Get the free Existing Annuity Contract

Show details

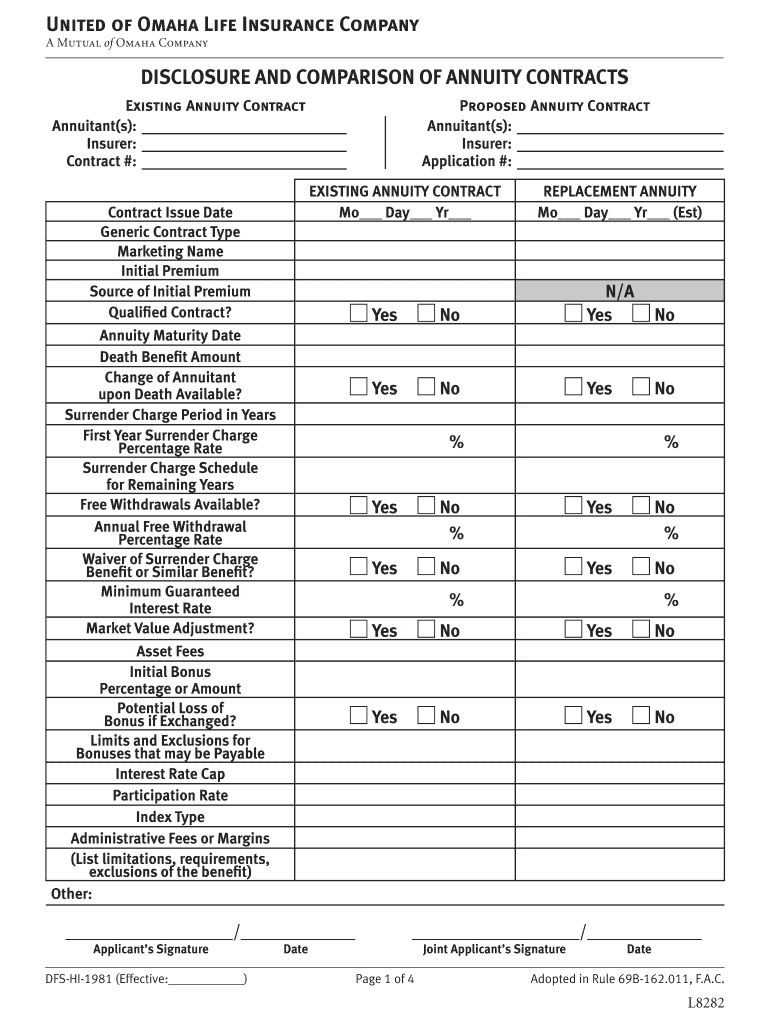

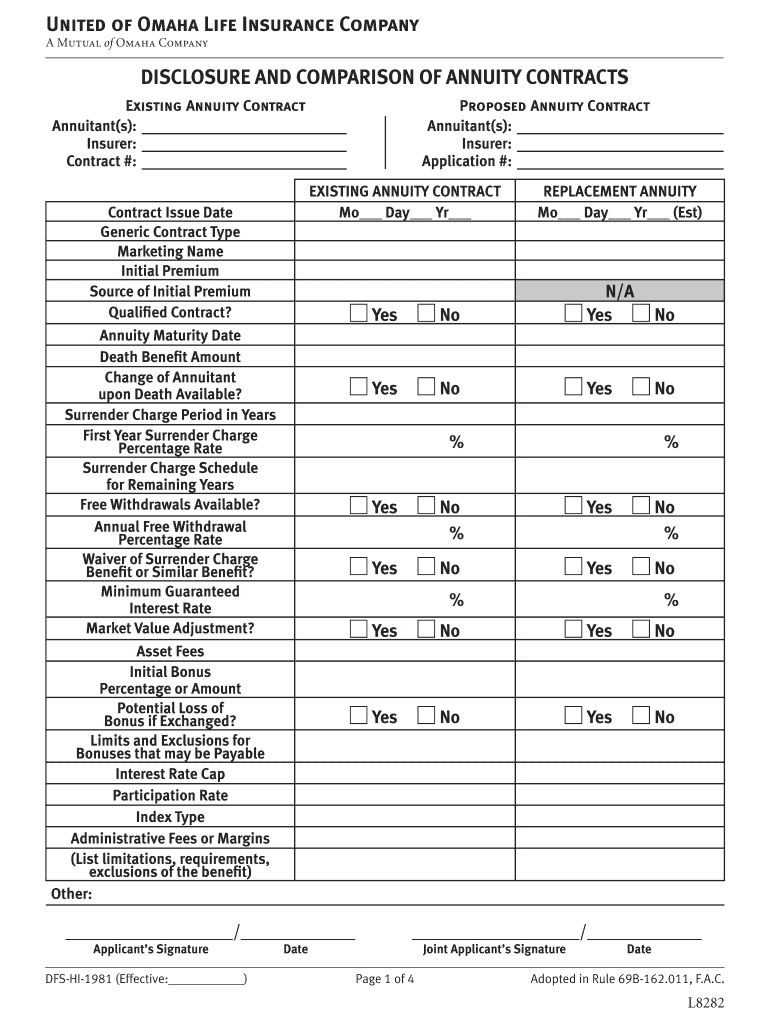

United of Omaha Life Insurance Company A Mutual of Omaha Company DISCLOSURE AND COMPARISON OF ANNUITY CONTRACTS Existing Annuity Contract Annuitant(s): Insurer: Contract #: Contract Issue Date Generic

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign existing annuity contract

Edit your existing annuity contract form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your existing annuity contract form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing existing annuity contract online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit existing annuity contract. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out existing annuity contract

How to Fill Out an Existing Annuity Contract:

01

Gather all necessary documents, including the annuity contract itself, any accompanying agreements or riders, and any relevant personal information.

02

Carefully review the terms and conditions of the annuity contract, paying attention to details such as the interest rate, payment frequency, and any applicable fees or penalties.

03

Complete the required sections of the annuity contract, providing accurate and up-to-date information. This may include details about your finances, beneficiaries, and desired payment options.

04

If there are any optional features or riders that you wish to add or remove from the annuity contract, clearly indicate your choices.

05

Double-check all the information you have provided to ensure its accuracy. Any mistakes or omissions could have financial implications later on.

06

If you are unsure about any specific sections or terminology in the annuity contract, consult with a financial professional or seek legal advice to ensure you fully understand the contract.

07

Once you are confident that all necessary information has been provided and that you understand the terms, sign the annuity contract and keep a copy for your records. Consider sending a copy to the insurance company or financial institution administering the annuity as well.

Who Needs an Existing Annuity Contract:

01

Individuals who are planning for retirement and seeking a steady income stream during their post-employment years may find an existing annuity contract beneficial.

02

Those who have accumulated a significant amount of savings and wish to protect their assets and ensure a guaranteed income stream may also opt for an existing annuity contract.

03

