Get the free FR K-2 - federalreserve

Show details

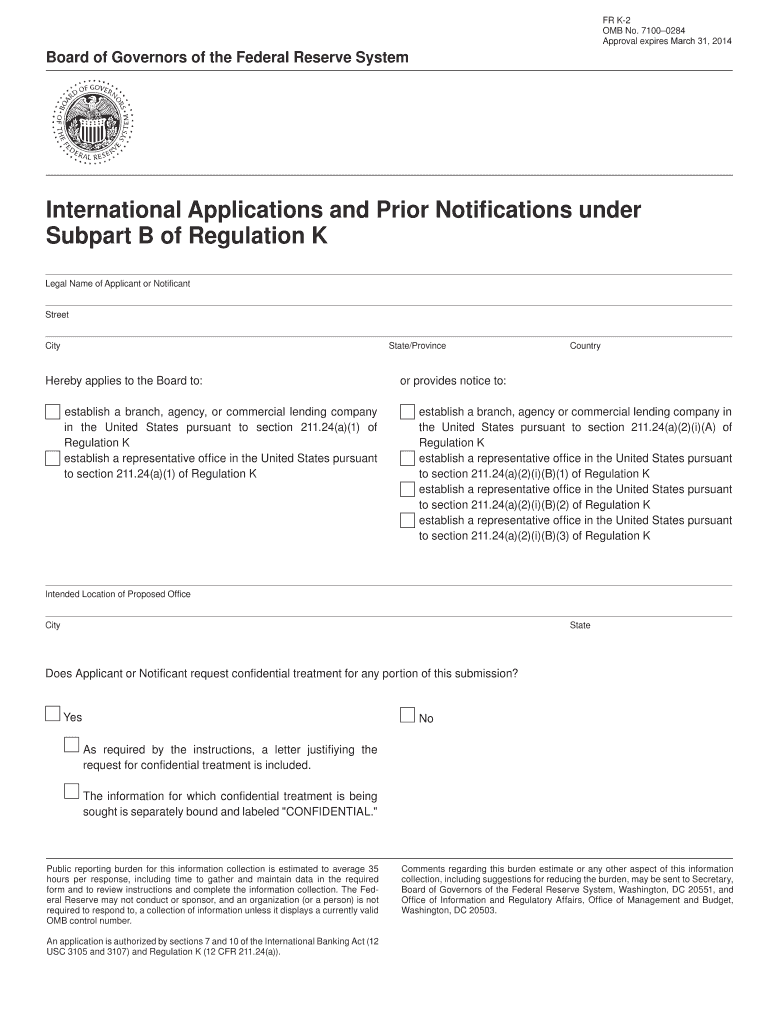

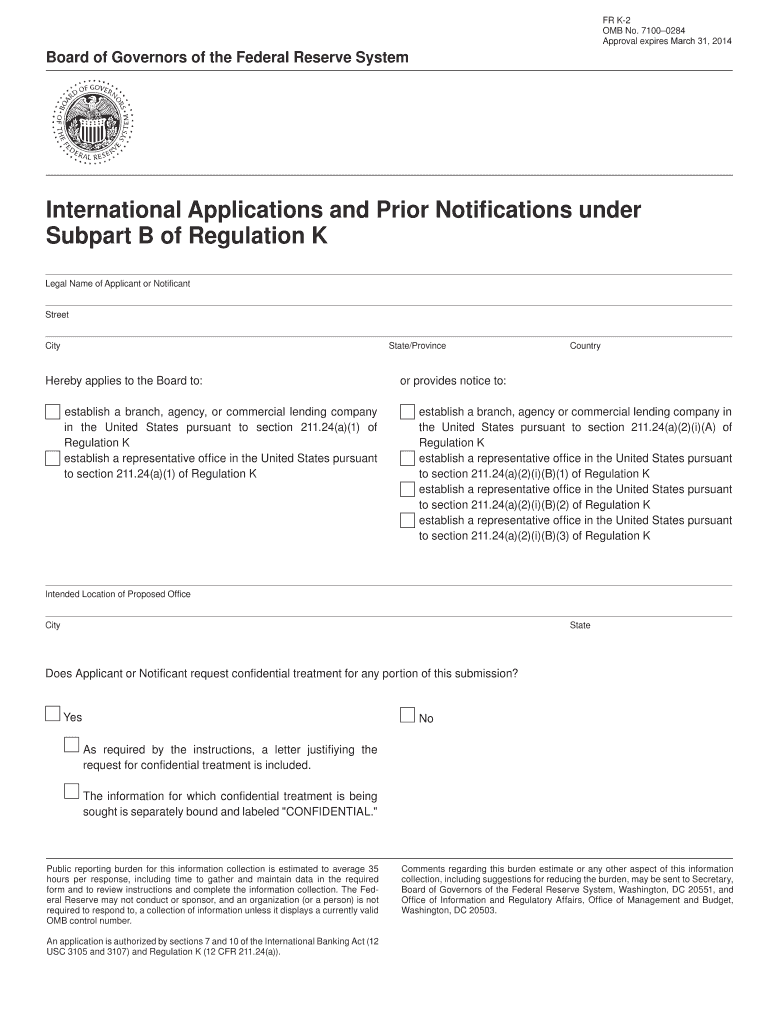

This document serves as an application for foreign banks seeking to establish a branch, agency, or commercial lending company in the United States under Regulation K, including provisions for notifications

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fr k-2 - federalreserve

Edit your fr k-2 - federalreserve form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fr k-2 - federalreserve form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fr k-2 - federalreserve online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fr k-2 - federalreserve. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fr k-2 - federalreserve

How to fill out FR K-2

01

Gather necessary financial documents for the tax year.

02

Fill in your personal information including your name, address, and tax identification number.

03

Report your income, including wages, dividends, and any other income sources.

04

List your deductions and credits according to the relevant sections.

05

Calculate your tax owed or refund due based on the provided instructions.

06

Review the form for accuracy and completeness.

07

Sign and date the form before submitting it.

Who needs FR K-2?

01

Individuals or businesses required to report specific financial activities or income to the tax authorities.

02

Taxpayers seeking to claim deductions or credits relevant to their tax situation.

03

Residents of France needing to comply with local tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

What does regulation K permit representative offices to do?

However, as a matter of Federal law under Regulation K, a representative office may make credit decisions if: The foreign bank operates one or more branches or agencies in the United States; The loans approved at the representative office are made by a U.S. branch or agency of a foreign bank; and The loan proceeds are

What is the Federal Reserve bank supervision and regulation?

The Federal Reserve's supervision activities include examinations and inspections to ensure that financial institutions operate in a safe and sound manner and comply with laws and regulations. These include an assessment of a financial institution's risk-management systems, financial conditions, and compliance.

What are the aggregate regulation K limits on a bank if it decided to make an additional investment in the capital stock of the Edge Corporation?

A member bank may invest up to 10 percent of its capital and surplus in the capital stock of Edge and agreement corporations or, with the prior approval of the Board, up to 20 percent of its capital and surplus in such stock.

