Get the free Cash and Credit - Biz Kids

Show details

Cash and Credit EPISODE #109 LESSON LEVEL NATIONAL STANDARDS CORRELATIONS Grades 46 Aligned to National Financial Literacy Standards from the Jump start Coalition for Personal Financial Literacy.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cash and credit

Edit your cash and credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash and credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cash and credit online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cash and credit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

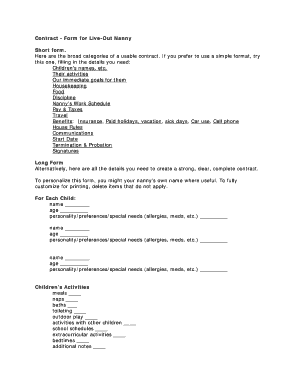

How to fill out cash and credit

How to fill out cash and credit:

01

Gather the necessary information: Before filling out any forms or applications, make sure you have all the required information handy, such as your personal details, financial information, and employment history.

02

Determine your financial goals: Before deciding on how much cash or credit you need, it's essential to understand your financial goals. Are you looking to make a big purchase, build credit history, or have emergency funds? This will help you better allocate your cash and credit.

03

Evaluate your current financial situation: Assess your income, expenses, and existing debt to determine how much cash you have readily available and how much credit you can afford to use. This evaluation will help you make informed decisions about filling out cash and credit options.

04

Choose the appropriate cash options: If you have cash on hand for a specific purpose, such as making a purchase or covering daily expenses, determine the best way to use it. You can either use physical cash, write a check, or make an online payment depending on the situation.

05

Research credit options: If you need to borrow money or utilize credit, research different credit options available to you. Compare interest rates, repayment terms, and fees associated with credit cards, personal loans, or lines of credit. This will allow you to make an informed decision on which credit option best suits your needs.

06

Fill out cash forms accurately: If you need to deposit cash into a bank account, make sure to accurately fill out any forms required. Provide your personal information, amount to be deposited, and any additional details requested by the bank or financial institution.

07

Fill out credit applications: If you decide to apply for credit, fill out credit applications accurately and thoroughly. Provide your personal information, income details, employment history, and any other information required by the chosen credit provider. Make sure to read and understand the terms and conditions before signing any agreements.

Who needs cash and credit?

01

Individuals who prefer using physical currency instead of digital payments may find cash a necessary form of payment. It can also be handy for emergencies or situations where electronic forms of payment are not accepted.

02

Individuals who require credit for making larger purchases, such as buying a car, a house, or other expensive items, may need access to credit options. Credit allows them to spread out payments over time, making it more affordable.

03

People who want to build or improve their credit history and score may need to utilize credit responsibly. By using credit cards or loans and making timely payments, individuals can establish a positive credit history, which can be essential for future financial endeavors or loan approvals.

In summary, filling out cash and credit involves gathering necessary information, understanding your financial goals, evaluating your financial situation, selecting appropriate cash options, researching credit options, accurately filling out cash forms and credit applications. Cash is needed by individuals who prefer physical currency or require emergency funds, while credit is necessary for those making significant purchases or building credit history.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cash and credit?

Cash and credit refers to the two main forms of payment that individuals and businesses use for transactions. Cash is physical currency or coins, while credit involves using a line of credit or borrowing money to make purchases.

Who is required to file cash and credit?

Individuals and businesses that engage in financial transactions involving cash or credit are required to file cash and credit reports with the appropriate financial authorities.

How to fill out cash and credit?

To fill out a cash and credit report, individuals and businesses must accurately document all transactions involving cash or credit, including the amount, date, and purpose of the transaction.

What is the purpose of cash and credit?

The purpose of cash and credit reports is to track and monitor financial transactions, detect potential fraud or illegal activities, and ensure compliance with financial regulations.

What information must be reported on cash and credit?

Cash and credit reports must include details such as the amount of the transaction, the date of the transaction, the names of the parties involved, and the purpose of the transaction.

How do I modify my cash and credit in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your cash and credit and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I make edits in cash and credit without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your cash and credit, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out the cash and credit form on my smartphone?

Use the pdfFiller mobile app to fill out and sign cash and credit on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your cash and credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash And Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.