Get the free Surety Bond Application - Carter and Company LLP

Show details

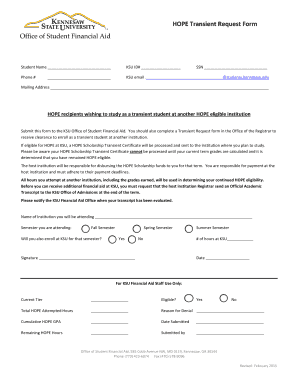

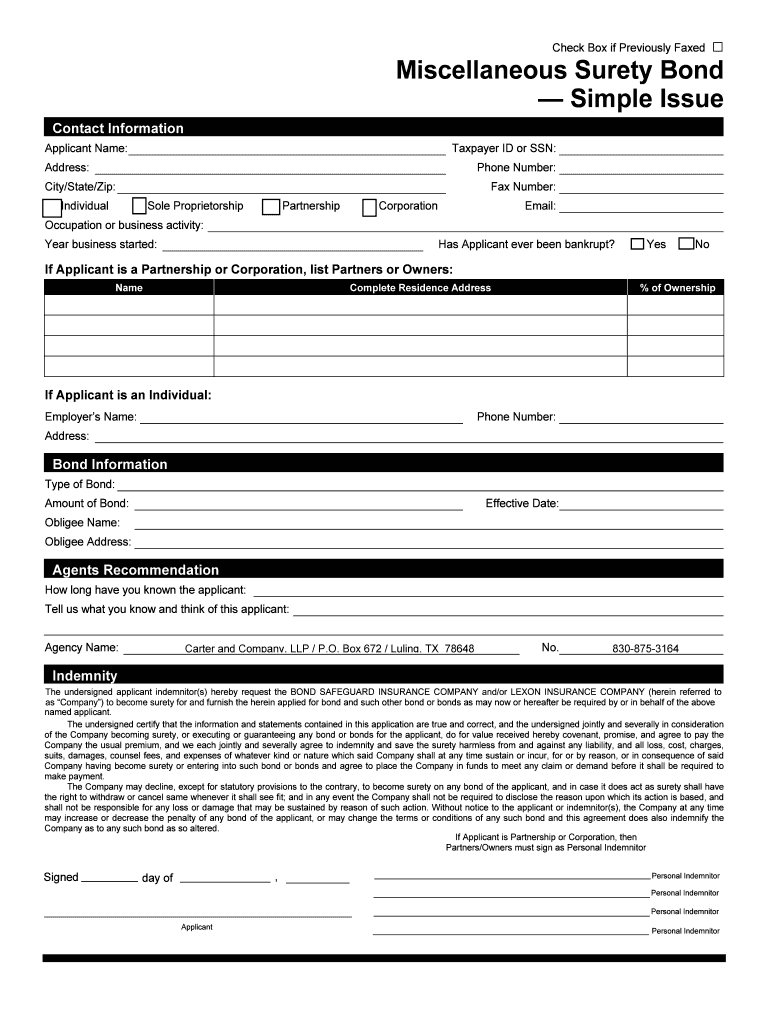

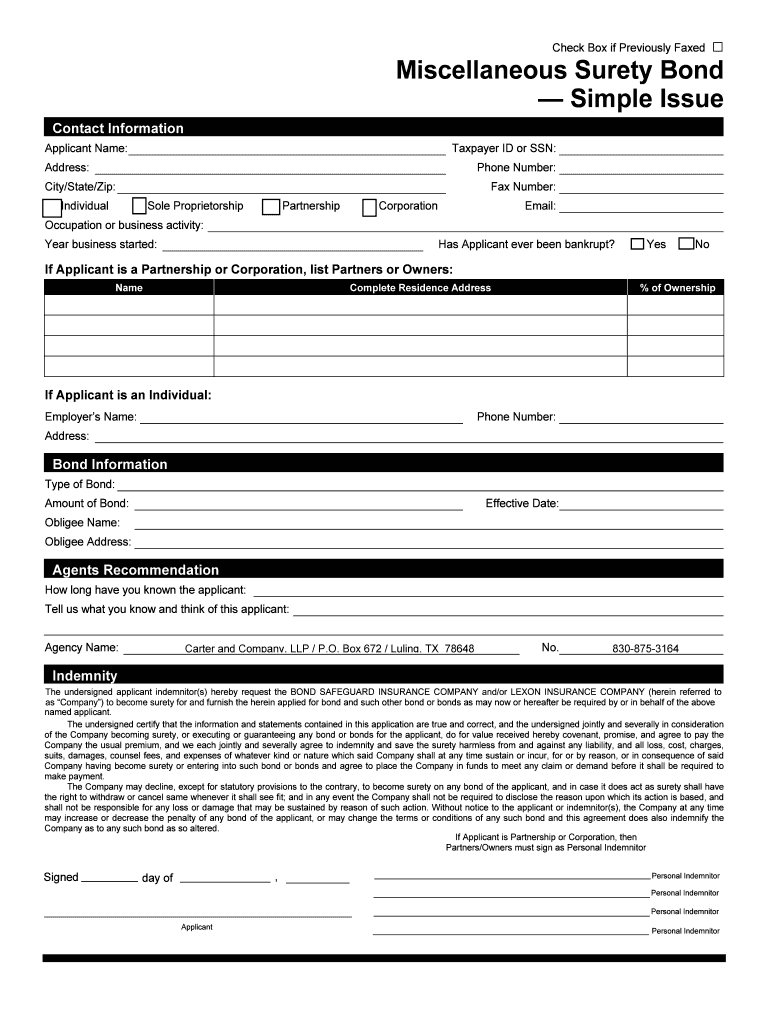

Check Box if Previously Faxed Leon Insurance Company Miscellaneous Surety Bond Simple Issue Contact Information Applicant Name: Taxpayer ID or SSN: Address: Phone Number: City/State/Zip: Fax Number:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign surety bond application

Edit your surety bond application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your surety bond application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing surety bond application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit surety bond application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out surety bond application

How to Fill Out a Surety Bond Application:

01

Begin by gathering all the necessary information and documentation. This may include personal identification, financial statements, and business licenses or permits.

02

Carefully read through the application form and instructions provided by the surety bond company. Familiarize yourself with the questions and requirements to ensure accurate and complete responses.

03

Start by providing your personal information, such as your full name, contact details, and social security number. If applying on behalf of a business, include the company's name, address, and legal structure.

04

Fill in the purpose or type of surety bond required. Specify the industry or sector for which the bond is needed, whether it is construction, finance, or any other industry that requires bonding.

05

If applicable, provide information about the project or contract that necessitates the bond. Include details such as the project's location, estimated value, and duration.

06

Complete the financial information section, which may require you to provide details about your assets, liabilities, and income. For businesses, additional financial documentation like balance sheets, profit and loss statements, and cash flow statements may be necessary.

07

If the surety bond application requires references, ensure you submit accurate and relevant information. These references may be required to vouch for your character, financial stability, or past performance.

08

Review the application form thoroughly before submitting it. Double-check all the information provided to ensure accuracy and completeness. Any errors or incomplete responses may cause delays or lead to the rejection of your bond application.

09

Once everything is filled out accurately, sign and date the application. If necessary, have the application notarized or witnessed as per the instructions provided.

10

Keep copies of the completed application and any supporting documents for your records. It is always good practice to have all the necessary paperwork readily available in case of any future inquiries or requirements.

Who Needs a Surety Bond Application:

01

