Get the free Endowment Policy - Level Death Benefit - insurance arkansas

Show details

SERFF Tracking Number ONLI-125656100 State Arkansas Filing Company Ozark National Life Insurance Company State Tracking Number 39074 Company Tracking Number 429 R 08 TOI L02I Individual Life - Endowment Sub-TOI L02I. 000 Life - Endowment Product Name Endowment Policy - Level Death Benefit Project Name/Number Filing at a Glance Company Ozark National Life Insurance Company SERFF Tr Num ONLI-125656100 Death Benefit TOI L02I Individual Life - Endowment SERFF Status Closed Sub-TOI L02I. 000...

We are not affiliated with any brand or entity on this form

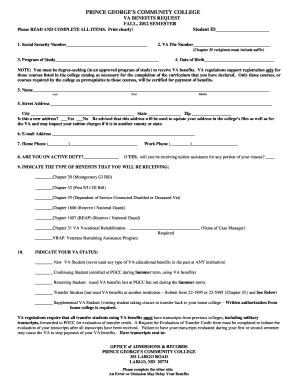

Get, Create, Make and Sign endowment policy - level

Edit your endowment policy - level form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your endowment policy - level form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit endowment policy - level online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit endowment policy - level. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out endowment policy - level

How to fill out Endowment Policy - Level Death Benefit

01

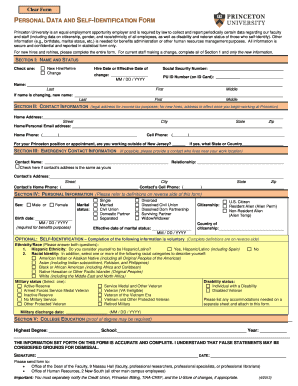

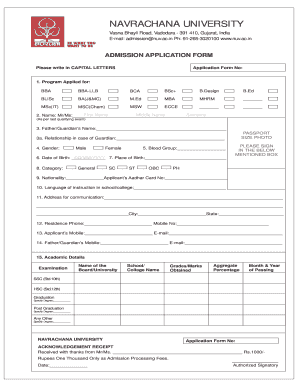

Gather necessary personal information: Full name, address, date of birth, and identification details.

02

Choose the sum assured: Decide the amount you wish to be covered for under the endowment policy.

03

Select the policy term: Determine the duration for which you want the policy to be active.

04

Provide beneficiary details: Include the name and relationship of the person(s) who will receive the benefit.

05

Complete medical history: Fill out any required medical questionnaires regarding your health.

06

Submit the application: Review the filled form for accuracy and submit it to the insurance provider.

07

Pay the premium: Ensure the initial premium payment is made as per policy requirements.

Who needs Endowment Policy - Level Death Benefit?

01

Individuals looking for a combination of life insurance and savings.

02

Those who want to ensure financial protection for loved ones in case of untimely demise.

03

People aiming to accumulate savings over a fixed period for future goals.

04

Parents planning for their children's education or marriage expenses.

05

Anyone seeking a financial tool that provides a payout at maturity or in the event of death.

Fill

form

: Try Risk Free

People Also Ask about

What is the endowment policy for death benefit?

Under an Endowment Policy, if the policyholder passes away during the policy term, the nominee receives the sum assured or outlives the policy term. However, if the policyholder survives the policy term, he or she gets the maturity benefit, which is the sum assured plus any bonuses accrued during the policy term.

What is an endowment benefit?

Key Takeaways. Endowment insurance is a life insurance that offers a death benefit and a guaranteed lump sum payout at the conclusion of the policy term, as long as premiums are paid. To fund the endowment, you pay premiums into a policy, and the policy's value grows over time.

What is a level death benefit term life insurance policy?

What Is Level-Premium Insurance? Level-premium insurance is a type of permanent or term life insurance where the premium remains the same over the policy's life.

What is the difference between term and level term?

A level term life insurance policy can be ideal for helping to protect an interest-only mortgage due to the fixed sum assured. Alternatively, if you have a repayment mortgage, a level term policy could be used to help cover your mortgage balance and provide an additional sum to help cover bills and family living costs.

What is a level death benefit term premium?

Premiums and death benefits don't change If you choose level term life insurance, you can budget for your premiums because they'll stay the same throughout your term. Plus, you'll know exactly how much of a death benefit your beneficiaries will receive if you pass away, as this amount won't change either.

What is a level term premium life insurance policy?

Term insurance contracts are for a relatively short, defined period of time but have options you can tailor to your needs. Certain benefit options can make your premiums change over time. Level term insurance, however, is a type of term life insurance that has consistent payments and an unchanging death benefit .

What does a level death benefit option mean?

Level Death Benefit is an option in life insurance policies where the payout to beneficiaries remains unchanged for the policy's duration. Its characteristics include: Constant Payout: The sum paid upon the insured's death doesn't fluctuate over time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Endowment Policy - Level Death Benefit?

An Endowment Policy with a Level Death Benefit is a type of life insurance that provides a guaranteed payout either on the death of the insured or at the end of a specified term, whichever occurs first. Unlike other life insurance policies, the payout remains constant throughout the policy's term.

Who is required to file Endowment Policy - Level Death Benefit?

Typically, individuals or businesses that have taken out an endowment policy and wish to claim benefits or provide information for tax purposes are required to file an Endowment Policy - Level Death Benefit. This may also include beneficiaries or dependents of the insured.

How to fill out Endowment Policy - Level Death Benefit?

To fill out an Endowment Policy - Level Death Benefit, you should provide personal details such as the insured's name, date of birth, amount of coverage, beneficiaries' information, and policy term. Additionally, any relevant financial information and signatures required by the insurance company must be included.

What is the purpose of Endowment Policy - Level Death Benefit?

The purpose of an Endowment Policy - Level Death Benefit is to provide financial security to beneficiaries in the event of the insured's death, ensuring that a sum of money is available for their needs. It also serves as a savings or investment vehicle that matures at a specified time, providing a lump sum payout.

What information must be reported on Endowment Policy - Level Death Benefit?

The information that must be reported on an Endowment Policy - Level Death Benefit includes the policy number, insured's details, beneficiary information, coverage amount, premium payment history, and any claims made or pending. It may also require disclosure of any loans against the policy.

Fill out your endowment policy - level online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Endowment Policy - Level is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.