People who are looking for an investment vehicle that offers tax-deferred growth and potentially higher returns than traditional savings or checking accounts might consider obtaining an existing annuity contract.

04

Individuals who want to pass on their wealth to beneficiaries while minimizing estate taxes may utilize an existing annuity contract as part of an estate planning strategy.

05

Those who prefer to have a fixed income stream that is not subject to market fluctuations or interest rate changes may choose an existing annuity contract to provide financial stability.

In conclusion, filling out an existing annuity contract requires careful attention to detail and understanding of its terms. The contract is suitable for various individuals, such as those planning for retirement, seeking guaranteed income, looking for tax advantages, engaging in estate planning, or desiring financial stability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is existing annuity contract?

An existing annuity contract is a contract between an individual and an insurance company where the individual makes payments to the insurance company, which in turn agrees to make periodic payments to the individual in the future.

Who is required to file existing annuity contract?

The individual who holds the existing annuity contract is required to file it.

How to fill out existing annuity contract?

The existing annuity contract can be filled out by providing information about the contract holder, the insurance company, and the terms of the contract.

What is the purpose of existing annuity contract?

The purpose of an existing annuity contract is to provide a stream of income for the contract holder during retirement.

What information must be reported on existing annuity contract?

The existing annuity contract must include details such as the name of the contract holder, the name of the insurance company, the amount of the annuity payments, and the payment schedule.

How do I complete existing annuity contract online?

pdfFiller has made filling out and eSigning existing annuity contract easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I sign the existing annuity contract electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your existing annuity contract.

How do I edit existing annuity contract on an Android device?

With the pdfFiller Android app, you can edit, sign, and share existing annuity contract on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your existing annuity contract online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Existing Annuity Contract is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.