Get the free Denison Companys Liquidity Insured Reserve Access Program (LYRA Program)

Show details

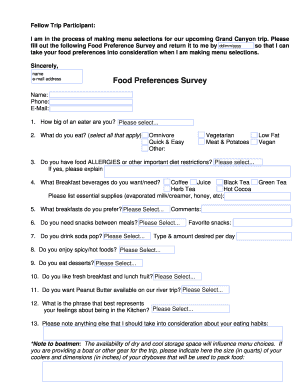

H.C. Denison Company s Liquidity Insured Reserve Access Program (LYRA Program) AUTHORIZATION FORM Yes! Sign me up for the new LYRA Program! This document serves as your consent to participate in the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign denison companys liquidity insured

Edit your denison companys liquidity insured form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your denison companys liquidity insured form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit denison companys liquidity insured online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit denison companys liquidity insured. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out denison companys liquidity insured

How to fill out Denison Company's liquidity insured?

01

Start by obtaining the necessary forms from Denison Company or their designated insurance provider. These forms can typically be found on their website or by contacting their customer service.

02

Carefully read through the forms and instructions to understand the information required for filling out Denison Company's liquidity insured. Each field may have specific requirements, such as providing accurate financial information or details about the insured company's operations.

03

Begin by filling out basic information, such as the name, address, and contact details of the insured company. Double-check for any spelling or grammatical errors to ensure accuracy.

04

Proceed to provide financial information about the insured company. This may include the company's annual revenue, assets, liabilities, and any existing insurance coverage. It's essential to provide accurate and up-to-date information to avoid any discrepancies or issues with the insurance coverage.

05

If required, provide additional details about the insured company's operations, such as the industry it operates in, the number of employees, or any specific risks associated with its line of business. This information helps Denison Company or their insurance provider assess the insurance needs of the company accurately.

06

Review the completed forms thoroughly before submission. Ensure all the necessary fields are filled correctly, and attachments or supporting documentation, if requested, are included. Any missing or incorrect information could lead to delays in processing or even the rejection of the application.

Who needs Denison Company's liquidity insured?

01

Small to medium-sized businesses: Denison Company's liquidity insurance can be valuable for small to medium-sized businesses that want to protect their cash flow and financial stability. Such businesses may have limited capital and resources to tackle unforeseen liquidity challenges, making insurance coverage a crucial safeguard.

02

Startups and growing businesses: Companies in their early stages or experiencing significant growth often face financial uncertainties. Denison Company's liquidity insurance can provide a safety net during these periods, ensuring that any unexpected cash flow issues or liquidity problems don't jeopardize their operations.

03

Businesses in volatile industries: Certain industries are more susceptible to economic fluctuations or market volatility. Companies operating in such sectors, such as manufacturing, retail, or hospitality, may greatly benefit from liquidity insurance offered by Denison Company. It can help mitigate financial risks associated with unforeseen events and maintain stability in uncertain market conditions.

Note: It is advisable to consult with a financial advisor or insurance professional to determine the specific needs and suitability of Denison Company's liquidity insurance for an individual or business.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute denison companys liquidity insured online?

With pdfFiller, you may easily complete and sign denison companys liquidity insured online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make changes in denison companys liquidity insured?

The editing procedure is simple with pdfFiller. Open your denison companys liquidity insured in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How can I fill out denison companys liquidity insured on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your denison companys liquidity insured from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is denison companys liquidity insured?

Denison Company's liquidity is insured through various short-term investments, cash reserves, and lines of credit.

Who is required to file denison companys liquidity insured?

Denison Company's financial department or designated financial officers are required to file the liquidity insured report.

How to fill out denison companys liquidity insured?

To fill out Denison Company's liquidity insured report, one must gather all relevant financial data regarding cash flow, investments, and available credit lines, and accurately document them in the designated reporting format.

What is the purpose of denison companys liquidity insured?

The purpose of Denison Company's liquidity insured report is to provide stakeholders with a clear understanding of the company's financial liquidity, ability to meet short-term obligations, and overall financial health.

What information must be reported on denison companys liquidity insured?

Information such as cash on hand, short-term investments, available credit lines, outstanding debts, and any other relevant financial data must be reported on Denison Company's liquidity insured report.

Fill out your denison companys liquidity insured online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Denison Companys Liquidity Insured is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.