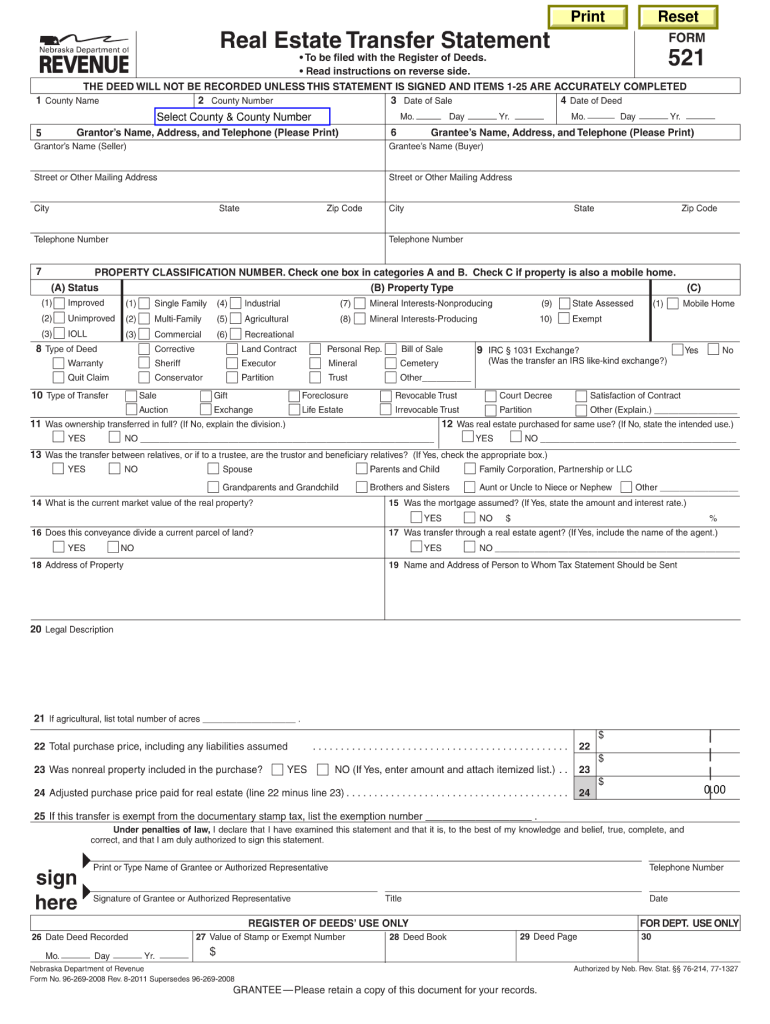

NE form 521 2011 free printable template

Show details

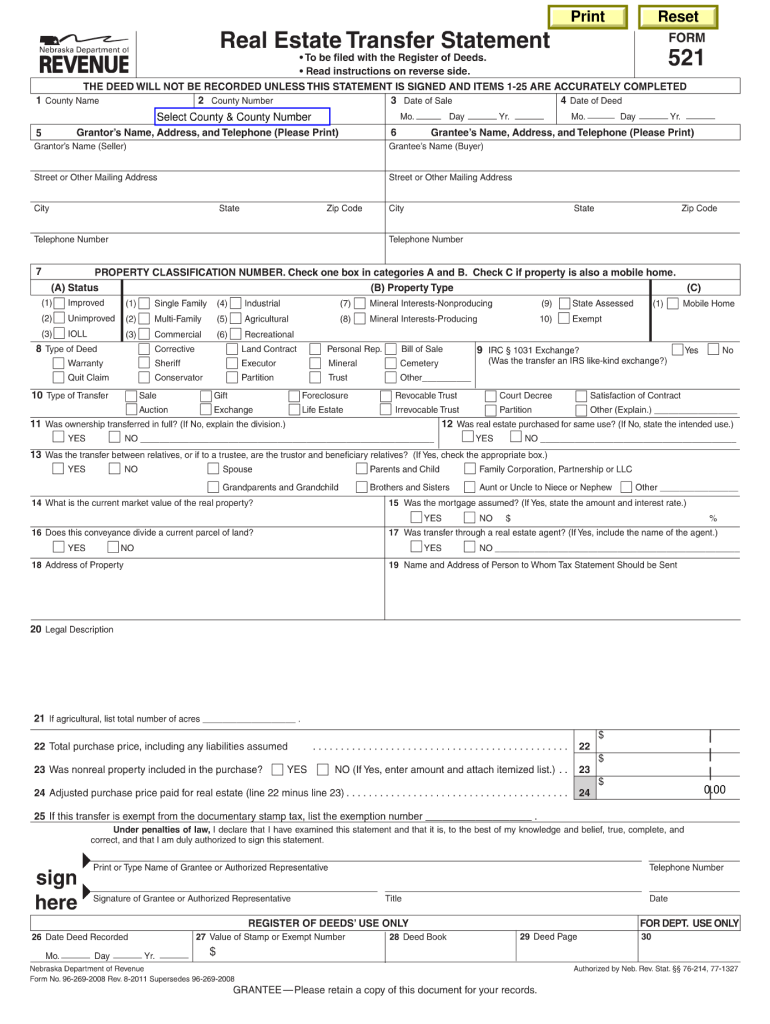

Use Only 29 Deed Page Nebraska Department of Revenue Form No. 96-269-2008 Rev. 7-2013 Supersedes 96-269-2008 Rev. 8-2011 Grantee Retain a copy of this document for your records. Authorized by Neb. Rev. Stat. 76-214 77-1327 Instructions The Register of Deeds will not accept a deed for recording unless items 1 through 25 are properly completed and this Real Estate Transfer Statement Form 521 is signed. Who Must File. Authorized by Neb. Rev. Stat. 76-214 77-1327 Instructions The Register of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NE form 521

Edit your NE form 521 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NE form 521 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NE form 521 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NE form 521. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NE form 521 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NE form 521

How to fill out NE Form 521

01

Obtain a copy of NE Form 521 from the relevant authority or their official website.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Provide your personal information in the designated fields, including name, address, and contact details.

04

Fill in the specific details as required by the form, such as dates and descriptions related to the purpose of the form.

05

Double-check all entries for accuracy to avoid any errors.

06

Sign and date the form where indicated, making sure to provide any necessary supporting documents.

07

Submit the completed form to the appropriate office or via their online submission portal, if available.

Who needs NE Form 521?

01

Individuals who are applying for specific services or benefits that require NE Form 521.

02

Businesses that need to report information or comply with regulations that necessitate the completion of NE Form 521.

03

Anyone required by law or regulation to complete the form for compliance purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is the property transfer tax in Nebraska?

The Documentary Stamp Tax, or transfer tax, rate in Nebraska is $2.25 for every $1,000 value. The total amount taxed is based on the value of the property. ing to Nebraska law, transfer taxes must be paid by the time the deed is transferred and recorded.

What is Nebraska 521?

This Form 521 must be filed with the register of deeds when a deed, land contract, memorandum of contract, or a death certificate being recorded pursuant to a transfer on death deed is presented for recording. Specific Instructions. Grantee (Buyer)

