Get the free classes of shares

Show details

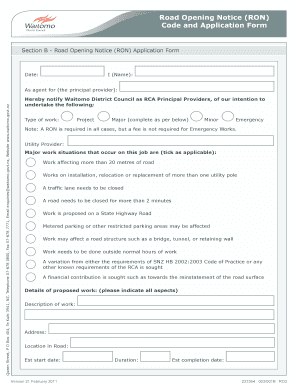

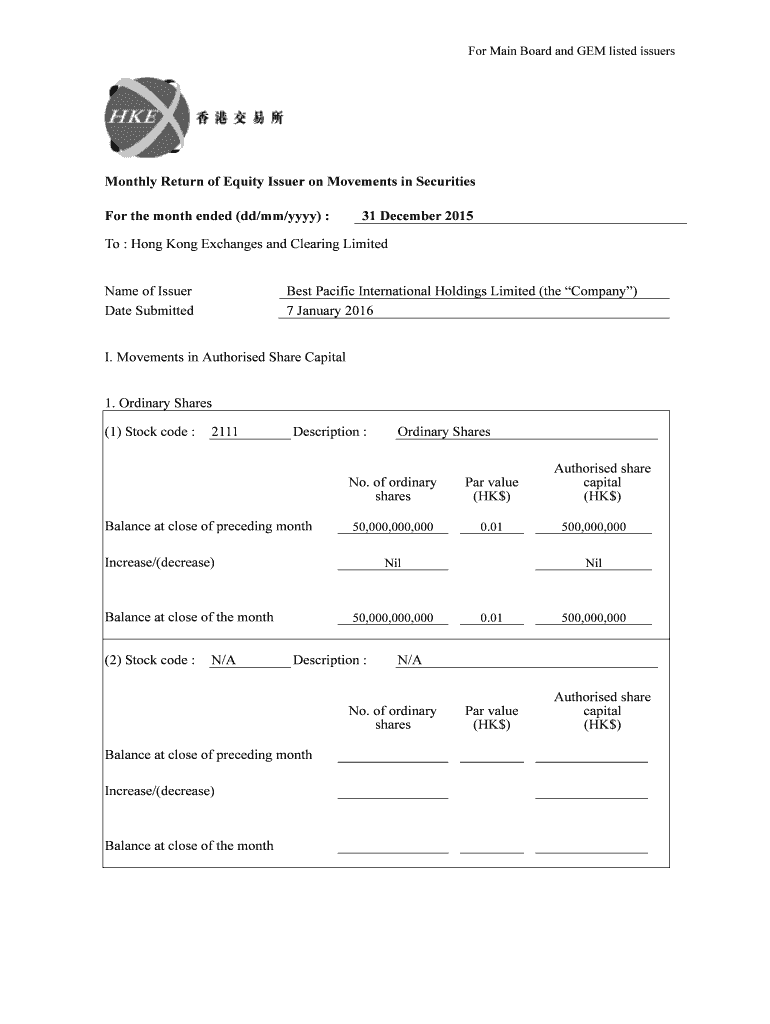

For Main Board and GEM listed issuers Monthly Return of Equity Issuer on Movements in Securities For the month ended (dd/mm/YYY) : 31 December 2015 To : Hong Kong Exchanges and Clearing Limited Name

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign classes of shares

Edit your classes of shares form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your classes of shares form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit classes of shares online

Follow the steps down below to benefit from a competent PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit classes of shares. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out classes of shares

Steps to fill out classes of shares:

01

Determine the different types of shares required: Before filling out the classes of shares, it is important to determine the different types or classes of shares that the company wishes to allocate. For example, there could be different classes of shares for voting rights, dividend distribution, or liquidation preference.

02

Define the rights and privileges for each class: Once the types of shares are identified, it is essential to define the specific rights and privileges associated with each class. This may include aspects such as voting rights, dividend entitlements, conversion rights, and redemption provisions. Each class should have unique characteristics that differentiate it from the others.

03

Prepare the necessary documentation: Proper documentation is required to formalize the classes of shares. This typically involves drafting an amendment to the company's articles of incorporation or a resolution from the board of directors, which clearly outlines the creation and allocation of the different classes of shares. The documentation should clearly specify the rights and privileges associated with each class.

04

Seek legal and professional advice: It is recommended to seek legal and professional advice while filling out classes of shares as the process can be complex and may have legal implications. Consulting with a lawyer or a corporate secretary can ensure compliance with applicable laws and regulations and help avoid any potential issues in the future.

Who needs classes of shares?

01

Startups or new businesses: Startups or new businesses often issue classes of shares to attract investors with different preferences. For example, they may issue a class of shares with voting rights only to founders or management, while issuing another class with dividend preference to investors.

02

Companies with different ownership structures: In cases where a company has multiple owners or stakeholders with varying levels of involvement or investment, classes of shares can be useful. These classes allow for flexible ownership structures, enabling different levels of control or benefits to different shareholders.

03

Publicly traded companies: Publicly traded companies may issue different classes of shares to provide different levels of ownership or voting rights to different types of shareholders. This can be beneficial in situations where maintaining control of the company is crucial, but additional capital is required from investors.

In summary, filling out classes of shares involves determining the types of shares needed, defining their rights and privileges, preparing the necessary documentation, and seeking legal advice. Classes of shares are commonly used by startups, companies with diverse ownership structures, and publicly traded companies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is classes of shares?

Classes of shares refer to different types or categories of shares that a company can issue, each with its own unique rights and privileges.

Who is required to file classes of shares?

The company must file classes of shares with the appropriate regulatory body, such as the Securities and Exchange Commission (SEC) or the Companies House, depending on the jurisdiction.

How to fill out classes of shares?

Classes of shares can be filled out by providing detailed information about each class of shares, including the rights, privileges, restrictions, and voting rights associated with each class.

What is the purpose of classes of shares?

The purpose of classes of shares is to differentiate between different types of share ownership, allowing companies to offer tailored investment opportunities to different types of shareholders.

What information must be reported on classes of shares?

The information reported on classes of shares typically includes the name of each class, the number of shares in each class, the rights and privileges associated with each class, and any restrictions on transferability.

How do I edit classes of shares straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing classes of shares.

Can I edit classes of shares on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as classes of shares. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I complete classes of shares on an Android device?

Use the pdfFiller mobile app and complete your classes of shares and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your classes of shares online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Classes Of Shares is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.