Get the free ATO Small Business

Show details

Newsletter for micro small business ATO Small Business

Assistance Program

May 201210Welcome to the 10th edition of the ATO Small Business News for

the 201112 year.

Small Business Feature topic

Tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ato small business

Edit your ato small business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ato small business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ato small business online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ato small business. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

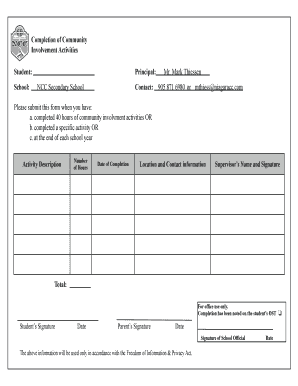

How to fill out ato small business

How to fill out ATO small business:

01

Gather all necessary information: Before starting the process, make sure you have all the required information. This may include your business income and expenses, tax file number (TFN), Australian business number (ABN), and any other relevant documentation.

02

Determine your business structure: Identify the structure of your small business, whether it's a sole trader, partnership, company, trust, or another form. This will affect the way you fill out the ATO forms.

03

Use the correct form: Based on your business structure, select the appropriate form provided by the Australian Taxation Office (ATO) to fill out. The ATO website offers a range of forms specifically designed for different types of small businesses.

04

Complete the necessary sections: Carefully fill out the form, ensuring you provide accurate and up-to-date information. Pay close attention to sections that require you to report your income, deductions, and any other relevant details.

05

Keep records: It is essential to maintain accurate records of all your financial transactions and supporting documents. This includes invoices, receipts, bank statements, and any other records relevant to your income and expenses.

06

Seek professional advice if unsure: If you are uncertain about any aspect of filling out the ATO small business forms, consider seeking advice from a qualified tax professional or accountant. They can guide you through the process and ensure compliance with tax laws.

Who needs ATO small business:

01

Sole traders: Individuals operating their own businesses without forming a separate legal entity are considered sole traders. They need to fill out ATO small business forms to report their business income and claim deductions accurately.

02

Partnerships: When two or more individuals run a business together and share the profits and losses, they form a partnership. Partnerships are required to fill out ATO small business forms to report their business income and share of profits or losses.

03

Companies: Registered companies are separate legal entities from their shareholders. They must fill out ATO small business forms to report their business income, expenses, and other financial details.

04

Trusts: Trusts are legal structures that hold and manage assets or businesses for the benefit of others. Trusts need to fill out ATO small business forms to report their income, deductions, and distribute profits to beneficiaries.

05

Other business structures: Depending on the nature of your business, you may fall under various other structures such as joint ventures, associations, or non-profit organizations. Each of these structures may have specific ATO small business forms that need to be filled out accordingly.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ato small business?

ATO small business refers to the Australian Taxation Office requirements and regulations for small businesses.

Who is required to file ato small business?

Small business owners and operators in Australia are required to file ATO small business.

How to fill out ato small business?

To fill out ATO small business, small business owners need to provide detailed information on their business income, expenses, deductions, and any other relevant financial details.

What is the purpose of ato small business?

The purpose of ATO small business is to ensure that small businesses are complying with tax laws and regulations in Australia.

What information must be reported on ato small business?

Information like business income, expenses, deductions, financial statements, and any other relevant financial details must be reported on ATO small business.

How can I get ato small business?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific ato small business and other forms. Find the template you need and change it using powerful tools.

How do I edit ato small business online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your ato small business and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an eSignature for the ato small business in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your ato small business right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Fill out your ato small business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ato Small Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.