Get the free AUTOMATIC REBALANCING - - - - 4 - SMI Funds

Show details

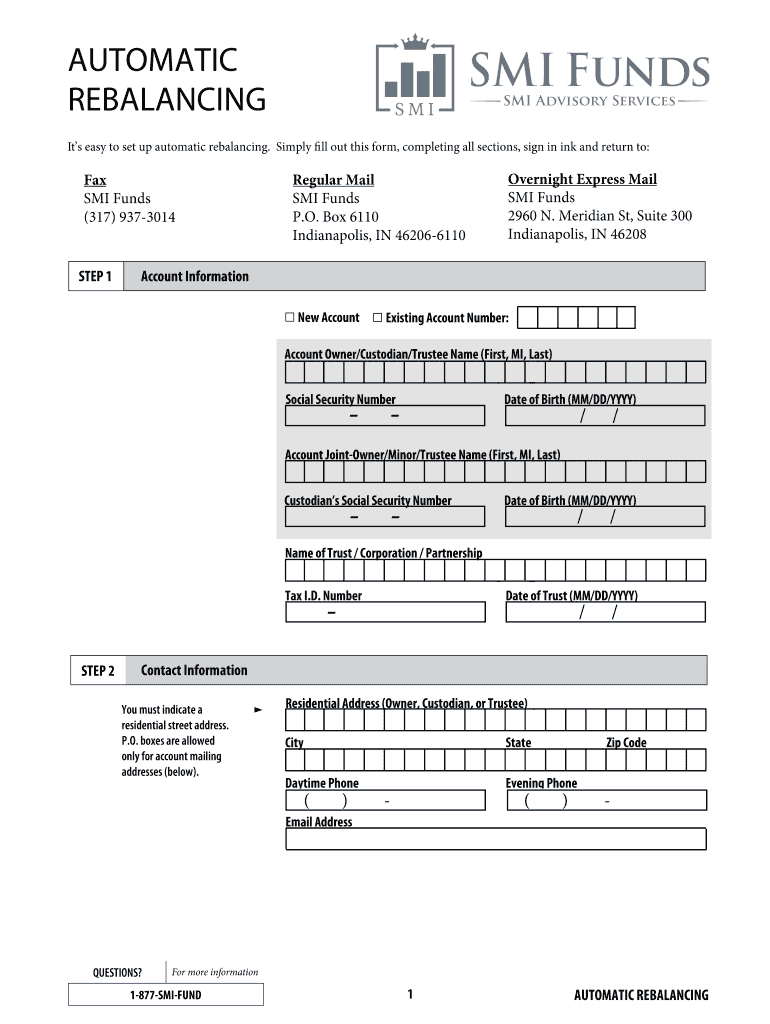

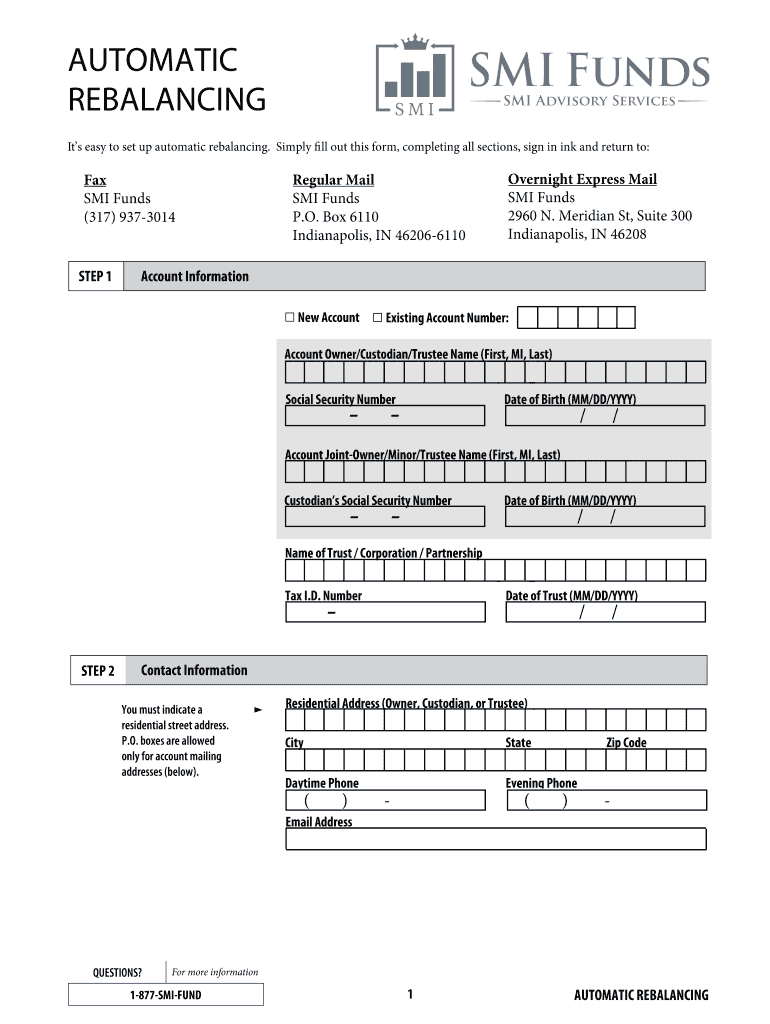

AUTOMATIC REBALANCING Its easy to set up automatic rebalancing. Simply fill out this form, completing all sections, sign in ink and return to: Fax SMI Funds (317) 9373014 STEP 1 Regular Mail SMI Funds

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign automatic rebalancing

Edit your automatic rebalancing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automatic rebalancing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit automatic rebalancing online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit automatic rebalancing. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out automatic rebalancing

How to fill out automatic rebalancing:

01

Identify your investment goals and risk tolerance: Before filling out automatic rebalancing, it is important to have a clear understanding of your investment goals and the level of risk you are comfortable with. This will help determine the appropriate asset allocation for your portfolio.

02

Determine your target asset allocation: Based on your investment goals and risk tolerance, decide on the ideal mix of investments for your portfolio. This may include a combination of stocks, bonds, and other asset classes.

03

Set your rebalancing parameters: Determine the tolerance bands or thresholds for each asset class in your portfolio. These parameters will determine when you need to rebalance your portfolio to maintain your desired asset allocation. For example, you may decide to rebalance if an asset class deviates more than 5% from its target allocation.

04

Choose a rebalancing strategy: There are different methods for rebalancing your portfolio automatically. Some common strategies include time-based rebalancing (e.g., rebalancing every quarter or annually), threshold-based rebalancing (e.g., rebalancing when an asset class deviates beyond the specified threshold), and cash flow rebalancing (e.g., rebalancing when new contributions or withdrawals are made).

05

Select an automatic rebalancing tool or service: There are various online platforms, robo-advisors, and investment management services that offer automatic rebalancing features. Research and choose a reliable and suitable tool or service that aligns with your investment needs and preferences.

Who needs automatic rebalancing?

01

