Get the free DUE 8213 - Independence Charter School - independencecharter

Show details

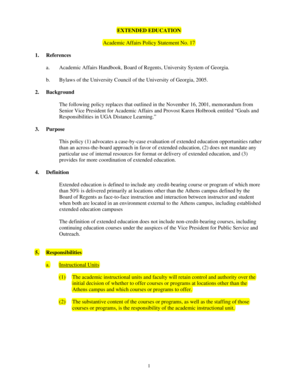

DUE 8/2/13 Independence Charter School 20132014 Dismissal Plans PLEASE PRINT ALL INFORMATION CLEARLY! Please complete a separate form for EACH CHILD!! Students Name Grade 20132014KINDERGARTEN Home

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign due 8213 - independence

Edit your due 8213 - independence form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your due 8213 - independence form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing due 8213 - independence online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit due 8213 - independence. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out due 8213 - independence

01

Due Form 8213 - Independence is typically required to be filled out by independent contractors or consultants who have provided services to a company or organization.

02

The purpose of this form is to ensure that the independent contractor or consultant is truly independent and not an employee of the company. It helps to establish the independence of the working relationship and helps to avoid potential liabilities associated with misclassification.

03

To fill out due 8213 - independence, you will need to provide basic information about the independent contractor or consultant, such as their name, address, and tax identification number.

04

The form will also require the independent contractor or consultant to certify that they are not an employee of the company, that they are responsible for their own taxes, and that they have their own liability insurance.

05

Additionally, the form may require the independent contractor or consultant to provide information about any other clients or contracts they currently have, as well as any conflicts of interest that may arise from their work with the company.

06

It is important to thoroughly read and understand the instructions provided with the form to ensure that all relevant information is accurately provided.

07

Once the form is filled out, it is typically submitted to the appropriate department within the company or organization, such as the human resources department or the department responsible for contract management.

08

The company or organization may review the form and may request additional documentation or clarification if needed.

09

Ultimately, the completion of due Form 8213 - Independence helps to establish and document the independent contractor status of the individual, ensuring compliance with applicable laws and regulations.

10

It is important to consult with legal or tax professionals to ensure that all requirements are met and that the form is filled out correctly to avoid any potential legal or financial consequences.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is due 8213 - independence?

Due 8213 - independence refers to the deadline for entities to demonstrate their independence.

Who is required to file due 8213 - independence?

Entities that are subject to independence requirements are required to file due 8213 - independence.

How to fill out due 8213 - independence?

Due 8213 - independence is typically filled out by providing information and documentation that demonstrates the entity's independence.

What is the purpose of due 8213 - independence?

The purpose of due 8213 - independence is to ensure that entities are independent and can make unbiased decisions.

What information must be reported on due 8213 - independence?

Due 8213 - independence may require reporting on relationships, financial interests, and other relevant factors that could affect independence.

How do I edit due 8213 - independence online?

The editing procedure is simple with pdfFiller. Open your due 8213 - independence in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I edit due 8213 - independence on an Android device?

The pdfFiller app for Android allows you to edit PDF files like due 8213 - independence. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I fill out due 8213 - independence on an Android device?

On an Android device, use the pdfFiller mobile app to finish your due 8213 - independence. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your due 8213 - independence online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Due 8213 - Independence is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.