Get the free Tax Installment Payment Plan - MD BigHorn - mdbighorn

Show details

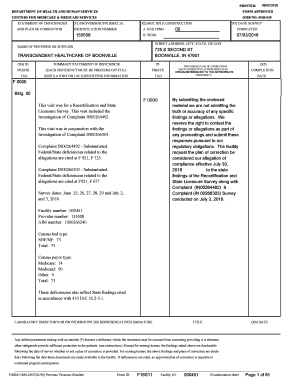

TIPP (Tax Installment Payment Plan) MONTHLY Application Tax Roll A Property Identification Street Address of Property Owned Legal Description: Lot/Unit Block Plan Section B Applicants Personal Information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax installment payment plan

Edit your tax installment payment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax installment payment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax installment payment plan online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax installment payment plan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax installment payment plan

How to fill out tax installment payment plan:

01

Gather all necessary information: Before filling out the tax installment payment plan, you need to gather all the relevant information, such as your tax returns, social security number, and any previous payment history.

02

Determine your eligibility: Ensure that you meet the requirements to qualify for a tax installment payment plan. This usually includes having a tax debt below a certain threshold and being up to date with your tax filings.

03

Choose the appropriate application form: The IRS offers various application forms for different types of tax installment plans. Select the form that best fits your situation, such as Form 9465 for individuals or Form 433-D for businesses.

04

Fill out the application form accurately: Provide all the required information on the application form, including your personal details, tax debt amount, proposed monthly payment amount, and any supporting documentation requested.

05

Decide on a monthly payment amount: Determine the monthly payment you can afford to make towards your tax debt. Consider your income, expenses, and other financial obligations. It's important to propose a reasonable payment amount that you can consistently meet.

06

Submit the application: After completing the application form, submit it to the appropriate tax authority, which is typically the IRS. Make sure to include any required documentation and double-check that all information is accurate and complete.

07

Await a response: Once your application is submitted, it may take some time for the tax authority to review and process it. Be patient and wait for their response, which could be an approval, a request for additional information, or a denial.

08

Review and agree to the terms: If your tax installment payment plan is approved, carefully review the terms and conditions provided by the tax authority. Ensure that you understand the interest rates, penalties, and any other fees associated with the plan.

09

Make timely payments: Once your tax installment payment plan is in place, it's crucial to make your monthly payments on time. Consider setting up automatic payments or reminders to avoid missing any payments.

10

Keep records and stay compliant: Maintain records of your tax installment payments, correspondence with the tax authority, and any changes in your financial situation. It's essential to stay compliant with the terms of the plan to avoid any further penalties or issues.

Who needs a tax installment payment plan:

01

Individuals with a significant tax debt: If you owe a large amount in taxes that you're unable to pay in full, a tax installment payment plan can provide a structured approach to repay your debt over time. It's a suitable option for individuals who don't have the immediate financial means to settle their tax liabilities.

02

Business owners with tax obligations: Businesses that are struggling financially or have faced unexpected expenses may find it challenging to pay their tax debts all at once. A tax installment payment plan allows businesses to spread out their payments over a defined period, making it easier to manage their cash flow.

03

Those facing temporary financial hardship: Individuals or businesses experiencing temporary financial hardship, such as job loss, medical expenses, or natural disasters, may need a tax installment payment plan to navigate their tax debt while addressing their immediate financial challenges.

04

Taxpayers needing to avoid collection actions: For individuals or businesses at risk of federal tax liens, wage garnishments, or other collection actions, a tax installment payment plan can help prevent such actions. It provides a proactive approach to resolving tax debt while maintaining a better financial standing with the tax authorities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax installment payment plan online?

With pdfFiller, the editing process is straightforward. Open your tax installment payment plan in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit tax installment payment plan straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit tax installment payment plan.

How do I complete tax installment payment plan on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your tax installment payment plan. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is tax installment payment plan?

A tax installment payment plan allows taxpayers to pay their taxes in multiple installments rather than in a single lump sum.

Who is required to file tax installment payment plan?

Taxpayers who expect to owe a large amount of taxes at the end of the year may be required to file a tax installment payment plan.

How to fill out tax installment payment plan?

Taxpayers can fill out a tax installment payment plan by providing information about their income, deductions, and estimated tax liability.

What is the purpose of tax installment payment plan?

The purpose of a tax installment payment plan is to help taxpayers manage their cash flow and avoid steep penalties for underpayment of taxes.

What information must be reported on tax installment payment plan?

Taxpayers must report their estimated tax liability, income sources, deductions, and any credits they are eligible for on the tax installment payment plan.

Fill out your tax installment payment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Installment Payment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.