Get the free CREDIT RISK TRAINING

Show details

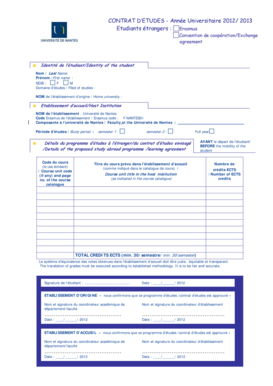

INTENSIVE CREDIT RISK TRAINING Program Registration Form www.caricris.com Date: June 8th 10th, 2009 Time: 8:30 am to 4:30 pm Venue: Mona Visitors Lodge Blue Room, Mona Campus UPI Registration/Payment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit risk training

Edit your credit risk training form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit risk training form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit risk training online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit risk training. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit risk training

How to fill out credit risk training?

01

Begin by understanding the purpose and importance of credit risk training. Credit risk refers to the potential financial loss a company may face if a borrower fails to meet their repayment obligations. Training in this area equips individuals with the knowledge and skills to assess, mitigate, and manage credit risk effectively.

02

Familiarize yourself with the key concepts and principles of credit risk. This includes understanding credit analysis, credit scoring models, credit rating agencies, and various risk measurement techniques. Develop a solid foundation in financial analysis and credit assessment methodologies.

03

Identify the specific training courses or programs available for credit risk training. Many organizations offer workshops, seminars, or online courses dedicated to credit risk. Look for courses that cover topics such as credit risk management, credit risk modeling, loan portfolio management, and regulatory requirements related to credit risk.

04

Evaluate the credibility and reputation of the training provider or institution. Ensure that the training program is recognized by industry professionals and aligns with industry standards and best practices. Consider reading reviews or seeking recommendations from professionals in the field.

05

Enroll in the chosen credit risk training program and actively participate in the learning process. Take advantage of any hands-on exercises, case studies, or simulations provided to enhance your understanding and practical skills. Engage with trainers or instructors to clarify any doubts or questions that may arise.

06

Allocate sufficient time and effort to complete the training program. Credit risk training may involve self-study, group discussions, or assessments. Set aside dedicated study hours and stay committed to completing the required coursework within the given timeframe.

07

Apply the knowledge gained from the credit risk training in practical scenarios. Seek opportunities to work on real-world credit risk projects or engage in relevant internships to further strengthen your skills. Take part in credit risk analysis or underwriting activities to gain hands-on experience.

Who needs credit risk training?

01

Professionals working in financial institutions such as banks, credit unions, or investment firms who are involved in lending and credit decisions. This includes credit officers, loan officers, risk managers, and credit analysts.

02

Risk management professionals responsible for assessing and managing credit risk within their organizations. This may include individuals working in corporate risk management departments or risk consulting firms.

03

Individuals aspiring to pursue a career in credit risk management or underwriting. Credit risk training can provide a strong foundation and enhance employability in these roles.

04

Business owners or entrepreneurs who want to understand credit risk to make informed decisions relating to borrowing, lending, or credit investments.

05

Regulators and compliance professionals who need a thorough understanding of credit risk to oversee and enforce regulatory requirements.

Overall, credit risk training is beneficial for anyone involved in the lending process, risk management, or financial decision-making where credit risk is a significant factor.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is credit risk training?

Credit risk training is a form of education and preparation for individuals or organizations to better understand and manage the risks associated with extending credit to borrowers.

Who is required to file credit risk training?

Certain financial institutions, such as banks and credit unions, may be required to file credit risk training with regulatory authorities.

How to fill out credit risk training?

Credit risk training can be filled out by providing relevant information about the credit risk management practices, policies, and procedures in place within an organization.

What is the purpose of credit risk training?

The purpose of credit risk training is to enhance the understanding of credit risk management processes and help mitigate potential risks associated with credit lending.

What information must be reported on credit risk training?

Information such as risk assessment methodologies, credit policies, procedures, and controls may need to be reported on credit risk training.

How can I send credit risk training for eSignature?

When you're ready to share your credit risk training, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I edit credit risk training on an Android device?

You can make any changes to PDF files, such as credit risk training, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I complete credit risk training on an Android device?

Use the pdfFiller app for Android to finish your credit risk training. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your credit risk training online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Risk Training is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.