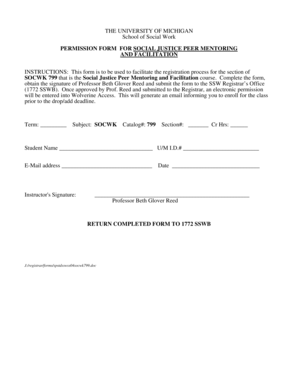

Get the free CAPTIVE INSURANCE

Show details

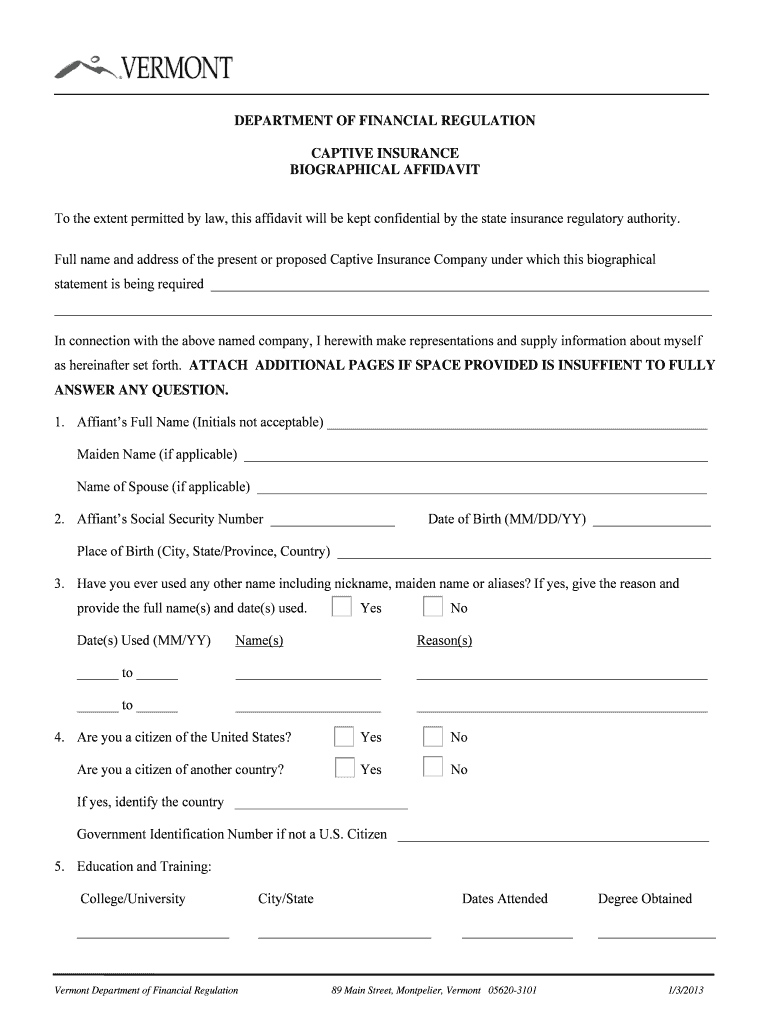

DEPARTMENT OF FINANCIAL REGULATION CAPTIVE INSURANCE BIOGRAPHICAL AFFIDAVIT To the extent permitted by law, this affidavit will be kept confidential by the state insurance regulatory authority. Full

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign captive insurance

Edit your captive insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your captive insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit captive insurance online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit captive insurance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out captive insurance

How to fill out captive insurance:

01

Research and Understand Captive Insurance: Before filling out captive insurance, it is crucial to have a clear understanding of what it is and how it works. Research about different types of captive insurance, including single-parent captives, group captives, and risk retention groups. Familiarize yourself with the requirements, benefits, and potential drawbacks of captive insurance.

02

Assess Your Insurance Needs: Evaluate your organization's insurance needs to determine whether captive insurance is a suitable option. Consider factors such as the nature of your business, risk exposure, and current insurance coverage. Assess whether traditional insurance options adequately address your specific risks, or if captive insurance would offer more tailored and cost-effective coverage.

