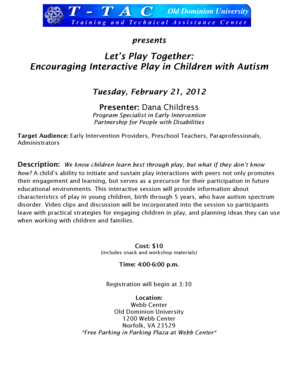

Get the free Mortgage of Industrial land - Format of NOC and tripartite agreement

Show details

Annexure9.53 Mortgage of Industrial land Format of NOC and tripartite agreement Certificate permitting mortgage of industrial unit for land in Industrial Development Area/Plot Cases in which Pasta

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage of industrial land

Edit your mortgage of industrial land form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage of industrial land form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage of industrial land online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage of industrial land. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage of industrial land

How to fill out a mortgage application for industrial land:

01

Gather all necessary documents: Prepare all relevant paperwork such as property deeds, land survey, and property valuation report. You may also need to provide personal identification, income proof, and credit history details.

02

Research mortgage lenders: Find reputable lenders who specialize in providing mortgages for industrial land. Compare interest rates, loan terms, and eligibility criteria to select the most suitable lender.

03

Assess financial capability: Analyze your financial situation to determine if you can afford the mortgage repayments. Consider factors such as your income, expenses, and other financial obligations.

04

Complete the application: Fill out the mortgage application form accurately and thoroughly. Provide all requested information about the property, such as its legal description, land size, and intended use.

05

Submit supporting documents: Attach all required supporting documents, such as property documents, financial statements, and tax returns. Ensure that all documents are current and valid.

06

Verify legal compliances: Check if any zoning or land-use restrictions are applicable to your industrial land. Ensure that the property is compliant with local laws, building codes, and regulations.

07

Engage legal counsel: Consider seeking legal advice throughout the mortgage application process. A legal professional can review the documents, negotiate terms, and assist with any legal implications.

08

Appraisal and underwriting: The lender may conduct an independent appraisal and underwriting process to evaluate the property value and assess your creditworthiness. Cooperate with the lender's requests during this stage.

09

Review loan offer: Once the lender reviews your application, they will provide a loan offer outlining the terms and conditions, loan amount, interest rate, and repayment schedule.

10

Sign the mortgage agreement: If you agree to the terms presented in the loan offer, sign the mortgage agreement. Make sure to carefully read and understand all clauses before signing.

Who needs a mortgage of industrial land?

01

Real estate developers: Developers who wish to acquire industrial land for construction or development projects may need a mortgage to finance the purchase.

02

Business owners: Entrepreneurs who operate industrial businesses, such as warehouses, manufacturing units, or logistics centers, may require a mortgage to buy the land where their business will be established.

03

Investors: Individuals or companies looking to invest in industrial land for future appreciation or rental income may seek a mortgage to fund the purchase.

04

Expansion or relocation: Existing businesses that want to expand their operations or relocate to a larger or more suitable industrial property may need a mortgage to facilitate the transition.

05

Entrepreneurs looking for property appreciation: Some individuals may purchase industrial land with the goal of holding onto it until its value appreciates before selling it for a profit. A mortgage can help finance this investment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is mortgage of industrial land?

Mortgage of industrial land is a legal agreement where a borrower pledges their industrial land as collateral for a loan.

Who is required to file mortgage of industrial land?

The individual or company who has borrowed a loan using their industrial land as collateral is required to file a mortgage of industrial land.

How to fill out mortgage of industrial land?

To fill out a mortgage of industrial land, one needs to include details such as the borrower's information, loan amount, terms of the loan, and description of the industrial land being used as collateral.

What is the purpose of mortgage of industrial land?

The purpose of mortgage of industrial land is to secure a loan by using the industrial land as collateral, ensuring that the lender has a legal claim to the property in case the borrower defaults on the loan.

What information must be reported on mortgage of industrial land?

Information that must be reported on mortgage of industrial land includes details about the borrower, loan amount, interest rate, repayment terms, and legal description of the industrial land.

How do I edit mortgage of industrial land online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your mortgage of industrial land to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an eSignature for the mortgage of industrial land in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your mortgage of industrial land right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I edit mortgage of industrial land on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit mortgage of industrial land.

Fill out your mortgage of industrial land online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Of Industrial Land is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.