Get the free Chapter 11 Employee Provisions Appendix C - Freeburg

Show details

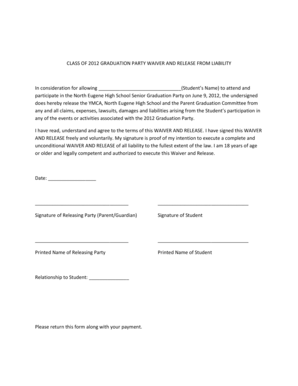

APPENDIX C COLLECTIVE BARGAINING AGREEMENT BETWEEN VILLAGE OF FREIBURG, ILLINOIS AND THE POLICEMEN BENEVOLENT LABOR COMMITTEE APRIL 1, 2014, THROUGH MARCH 31, 2018, PREAMBLE This Agreement is entered

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 11 employee provisions

Edit your chapter 11 employee provisions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 11 employee provisions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing chapter 11 employee provisions online

Follow the steps down below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit chapter 11 employee provisions. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 11 employee provisions

How to fill out chapter 11 employee provisions:

01

Start by gathering all the necessary information and documents required to complete the chapter 11 employee provisions form. This may include employee details such as their names, addresses, social security numbers, job titles, and dates of hire.

02

Carefully review the instructions provided with the form to ensure you understand the requirements and any specific guidelines for filling it out. This will help you avoid mistakes or omissions that could potentially cause delays or complications.

03

Begin by entering the employer's information in the designated fields. Include the employer's name, address, contact information, and any other details requested.

04

Move on to the section for employee information. Enter the required details for each employee covered under the chapter 11 employee provisions. This may involve filling in multiple rows or sections depending on the number of employees you have.

05

Ensure accuracy and double-check all the information entered, especially when it comes to sensitive details such as Social Security numbers or addresses. Mistakes in these fields can have serious consequences, so it's important to be diligent in verifying the information before submitting the form.

06

Review any additional sections or questions on the form and complete them accordingly. The chapter 11 employee provisions form may ask for additional information or require you to answer specific questions related to the provisions, so make sure you address each one accurately and comprehensively.

07

Once you have completed all the necessary sections and provided all required information, carefully review the form one final time. Check for any errors, missing information, or inconsistencies. It's always a good idea to have someone else review the form as well, as fresh eyes may catch any oversights.

08

Sign and date the completed form as instructed. This signifies that you have reviewed and accurately filled out the chapter 11 employee provisions, taking responsibility for the information provided.

Who needs chapter 11 employee provisions?

Chapter 11 employee provisions typically affect employers who are filing for bankruptcy under Chapter 11 of the United States Bankruptcy Code. Chapter 11 bankruptcy is commonly used by businesses to restructure their debts and continue operating while under bankruptcy protection.

The employee provisions within Chapter 11 are designed to protect the rights and interests of employees during the bankruptcy process. They ensure that employees are given proper notice of potential job loss or changes to their employment terms, including severance pay, continuation of health insurance coverage, and other employment-related benefits.

Employers going through Chapter 11 bankruptcy proceedings must comply with these provisions to ensure that their employees' rights and entitlements are upheld. Filing for Chapter 11 bankruptcy triggers the need to fill out the specific employee provisions forms, which detail the necessary information about each employee affected by the bankruptcy process.

It is important for employers, business owners, or individuals responsible for managing employees during a Chapter 11 bankruptcy to be well-informed about these provisions and fulfill their obligations to their employees. Properly filling out the chapter 11 employee provisions form is crucial to ensure compliance with the law and mitigate the potential negative impact on employees.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my chapter 11 employee provisions in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your chapter 11 employee provisions and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send chapter 11 employee provisions to be eSigned by others?

When your chapter 11 employee provisions is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I edit chapter 11 employee provisions on an iOS device?

Use the pdfFiller mobile app to create, edit, and share chapter 11 employee provisions from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is chapter 11 employee provisions?

Chapter 11 employee provisions refer to the requirements regarding the treatment of employee-related obligations during a bankruptcy proceeding.

Who is required to file chapter 11 employee provisions?

Any company or individual filing for Chapter 11 bankruptcy protection is required to adhere to the employee provisions outlined in the bankruptcy code.

How to fill out chapter 11 employee provisions?

Chapter 11 employee provisions should be filled out following the guidelines provided in the bankruptcy code, ensuring that all employee-related obligations are properly addressed.

What is the purpose of chapter 11 employee provisions?

The purpose of chapter 11 employee provisions is to protect the rights and interests of employees when a company enters into bankruptcy proceedings.

What information must be reported on chapter 11 employee provisions?

Chapter 11 employee provisions require reporting of employee wages, benefits, and any other financial obligations owed to employees by the bankrupt company.

Fill out your chapter 11 employee provisions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 11 Employee Provisions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.