Get the free RELEVANT LIFE PLAN

Show details

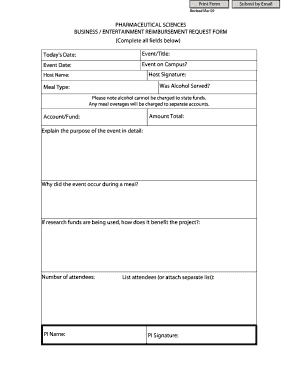

RELEVANT LIFE PLAN Data capture form You should use this form to capture the information you'll need from your client to use our online quote and apply system. We won't accept this form as a replacement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign relevant life plan

Edit your relevant life plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your relevant life plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit relevant life plan online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit relevant life plan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out relevant life plan

01

To fill out a relevant life plan, start by assessing your current financial situation. Take note of your income, expenses, debts, and investments. This will give you a clear understanding of your financial standing and help you determine your goals and priorities.

02

Identify your long-term financial objectives. These could include saving for retirement, paying off a mortgage, funding your children's education, or building an emergency fund. Prioritize these objectives based on their importance and feasibility.

03

Set specific and measurable goals. Instead of saying, "I want to save more money," be precise by stating, "I want to save $10,000 for a down payment on a house within five years." This clarity will make it easier to track your progress and stay motivated.

04

Consider your risk tolerance and investment preferences. Determine how comfortable you are with market fluctuations and if you prefer low-risk or high-risk investments. This will help you decide on an investment strategy that aligns with your goals and personality.

05

Consult with a financial advisor or planner. A professional can provide valuable insights, guidance, and expertise in creating a relevant life plan. They can help you analyze your financial situation, offer personalized advice, and assist in implementing your plan effectively.

Who needs a relevant life plan?

01

Individuals who want to achieve financial stability and security in the long run can benefit from having a relevant life plan. It helps them organize their financial goals, prioritize objectives, and make informed decisions about saving, investing, and spending.

02

Young professionals who are starting their careers should consider creating a relevant life plan to set themselves up for financial success. By establishing good habits early on and having a clear roadmap, they can avoid common mistakes and build a strong foundation for their future.

03

Families who want to secure their loved ones' financial well-being can greatly benefit from a relevant life plan. It allows them to protect their assets, plan for their children's education, and ensure adequate insurance coverage for unforeseen circumstances.

04

Business owners or self-employed individuals who have variable income streams and unique financial considerations should create a relevant life plan tailored to their specific circumstances. It can help them manage their business finances, plan for expansions or retirement, and mitigate risks.

Ultimately, a relevant life plan is a valuable tool for anyone who wants to take control of their financial future, make wise investment choices, and achieve their long-term goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is relevant life plan?

A relevant life plan is a type of life insurance policy specifically designed for high-earning individuals who want to provide their loved ones with a tax-efficient lump sum payment upon their death.

Who is required to file relevant life plan?

Employers are typically responsible for setting up relevant life plans for their employees, who can then choose to opt in or out of the scheme.

How to fill out relevant life plan?

To fill out a relevant life plan, individuals must provide information such as their personal details, beneficiary information, and desired coverage amount.

What is the purpose of relevant life plan?

The purpose of a relevant life plan is to provide financial protection for loved ones in the event of the policyholder's death, while also offering tax advantages compared to traditional life insurance policies.

What information must be reported on relevant life plan?

Relevant life plans typically require information about the policyholder's personal details, beneficiaries, coverage amount, and any additional benefits or features included in the policy.

How do I modify my relevant life plan in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign relevant life plan and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I modify relevant life plan without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your relevant life plan into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for signing my relevant life plan in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your relevant life plan and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Fill out your relevant life plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Relevant Life Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.