Get the free Occupational Pension - aviva co

Show details

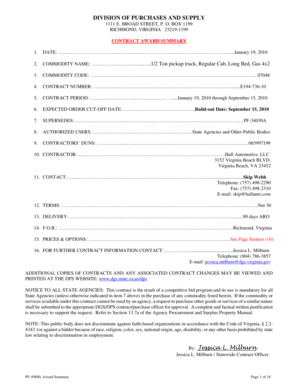

Occupational Pension Schemes (Channel Islands) Employee is retiring Please complete this form as this employee is due to retire 1 Personal details Pension scheme name Scheme number Employees surname

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign occupational pension - aviva

Edit your occupational pension - aviva form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your occupational pension - aviva form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing occupational pension - aviva online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit occupational pension - aviva. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out occupational pension - aviva

How to fill out occupational pension:

01

Start by understanding the requirements: Familiarize yourself with the eligibility criteria and guidelines for filling out an occupational pension. This may include factors like age, years of service, and employment status.

02

Gather necessary documents: Collect all relevant documents such as employment contracts, pay slips, and any previous pension-related paperwork. These documents will help you accurately fill out the occupational pension forms.

03

Consult with a pension advisor: If you are unsure about any aspect of filling out the occupational pension forms, consider seeking advice from a pension advisor. They can provide guidance on the specific requirements and help you make informed decisions.

04

Complete the application form: Fill out the application form with accurate and up-to-date information. Ensure that all fields are filled correctly, providing any necessary supporting documents as requested.

05

Review and double-check: Before submitting the application, carefully review all the information provided. Check for any errors or omissions that may impact your eligibility or pension benefits.

06

Submit the application: Once you have thoroughly reviewed the form, submit it to the designated authority. Make sure to keep copies of all submitted documents and forms for your personal records.

Who needs occupational pension?

01

Employees: Individuals who are employed by an organization, whether in the public or private sector, may be eligible for an occupational pension. This can provide them with additional financial support during their retirement years.

02

Self-employed individuals: Depending on the country or jurisdiction, self-employed individuals may also be eligible for an occupational pension. It is worth exploring options and requirements specific to your situation.

03

Certain professions or industries: In some cases, occupational pensions may be more common or mandatory in certain professions or industries. This could include sectors such as government, education, healthcare, or military service.

04

Long-term employees: Those who have worked for a particular company for an extended period may be entitled to an occupational pension based on their years of service. The length of service required will vary depending on the pension scheme in place.

05

Individuals planning for retirement: Regardless of the occupation or industry, anyone who wants to secure their financial future and have a stable income during retirement should consider an occupational pension. It can provide peace of mind and ensure a comfortable retirement phase.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is occupational pension?

Occupational pension is a retirement plan provided by an employer to its employees, which typically involves contributions from both the employer and the employee.

Who is required to file occupational pension?

Employers are required to file occupational pension for their employees who are enrolled in the pension plan.

How to fill out occupational pension?

To fill out occupational pension, employers need to provide information on employee contributions, employer contributions, investment choices, and other relevant details.

What is the purpose of occupational pension?

The purpose of occupational pension is to provide employees with a source of income during retirement, in addition to any government benefits they may receive.

What information must be reported on occupational pension?

Information that must be reported on occupational pension includes employee and employer contributions, investment performance, and any changes to the pension plan.

Can I sign the occupational pension - aviva electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I fill out occupational pension - aviva on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your occupational pension - aviva by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I edit occupational pension - aviva on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share occupational pension - aviva on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your occupational pension - aviva online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Occupational Pension - Aviva is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.