Is a transfer on death deed legal in Nebraska?

§§ 76-3401-76-3423 (the “Act”). The Act allows an individual to transfer property located in Nebraska to one or more beneficiaries effective at the transferor's death through the use of a special deed referred to as a “Transfer on Death Deed.”

How do I fill out a quit claim deed in Nebraska?

How to Write a Nebraska Quitclaim Deed Preparer's name and address. Name and mailing address of the party to whom the recorded deed should be sent. County where the real property is located. The consideration paid to the grantor (dollar amount should be written in words and numbers) Grantor's name and address.

How does a quitclaim deed work in Nebraska?

This type of deed often is used by property owners who want to ensure their property will go directly to the surviving owner(s). Quit Claim Deed: A quitclaim deed is the legal instrument through which the grantor transfers his or her interest (if any) to another person called the grantee.

How do I transfer a house deed in Nebraska?

To complete the transfer, the deed must be recorded in the office of the Register of Deeds of the county where the property is located. All deeds also require a Form 521 - Real Estate Transfer Statement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete NE form 521 online?

pdfFiller has made it simple to fill out and eSign NE form 521. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit NE form 521 online?

With pdfFiller, it's easy to make changes. Open your NE form 521 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out NE form 521 on an Android device?

Complete NE form 521 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is NE Form 521?

NE Form 521 is a tax form used in Nebraska for reporting non-resident income earned within the state.

Who is required to file NE Form 521?

Non-residents who earn income from Nebraska sources are required to file NE Form 521.

How to fill out NE Form 521?

To fill out NE Form 521, individuals must provide their personal information, report their Nebraska-source income, and calculate their tax due based on that income.

What is the purpose of NE Form 521?

The purpose of NE Form 521 is to ensure that non-residents accurately report their income earned in Nebraska and pay the appropriate state taxes.

What information must be reported on NE Form 521?

NE Form 521 requires reporting of personal identification information, details of income earned in Nebraska, deductions, and any tax credits applicable.

Fill out your NE form 521 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NE Form 521 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.