Get the free Level Term Application - insurance arkansas

Show details

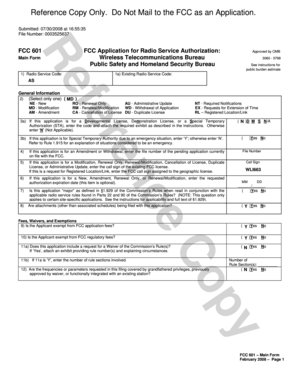

SERFF Tracking Number SHLI-126759055 State Arkansas Filing Company Shelter Life Insurance Company State Tracking Number 46415 Company Tracking Number 03L10210 TOI L04I Individual Life - Term Sub-TOI L04I. 213 Specified Age or Duration Fixed/Indeterminate Premium - Single Life Product Name Level Term Application Project Name/Number Paper App/L10210 Filing at a Glance Company Shelter Life Insurance Company TOI L04I Individual Life - Term SERFF Tr Num SHLI-126759055 State Arkansas SERFF Status...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign level term application

Edit your level term application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your level term application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing level term application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit level term application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out level term application

How to fill out Level Term Application

01

Gather necessary personal information including your name, address, and date of birth.

02

Prepare your health history, including any medical conditions, medications, and doctor visits.

03

Identify your coverage needs, determining how much coverage you want and for how long.

04

Fill out the application form completely, ensuring all information is accurate.

05

Review the application for any errors or omissions before submission.

06

Submit the application along with any required documentation and payment, if applicable.

Who needs Level Term Application?

01

Individuals looking for financial protection for their loved ones in case of untimely death.

02

People who want a fixed premium term for life insurance coverage over a specific period.

03

Those with financial obligations like mortgages, loans, or dependents who may need coverage.

Fill

form

: Try Risk Free

People Also Ask about

Is it better to have level term or decreasing life insurance?

Arguably, one advantage of level term life insurance vs decreasing term is that the payout can be put towards a range of living costs, rather than just the mortgage. This could include household bills, childcare fees and hobbies or interests. Or it could be used to help protect a mortgage.

Is level term life insurance worth it?

A level term life insurance policy can be ideal for helping to protect an interest-only mortgage due to the fixed sum assured. Alternatively, if you have a repayment mortgage, a level term policy could be used to help cover your mortgage balance and provide an additional sum to help cover bills and family living costs.

What does 10 year level term life insurance mean?

Level term life insurance is a type of term life insurance policy where the death benefit remains the same throughout a specified term length, usually ranging from 10 to 30 years.

What are the disadvantages of level term insurance?

Cons of level term insurance Unlike permanent life insurance , level term contracts have an end date, so you won't have coverage or death benefits once the policy has run out. No cash value. Level term insurance contracts don't accumulate cash value.

What happens at the end of a level term life insurance policy?

No, with a standard term life insurance policy, you won't be receive anything back if you outlive your life insurance. So, what happens at the end of your term life insurance? Your life insurance will simply expire and you can either take out a new policy or look into other types of financial protection.

What are the disadvantages of level term insurance?

Cons of level term insurance Unlike permanent life insurance , level term contracts have an end date, so you won't have coverage or death benefits once the policy has run out. No cash value. Level term insurance contracts don't accumulate cash value.

What does level in level term mean?

Level term life insurance is where the amount you pay and your cover stay the same during a policy term unless any changes are made to the policy. This is regardless of whether the insured person passes away on the day the policy starts or the day before the policy ends.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Level Term Application?

A Level Term Application is a type of insurance application used to obtain life insurance coverage that remains constant (level) over a specified term or period, typically ranging from 5 to 30 years.

Who is required to file Level Term Application?

Individuals seeking to purchase level term life insurance are required to file a Level Term Application. This includes anyone who wants financial protection for their dependents or to cover specific financial obligations.

How to fill out Level Term Application?

To fill out a Level Term Application, individuals must provide personal information such as name, address, date of birth, and health history, as well as details about the coverage desired, including the amount of insurance and the length of the term.

What is the purpose of Level Term Application?

The purpose of a Level Term Application is to assess an applicant's eligibility for level term life insurance, evaluate health risks, and determine the premium rate based on the information provided.

What information must be reported on Level Term Application?

Information that must be reported on a Level Term Application includes personal demographics, medical history, lifestyle habits (such as smoking), beneficiary details, and the desired coverage amount and term length.

Fill out your level term application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Level Term Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.