Individual investors: Automatic rebalancing can be beneficial for individual investors who want to maintain a disciplined investment approach without constantly monitoring their portfolio. It helps ensure that their asset allocation remains aligned with their desired goals and risk tolerance.

02

Retirement savers: Those saving for retirement can benefit from automatic rebalancing to keep their retirement accounts on track. It helps guard against overexposure to certain asset classes and reduces the risk of not meeting long-term retirement goals.

03

Busy professionals: Individuals with demanding careers or limited time to dedicate to portfolio management can leverage automatic rebalancing to simplify their investment strategy. It allows them to delegate the task of maintaining their portfolio's target asset allocation to an automated process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is automatic rebalancing?

Automatic rebalancing is a process that periodically adjusts the allocation of assets in a portfolio to maintain the desired level of risk and return.

Who is required to file automatic rebalancing?

Investors or financial institutions managing portfolios are required to file automatic rebalancing.

How to fill out automatic rebalancing?

Automatic rebalancing can be filled out by using software or platforms that automate the process based on predetermined criteria.

What is the purpose of automatic rebalancing?

The purpose of automatic rebalancing is to ensure that the asset allocation remains in line with the investor's risk tolerance and investment objectives.

What information must be reported on automatic rebalancing?

Information such as current asset allocation, target asset allocation, and any changes made to the portfolio must be reported on automatic rebalancing.

How do I make edits in automatic rebalancing without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing automatic rebalancing and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit automatic rebalancing straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing automatic rebalancing.

How do I fill out automatic rebalancing on an Android device?

On Android, use the pdfFiller mobile app to finish your automatic rebalancing. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your automatic rebalancing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Automatic Rebalancing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.