03

Seek Professional Guidance: Captive insurance involves complex legal and financial aspects, so it is recommended to consult with industry professionals. Engage an experienced captive insurance manager or consultant who can provide expert advice on structuring and managing your captive insurance. They will guide you through the entire process, ensuring compliance with regulatory requirements and maximizing the benefits of captive insurance.

04

Establish a Captive Insurance Company: If your assessment indicates that captive insurance is the right choice, you will need to establish a captive insurance company. This involves incorporating a separate legal entity designated solely for insurance purposes. Work with your captive insurance manager to navigate the legal and regulatory requirements for setting up the company in the jurisdiction of your choice.

05

Determine the Captive Structure: Work with your captive insurance manager to determine the most suitable captive structure for your needs. This includes deciding whether it will be a pure captive, a group captive, or another type of captive arrangement. Consider factors such as risk pooling, capitalization requirements, and governance structure when deciding on the best structure for your captive insurance.

06

Draft Insurance Policies and Procedures: Once the captive insurance company is established, design the insurance policies and procedures that will govern the coverage provided by the captive. These policies should align with your risk management strategy and the specific needs of your organization. Work with your captive insurance manager and legal advisors to ensure these policies are comprehensive and comply with applicable laws and regulations.

07

Obtain Reinsurance (if necessary): Depending on the nature and scale of your insurance risks, you may need to obtain reinsurance for your captive insurance company. Reinsurance provides an extra layer of protection for your captive, allowing it to handle larger claims or catastrophic events. Your captive insurance manager can assist in identifying suitable reinsurance options and structuring the terms of the reinsurance agreement.

Who needs captive insurance:

01

Businesses with High-Risk Profiles: Captive insurance is often beneficial for businesses with unique or high-risk profiles that find it challenging to obtain affordable and comprehensive coverage through traditional insurance markets. Industries such as healthcare, construction, transportation, and manufacturing commonly utilize captive insurance to address their specific risk exposures.

02

Mid-sized to Large Companies: Captive insurance is especially popular among mid-sized to large companies that have the financial resources and risk management strategies to establish and effectively manage a captive insurance company. These companies often have greater control over their insurance programs, resulting in better customization, improved risk management, and potential cost savings.

03

Organizations Seeking Risk Transfer and Retention: Captive insurance allows businesses to transfer and retain risk more effectively. By retaining a portion of the risk within the captive, companies can align their insurance coverage with their risk appetite and financial objectives. This approach often leads to better risk control, reduced overall insurance costs, and the potential for long-term profit through the captive's underwriting performance.

04

Companies Seeking Risk Management Flexibility: Captive insurance offers companies greater flexibility in risk management and insurance decision-making. Captive owners can tailor their insurance policies and coverage to match their unique needs and risk profiles. They can also respond quickly to evolving market conditions, regulatory changes, and emerging risks, allowing for more proactive risk management.

05

Businesses in Regions with Limited Insurance Options: In certain regions or industries, traditional insurance options may be limited or costly. Captive insurance can provide a viable alternative for these businesses, enabling them to maintain adequate coverage and better control their insurance costs, even in challenging insurance markets.

Remember, it is crucial to consult with professionals experienced in captive insurance to determine whether it is the right solution for your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is captive insurance?

Captive insurance is a form of self-insurance where a company creates its own insurance company to provide coverage for itself.

Who is required to file captive insurance?

Companies looking to establish their own insurance company for risk management purposes.

How to fill out captive insurance?

Companies must follow the regulatory requirements set by the jurisdiction where the captive insurance is established.

What is the purpose of captive insurance?

The purpose of captive insurance is to provide customized insurance coverage for the specific risks of the company.

What information must be reported on captive insurance?

Financial information, risk management strategy, and claims history must be reported on captive insurance.

How can I send captive insurance to be eSigned by others?

Once your captive insurance is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an eSignature for the captive insurance in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your captive insurance directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out the captive insurance form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign captive insurance and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your captive insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Captive Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.