Contractors: Those who operate in the construction industry frequently need surety bond applications. Contractors bidding on public or private projects may require different types of bonds, such as payment bonds, performance bonds, or bid bonds.

02

Business Professionals: Certain professionals, such as insurance agents, mortgage brokers, or auto dealers, may need to obtain a surety bond to comply with licensing or regulatory requirements.

03

Court Appointed Fiduciaries: Individuals appointed by the court to handle someone else's financial or personal matters may be required to obtain a surety bond. This helps protect the person or entity for whom they are acting as a fiduciary.

04

Notaries Public: Many states require notaries public to post a surety bond as part of their commission. This bond ensures that they fulfill their duties responsibly and protects the public from any misconduct or negligence.

05

License and Permit Holders: Various business licenses and permits, such as those for contractors, transportation companies, or alcohol establishments, may necessitate a surety bond as a form of financial guarantee to safeguard against potential liabilities.

Remember, the requirement for a surety bond application may vary depending on the industry, legal or contractual obligations, and state or local regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is surety bond application?

Surety bond application is a document that must be completed by individuals or businesses who need a guarantee of performance or payment for a specific obligation.

Who is required to file surety bond application?

Individuals or businesses who are required by law or regulation to obtain a surety bond for their activities.

How to fill out surety bond application?

Surety bond applications can typically be filled out online, through a bonding agency, or directly from the surety company. Applicants must provide detailed information about their personal or business finances, experience, and the specific bond needed.

What is the purpose of surety bond application?

The purpose of a surety bond application is to assess an individual or business's financial stability, credibility, and ability to fulfill their obligations.

What information must be reported on surety bond application?

Applicants must report detailed information about their personal or business finances, experience, and the specific bond needed. This may include credit history, references, financial statements, and project details.

How can I modify surety bond application without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like surety bond application, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make changes in surety bond application?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your surety bond application and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit surety bond application on an iOS device?

Create, modify, and share surety bond application using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your surety bond application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Surety Bond Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.