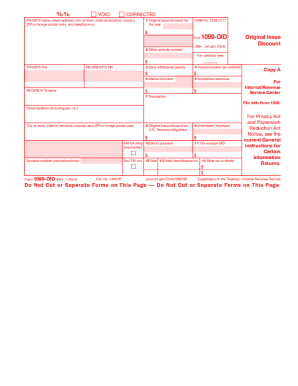

Who needs IRS Form 1099 DID?

Everyone who purchases a bond or a treasury note at a price less than face value gets IRS Form 1099-OID. Also known as Original Issue Discount, the form must be filled out by the respective bond purchaser.

What is IRS Form 1099 DID for?

Actually the Original Issue Discount is the difference between bond’s issued price and its redemption principal amount. DID refer to the interest which means that the money you get on it is taxable and should be reported as income until the bond expires even if you get no interest on it. If the DID in a bondholder’s income is at least $10, he or she must fill out Form 1099 DID. However, there are some exemptions when a person isn’t required to fill out the form. They are: tax-exempt obligations, U.S. savings bonds, etc.

Is IRS Form 1099 DID accompany by other forms?

Form 1099 DID relates to the Annual Summary and Transmittal of U.S. Information Returns which is Form 1099 DID. So it should accompany Form 1099 DID.

When is IRS Form 1099 DID due?

If form 1099 DID is filed electronically it should be submitted to the IRS by March 31. If the paper form is completed, it is sent to the IRS by February 28. All the recipients should get the form by January 31.

How do I fill out IRS Form 1099 DID?

Form 1099-OID consists of 13 boxes that you have to compete with the figures that account for original issue discount, periodic interest, market discount, etc. But before you start filling them out, provide the following information:

- Payer’s and recipient's names

- Their identification numbers

- Recipient's contact information

Where do I send IRS Form 1099 DID?

A completed Form 1099 DID is sent to the IRS.