Get the free Credit Score Notice - FICO - Merchants Information Solutions Inc

Show details

Doddering Act (DFA) Credit Score Notice

We also obtained your FICO credit score from Merchants Information Solutions, Inc. a reseller

for Experian and used it in making our credit decision. Your credit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit score notice

Edit your credit score notice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit score notice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit score notice online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit score notice. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit score notice

Point by point guide on how to fill out credit score notice:

01

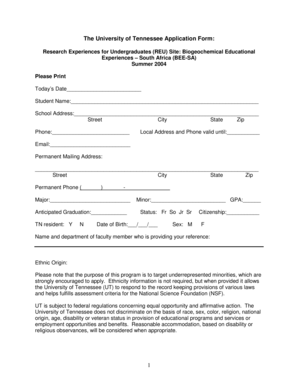

Obtain the credit score notice form: Start by acquiring the official credit score notice form. This form can usually be obtained from the credit reporting agency or downloaded from their website.

02

Provide personal information: Fill in your personal information accurately and completely. This typically includes your full name, current address, social security number, and contact information.

03

Verify the purpose of requesting the notice: Indicate the reason for requesting the credit score notice. This could include situations such as applying for a loan, rental application, or credit card application.

04

Specify the credit reporting agency: Select the credit reporting agency from which you wish to obtain the credit score notice. Different agencies may have varying information and scoring models, so it's essential to choose the relevant one.

05

Consent to terms and conditions: Read through the terms and conditions section carefully. Confirm your understanding and agreement by signing and dating the form. Ensure you understand any fees associated with accessing your credit score.

06

Submit the credit score notice: Once you have completed filling out the form, submit it to the designated address or online platform provided by the credit reporting agency. Ensure you follow the specified submission instructions accurately to avoid delays or issues.

Who needs credit score notice?

01

Individuals applying for credit: Those who are applying for credit, such as a loan or credit card, often require a credit score notice. Lenders and financial institutions use credit scores to assess the creditworthiness of applicants.

02

Renters or tenants: Some landlords or rental agencies may request a credit score notice as part of the application process. This helps them evaluate the potential tenants' financial history and determine their ability to pay rent consistently.

03

Individuals monitoring their credit: Even if not actively applying for credit, individuals may still want to request their credit score notice periodically to monitor their creditworthiness, identify any errors or fraudulent activities, and devise strategies for improving their credit score.

04

Those seeking financial advice or counseling: Individuals seeking financial advice or credit counseling may need to provide a credit score notice to the counselor. This allows them to better understand the individual's financial situation and provide tailored guidance or solutions.

05

Those involved in certain legal proceedings: In some legal proceedings, such as divorce or bankruptcy, individuals may be required to provide a credit score notice as part of the documentation process. This helps assess the impact of financial matters on the proceeding.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is credit score notice?

Credit score notice is a document that informs individuals about their credit score.

Who is required to file credit score notice?

Lenders or financial institutions are required to file credit score notice.

How to fill out credit score notice?

To fill out a credit score notice, include information about the individual's credit score and any relevant details.

What is the purpose of credit score notice?

The purpose of credit score notice is to provide individuals with information about their creditworthiness.

What information must be reported on credit score notice?

On credit score notice, information about the individual's credit score, credit history, and any relevant factors affecting creditworthiness must be reported.

How can I send credit score notice to be eSigned by others?

Once you are ready to share your credit score notice, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit credit score notice straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit credit score notice.

How do I edit credit score notice on an iOS device?

Use the pdfFiller mobile app to create, edit, and share credit score notice from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your credit score notice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Score Notice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.