Get the free Financial Planning Profile - Financial Advisor San Diego

Show details

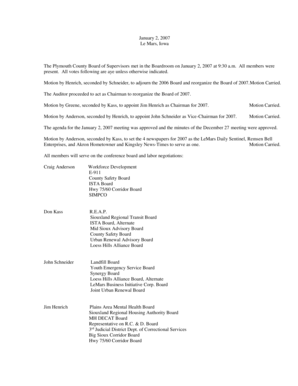

3655 Nobel Drive Suite 340 San Diego, CA 92122 Phone: 858.552.1488 Fax: 858.228.5151 www.sandiegofeeonly.com Financial Planning Profile The purpose of our Financial Planning Profile is to help facilitate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial planning profile

Edit your financial planning profile form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial planning profile form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial planning profile online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit financial planning profile. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial planning profile

How to Fill Out Financial Planning Profile:

01

Start by gathering all your financial documents, such as bank statements, tax returns, investment statements, and insurance policies. This will help you have a comprehensive view of your current financial situation.

02

Next, identify your financial goals and objectives. Think about what you want to achieve in the short term and long term, such as saving for retirement, buying a house, or paying off debt.

03

Assess your risk tolerance. Determine how comfortable you are with taking financial risks. This will help you determine the appropriate investment strategy for your financial goals.

04

Analyze your income and expenses. Calculate your monthly income and tally up all your expenses. This will give you a clear understanding of your cash flow and where you can potentially make adjustments to save or invest more.

05

Consider your current assets and liabilities. List down all your assets, such as savings accounts, investments, and properties. Also, list all your debts and liabilities, such as mortgages, credit card debt, and loans. This will give you a snapshot of your net worth.

06

Evaluate your insurance coverage. Review your current insurance policies, such as life insurance, health insurance, and property insurance. Make sure you have adequate coverage to protect yourself and your loved ones from unexpected events.

07

Finally, seek professional advice if needed. If you are unsure about certain aspects of filling out the financial planning profile or need help in creating a comprehensive financial plan, consult a certified financial planner who can guide you through the process.

Who needs financial planning profile?

01

Anyone who wants to take control of their financial future can benefit from filling out a financial planning profile. It is particularly helpful for individuals who are starting to plan for retirement, buying a house, starting a family, or facing major life events such as divorce or inheritance.

02

Young professionals who are just starting out in their careers can also greatly benefit from creating a financial planning profile. It helps them set clear goals, manage their income, and make informed decisions about saving and investing.

03

Individuals who have experienced significant changes in their financial circumstances, such as receiving an inheritance or going through a job loss, can use a financial planning profile to reassess their financial situation and make necessary adjustments.

04

Business owners and entrepreneurs can also benefit from having a financial planning profile. It helps them manage their personal finances alongside their business finances and plan for business expansion or exit strategies.

In summary, anyone who wants to have a better understanding of their current financial situation, set clear goals, and make informed decisions about their finances can greatly benefit from filling out a financial planning profile.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is financial planning profile?

Financial planning profile is a document that outlines an individual's current financial situation, goals, and strategies for achieving those goals.

Who is required to file financial planning profile?

Anyone who is seeking professional financial advice or guidance may be required to file a financial planning profile.

How to fill out financial planning profile?

To fill out a financial planning profile, you will need to provide information about your income, expenses, assets, debts, and financial goals.

What is the purpose of financial planning profile?

The purpose of a financial planning profile is to help individuals assess their current financial situation, set financial goals, and develop strategies to achieve those goals.

What information must be reported on financial planning profile?

Information such as income, expenses, assets, debts, financial goals, investment preferences, risk tolerance, and retirement plans must be reported on a financial planning profile.

How can I edit financial planning profile from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your financial planning profile into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I edit financial planning profile on an iOS device?

Use the pdfFiller mobile app to create, edit, and share financial planning profile from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How can I fill out financial planning profile on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your financial planning profile, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your financial planning profile online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Planning Profile is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.