Get the free UNDERSTANDING TRUSTS AND TRUSTEES

Show details

UNDERSTANDING TRUSTS AND TRUSTEES

In practice, one receives many questions from trustees regarding the practicalities of

managing trusts. What must be done if a trustee dies or resigns? What is required

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign understanding trusts and trustees

Edit your understanding trusts and trustees form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding trusts and trustees form via URL. You can also download, print, or export forms to your preferred cloud storage service.

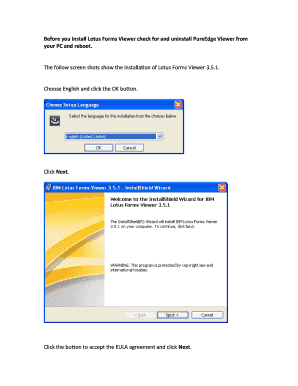

Editing understanding trusts and trustees online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit understanding trusts and trustees. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out understanding trusts and trustees

How to fill out understanding trusts and trustees:

01

Determine the purpose of the trust: Before filling out any paperwork, it is important to understand the purpose of the trust. This includes identifying the assets to be included in the trust and the beneficiaries who will benefit from it.

02

Choose the right type of trust: There are various types of trusts, such as revocable trusts, irrevocable trusts, and living trusts. Understanding the differences between these options will help in selecting the most suitable one for your specific needs.

03

Gather necessary documents: To properly fill out the paperwork, gather all relevant documents, such as the trust agreement, asset titles, and beneficiary information. These documents will provide the necessary information needed to complete the forms accurately.

04

Consult with a legal professional: Filling out trust documents can be complex, and it is crucial to seek advice from a legal professional specializing in estate planning. They can provide guidance, help navigate any legal requirements, and ensure the trust is properly established.

05

Review and revise: After filling out the initial paperwork, it is essential to review the trust documents thoroughly. Make sure all information is correct, beneficiaries are accurately named, and any potential issues are addressed. If any changes are necessary, consult with legal professionals to make the appropriate revisions.

Who needs understanding trusts and trustees:

01

Individuals with significant assets: Those who possess a considerable amount of assets or wealth may benefit from understanding trusts and trustees. Trusts can help protect assets, minimize estate taxes, and ensure a smooth transition of wealth to beneficiaries.

02

Families with dependents: Families with young children or dependents may consider understanding trusts and trustees to establish a plan for their financial wellbeing. Through a trust, parents can appoint a trustee to manage and distribute funds for the care and support of their dependents.

03

Business owners: Business owners often have unique assets and financial considerations. Understanding trusts and trustees can help them protect business assets, plan for succession, and safeguard their legacy.

In conclusion, filling out understanding trusts and trustees requires a thorough understanding of the purpose, gathering necessary documents, consulting with legal professionals, and reviewing the completed paperwork. Individuals with significant assets, families with dependents, and business owners are among those who may benefit from understanding trusts and trustees.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is understanding trusts and trustees?

Understanding trusts and trustees involves comprehending the legal entities created to hold assets on behalf of beneficiaries, with trustees being the individuals or entities responsible for managing the assets.

Who is required to file understanding trusts and trustees?

Individuals or entities who have created trusts, serve as trustees, or are beneficiaries of trusts may be required to file understanding trusts and trustees.

How to fill out understanding trusts and trustees?

To fill out understanding trusts and trustees, individuals or entities must provide detailed information about the trust, the trustees, and the beneficiaries, including financial details and any relevant legal documentation.

What is the purpose of understanding trusts and trustees?

The purpose of understanding trusts and trustees is to ensure transparency and compliance with legal and tax regulations regarding the management and reporting of trust assets.

What information must be reported on understanding trusts and trustees?

Information that must be reported on understanding trusts and trustees includes details about the trust assets, income, distributions, beneficiaries, and any changes in trustee status.

How can I manage my understanding trusts and trustees directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your understanding trusts and trustees and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I sign the understanding trusts and trustees electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your understanding trusts and trustees in seconds.

How do I edit understanding trusts and trustees on an iOS device?

Create, modify, and share understanding trusts and trustees using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your understanding trusts and trustees online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Understanding Trusts And Trustees is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.