ensure a consistent and timely flow of funds.

04

Investors: Investors who earn income from dividends, interest payments, or rental properties may opt for automatic withdrawal income payments to efficiently receive their earnings.

05

Self-employed individuals: Entrepreneurs and freelancers who have consistent income streams may find automatic withdrawal convenient for managing their finances and ensuring regular payments to themselves.

Remember, it is always advisable to consult with your employer or financial institution for specific eligibility and requirements related to automatic withdrawal income payment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify automatic withdrawal income payment without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your automatic withdrawal income payment into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I edit automatic withdrawal income payment on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing automatic withdrawal income payment right away.

Can I edit automatic withdrawal income payment on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as automatic withdrawal income payment. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is automatic withdrawal income payment?

Automatic withdrawal income payment is a mechanism where income tax is automatically deducted from an individual's income by the tax authorities.

Who is required to file automatic withdrawal income payment?

Individuals whose income exceeds a certain threshold set by the tax authorities are required to file automatic withdrawal income payment.

How to fill out automatic withdrawal income payment?

Automatic withdrawal income payment can be filled out online through the tax authority's website or in person at a tax office.

What is the purpose of automatic withdrawal income payment?

The purpose of automatic withdrawal income payment is to ensure that individuals pay their income tax in a timely manner and to reduce tax evasion.

What information must be reported on automatic withdrawal income payment?

Information such as income sources, deductions, tax credits, and personal details must be reported on automatic withdrawal income payment.

Fill out your automatic withdrawal income payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Automatic Withdrawal Income Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.