Get the free The Discretionary Gift Trust deed - Aegon - aegon co

Show details

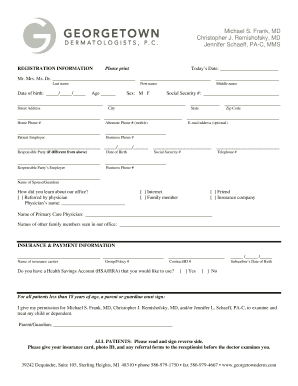

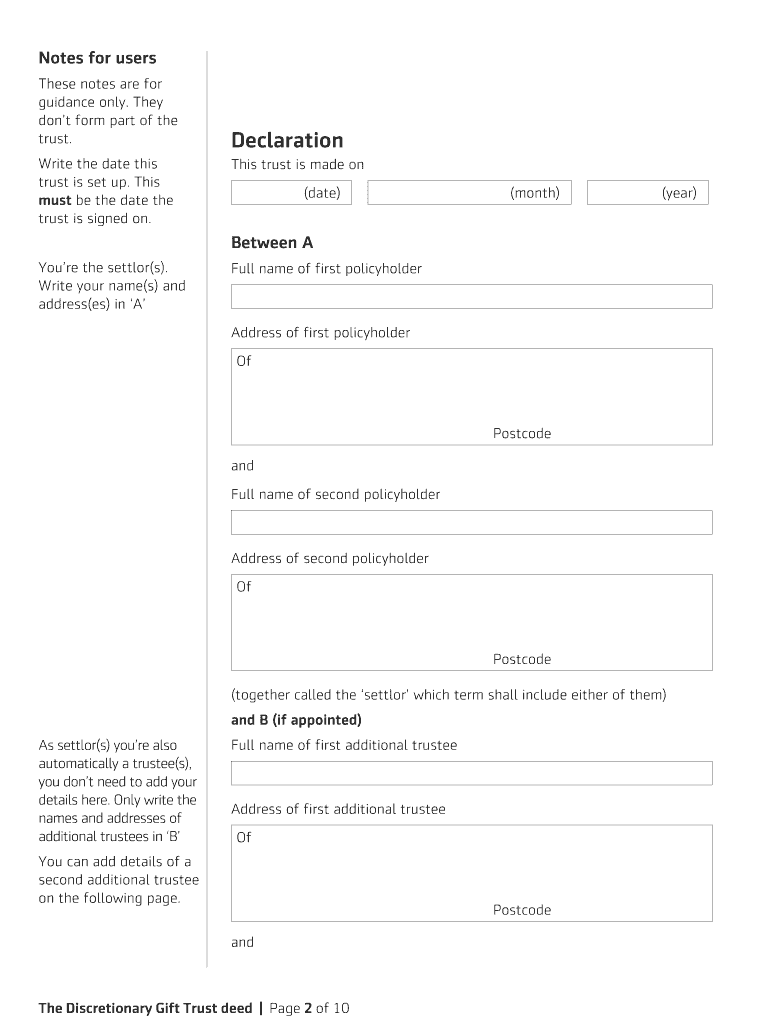

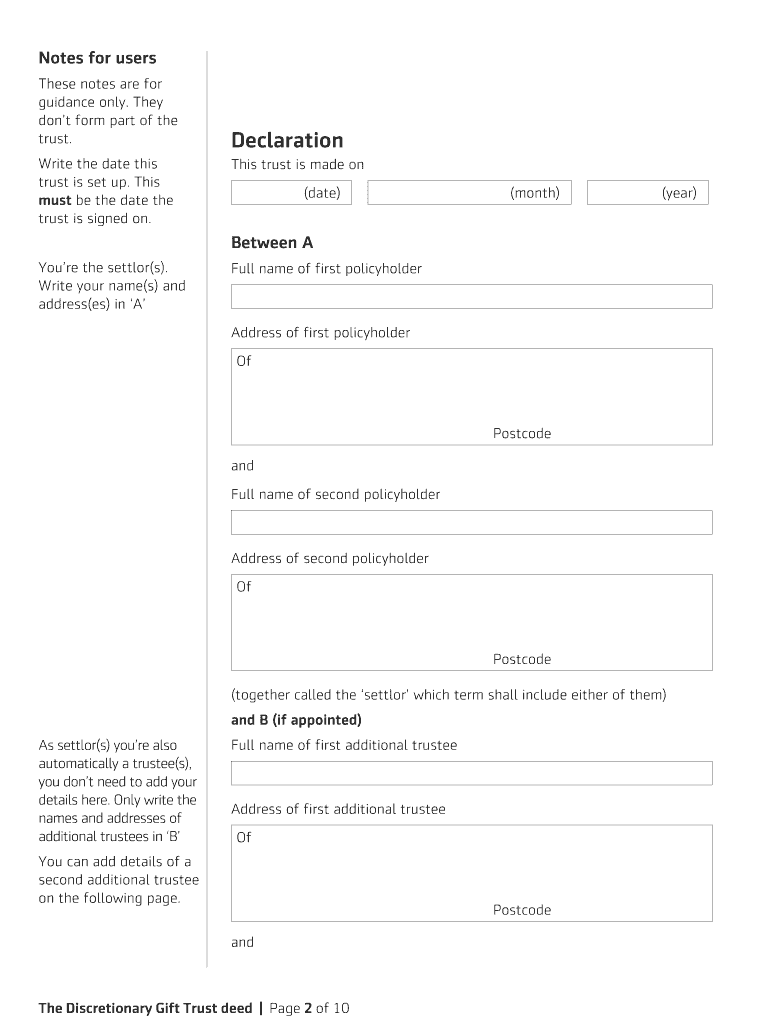

For customers The Discretionary Gift Trust deed Completion notes 1. Please complete all relevant sections of this deed by typing in the fields or printing and completing in pen. Once complete, please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form discretionary gift trust

Edit your form discretionary gift trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form discretionary gift trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form discretionary gift trust online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form discretionary gift trust. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form discretionary gift trust

How to fill out form discretionary gift trust?

01

Make sure you have all the necessary information: Before starting the form, gather all the required details such as the names and contact information of the settlor (the person establishing the trust) and the beneficiaries (those who will receive the gifts), as well as any specific instructions or restrictions for the trust.

02

Identify the jurisdiction: Determine the jurisdiction under which the trust will be established. This is important as the laws and regulations may vary depending on the location.

03

Consult with legal experts: It is advisable to seek professional advice from lawyers or financial advisors experienced in trust matters. They can guide you through the process and provide valuable insights based on your specific circumstances.

04

Begin filling out the form: Start by entering the necessary personal and contact information of the settlor, including their name, address, and social security number or tax identification number.

05

Provide details of the trust property: Specify the assets that will be transferred into the trust. Include a detailed description and estimated value for each asset, whether it be cash, stocks, real estate, or any other property.

06

Designate the beneficiaries: Clearly identify the beneficiaries who will receive the gifts from the trust. Include their names, addresses, and any other relevant details.

07

Specify any conditions or restrictions: If there are any specific conditions or restrictions for the distribution of gifts from the trust, make sure to state them clearly. This could include age restrictions, education requirements, or any other criteria set by the settlor.

08

Appoint trustees and successors: Indicate the individuals or institutions that will serve as trustees, responsible for managing and distributing the trust assets. It is important to provide their names, contact information, and any special powers or limitations they may have.

09