What activities does regulation K permit representative offices to do?

However, as a matter of Federal law under Regulation K, a representative office may make credit decisions if: The foreign bank operates one or more branches or agencies in the United States; The loans approved at the representative office are made by a U.S. branch or agency of a foreign bank; and The loan proceeds are

What is true about subsidiaries under the regulation K?

Since 1979, Regulation K also has specifically authorized foreign subsidiaries of both U.S. banks and bank holding companies to underwrite and deal in equity securities outside the United States, subject to certain limitations and restrictions.

What are the aggregate regulation K limits on a bank if it decided to make an additional investment in the capital stock of the Edge Corporation?

A member bank may invest up to 10 percent of its capital and surplus in the capital stock of Edge and agreement corporations or, with the prior approval of the Board, up to 20 percent of its capital and surplus in such stock.

What is US regulation K?

Regulation K allows corporations that qualify under the Edge Act to participate in a wide variety of global banking practices. It also allows domestic banks to own entire nonfinancial foreign business entities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FR K-2?

FR K-2 is a form used by certain taxpayers to report information related to their foreign income and tax obligations. It is part of the tax filing process for entities that have international operations.

Who is required to file FR K-2?

Taxpayers who have foreign income, foreign partnerships, or are engaged in foreign transactions that meet specific criteria are required to file FR K-2.

How to fill out FR K-2?

To fill out FR K-2, taxpayers must gather their foreign income data, follow the instructions provided on the form, and accurately report the required financial information. It's advisable to consult with a tax professional if unsure.

What is the purpose of FR K-2?

The purpose of FR K-2 is to ensure transparency and compliance with tax regulations by reporting foreign income and related tax obligations to the tax authorities.

What information must be reported on FR K-2?

FR K-2 requires reporting of information such as foreign income earned, foreign taxes paid, details about foreign partnerships, and any relevant deductions or credits related to international tax obligations.

Fill out your fr k-2 - federalreserve online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fr K-2 - Federalreserve is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.