Get the free Insurer/Administrator Profile Report - workerscomp state nm

Show details

The Insurer/Administrator Profile Report is used for maintaining information on insurance carriers, self-insured employers, and claims administrators that pay workers’ compensation claims or provide

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insureradministrator profile report

Edit your insureradministrator profile report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insureradministrator profile report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

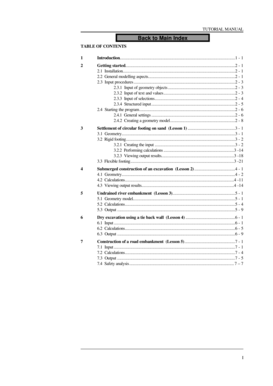

How to edit insureradministrator profile report online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit insureradministrator profile report. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insureradministrator profile report

How to fill out Insurer/Administrator Profile Report

01

Gather necessary information about the insurer/administrator, including company name, address, and contact details.

02

Provide details regarding the types of insurance or services offered.

03

Include information on organizational structure, management roles, and relevant certifications.

04

List any claims handling procedures and policies.

05

Identify and describe any partnerships or affiliations with other entities.

06

Fill in financial information including solvency ratios and funding sources if required.

07

Review the report for accuracy and completeness before submission.

Who needs Insurer/Administrator Profile Report?

01

Insurance agents and brokers who need to evaluate different insurers.

02

Regulatory bodies requiring compliance and oversight.

03

Employers who are selecting an insurance provider for employee benefits.

04

Consumers looking for detailed information on insurance options.

05

Financial analysts assessing the stability of insurance companies.

Fill

form

: Try Risk Free

People Also Ask about

Who is nghp?

Medicare Secondary Payer (MSP) provisions make Medicare a secondary payer to certain non-group health plans (NGHPs), which include liability insurers (including self-insured entities), no-fault insurers, and workers' compensation entities.

What is section 111 mandatory reporting profile report?

Section 111 authorizes CMS and GHP RREs to electronically exchange health insurance benefit entitlement information. On a quarterly basis, an RRE must submit a file of information about employees and dependents who are Medicare beneficiaries with employer GHP coverage that may be primary to Medicare.

What does MSP mean in insurance?

Providers are required to complete a Medicare Secondary Payer Questionnaire (MSPQ) upon admission of each Medicare patient. A sample of the MSPQ can be found in the Centers for Medicare & Medicaid Services' (CMS) Internet-Only Manual (IOM), Publication 100-05, Medicare Secondary Payer Manual, Chapter 3, Section 20.2.

Who completes the MSPQ?

Complete the claim form CMS-1500 or electronic equivalent in the usual manner. Report all claim coding usually required for the services including charges for all Medicare-covered services, not just the balance remaining after the primary payer's payment. Report the covered and noncovered charges as usual.

Who is responsible for MSP reporting?

Responsibility for reporting falls upon the entity serving as an insurer or TPA for a group health plan, or, in the case of a self-insured, self-administered group health plan, a plan administrator or fiduciary. CMS refers to these entities as responsible reporting entities (RREs).

Who regulates third-party administrators?

The NAIC regulates TPAs and has specific guidelines around the relationship between TPAs and insurance carriers as well as TPA compensation limitations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Insurer/Administrator Profile Report?

The Insurer/Administrator Profile Report is a document that provides detailed information about an insurance company or administrator, including its financial status, operational practices, and compliance with regulatory requirements.

Who is required to file Insurer/Administrator Profile Report?

Insurance companies and administrators that are regulated by state insurance departments or similar regulatory bodies are typically required to file the Insurer/Administrator Profile Report.

How to fill out Insurer/Administrator Profile Report?

To fill out the Insurer/Administrator Profile Report, individuals should gather the necessary financial and operational data, carefully complete each section of the report, ensuring accuracy, and submit it to the relevant regulatory authority by the specified deadline.

What is the purpose of Insurer/Administrator Profile Report?

The purpose of the Insurer/Administrator Profile Report is to provide regulators with essential insights into the financial health, management practices, and operational integrity of insurance entities, aiding in oversight and ensuring consumer protection.

What information must be reported on Insurer/Administrator Profile Report?

The Insurer/Administrator Profile Report must include information such as the insurer/administrator's financial statements, organizational structure, management team details, licensing information, and compliance history.

Fill out your insureradministrator profile report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insureradministrator Profile Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.