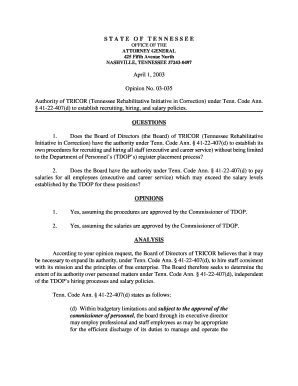

Get the free Introduction to Solvency II SCR - ermsymposium

Show details

Introduction to Solvency II SCR

Standard Formula for Market Risk

Erik Thorn

11 June 2015AgendaIntroduction to Solvency Market risk moduleAsset allocation considerations Page 2Introduction to Solvency

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign introduction to solvency ii

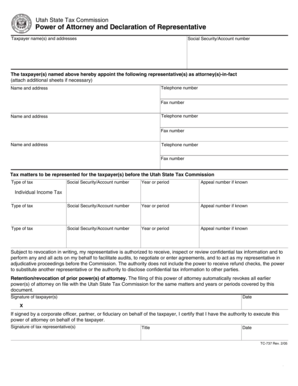

Edit your introduction to solvency ii form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your introduction to solvency ii form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit introduction to solvency ii online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit introduction to solvency ii. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out introduction to solvency ii

How to fill out introduction to Solvency II?

01

Start with a brief overview: Begin by providing a concise introduction to the concept of Solvency II. Explain that it is a set of regulatory requirements for insurance companies in the European Union designed to ensure their financial stability and risk management.

02

Explain the purpose: Highlight the main objectives of Solvency II, such as enhancing policyholder protection, promoting competition, and improving insurers' risk management capabilities. Emphasize the need for insurance companies to comply with these regulations to maintain financial soundness.

03

Discuss the three pillars: In the introduction, briefly explain the three pillars of Solvency II. Start with Pillar 1, which addresses quantitative requirements, such as the calculation of capital requirements and the valuation of assets and liabilities. Move on to Pillar 2, focusing on qualitative requirements like risk management and governance, and finally, conclude with Pillar 3, which deals with reporting and disclosure obligations.

04

Highlight the key components: Within each pillar, highlight the key components that insurance companies need to address. For example, under Pillar 1, discuss the calculation of the Solvency Capital Requirement (SCR) and the Minimum Capital Requirement (MCR). In Pillar 2, mention the Own Risk and Solvency Assessment (ORSA) and the governance requirements. Lastly, in Pillar 3, mention the disclosure requirements and reporting obligations.

05

Provide practical guidance: Give practical advice on how to approach the introduction to Solvency II. Recommend that insurance companies familiarize themselves with the regulatory framework by reading the relevant directives and guidelines. Suggest attending training programs or seeking professional advice to ensure a thorough understanding of the requirements and how to comply with them.

Who needs introduction to Solvency II?

01

Insurance companies: It is crucial for insurance companies operating within the European Union to have a comprehensive understanding of Solvency II. The introduction to Solvency II provides them with the necessary knowledge to comply with the regulations and adapt their risk management practices accordingly.

02

Regulators and supervisors: Regulatory authorities and supervisors responsible for overseeing insurance companies require an understanding of Solvency II to effectively perform their duties. Being familiar with the introduction to Solvency II enables them to assess the compliance of insurers and enforce the regulations appropriately.

03

Policyholders and consumers: While policyholders may not need an in-depth knowledge of Solvency II, they benefit from the protection and enhanced risk management it provides. Understanding the introduction to Solvency II can help policyholders make more informed decisions when selecting insurance providers and ensure that their coverage is provided by financially stable and well-managed companies.

In conclusion, filling out the introduction to Solvency II involves providing an overview of the concept, explaining its purpose, discussing the three pillars, highlighting key components, and offering practical guidance. This introduction is essential for insurance companies, regulators, supervisors, and policyholders to ensure compliance, effective oversight, and enhanced protection.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my introduction to solvency ii directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your introduction to solvency ii and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an electronic signature for signing my introduction to solvency ii in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your introduction to solvency ii right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit introduction to solvency ii on an Android device?

The pdfFiller app for Android allows you to edit PDF files like introduction to solvency ii. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is introduction to solvency ii?

Introduction to Solvency II is a regulatory regime that sets out the capital requirements for insurance companies operating in the European Union.

Who is required to file introduction to solvency ii?

Insurance companies operating in the European Union are required to file Introduction to Solvency II.

How to fill out introduction to solvency ii?

Introduction to Solvency II can be filled out electronically through the designated reporting system provided by regulators.

What is the purpose of introduction to solvency ii?

The purpose of Introduction to Solvency II is to ensure that insurance companies have enough capital to cover potential losses and protect policyholders.

What information must be reported on introduction to solvency ii?

Insurance companies must report their financial data, risk management practices, and capital adequacy assessments on Introduction to Solvency II.

Fill out your introduction to solvency ii online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Introduction To Solvency Ii is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.