Seek legal advice for signatures and witnessing: Consult with legal experts to ensure that the form is properly signed and witnessed according to the laws of the jurisdiction. This may involve having witnesses present during the signing or notarizing the document.

Who needs form discretionary gift trust?

01

Individuals with significant assets: Those who have substantial assets and wish to establish a trust to manage and distribute their gifts may need a form discretionary gift trust. This allows them to have control over how and when their assets are distributed to the beneficiaries.

02

High net worth families: Families with high net worth often turn to discretionary gift trusts as a way to protect and transfer their wealth to future generations. This form of trust provides flexibility in managing and distributing the assets according to the family's specific wishes.

03

Philanthropists: Individuals who have a desire to support charitable causes may opt for a form discretionary gift trust. This allows them to allocate funds for philanthropic purposes while ensuring that the distribution is done in accordance with their preferences and long-term goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

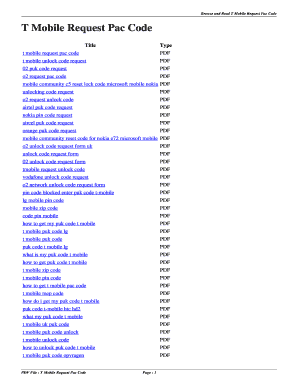

How can I get form discretionary gift trust?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific form discretionary gift trust and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit form discretionary gift trust straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing form discretionary gift trust.

How do I fill out form discretionary gift trust using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign form discretionary gift trust. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

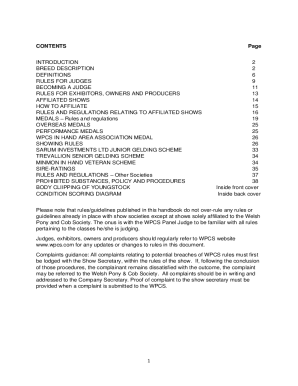

What is form discretionary gift trust?

Form discretionary gift trust is a legal document that allows a person to set aside assets to be managed by a trustee for the benefit of beneficiaries at the discretion of the trustee.

Who is required to file form discretionary gift trust?

Any person who creates a discretionary gift trust or serves as a trustee of such a trust may be required to file the form.

How to fill out form discretionary gift trust?

Form discretionary gift trust can be filled out by providing information about the trust, the trustee, the beneficiaries, and the assets held in the trust.

What is the purpose of form discretionary gift trust?

The purpose of form discretionary gift trust is to provide a legal framework for the management and distribution of assets held in a trust for the benefit of beneficiaries.

What information must be reported on form discretionary gift trust?

Information such as the trust's name, the trustee's contact information, the beneficiaries' names, and a list of the assets held in the trust must be reported on the form.

Fill out your form discretionary gift trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Discretionary Gift Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.