Get the free CREDIT CARD PAYMENT AUTHORISATION FORM - City of Gosnells

Show details

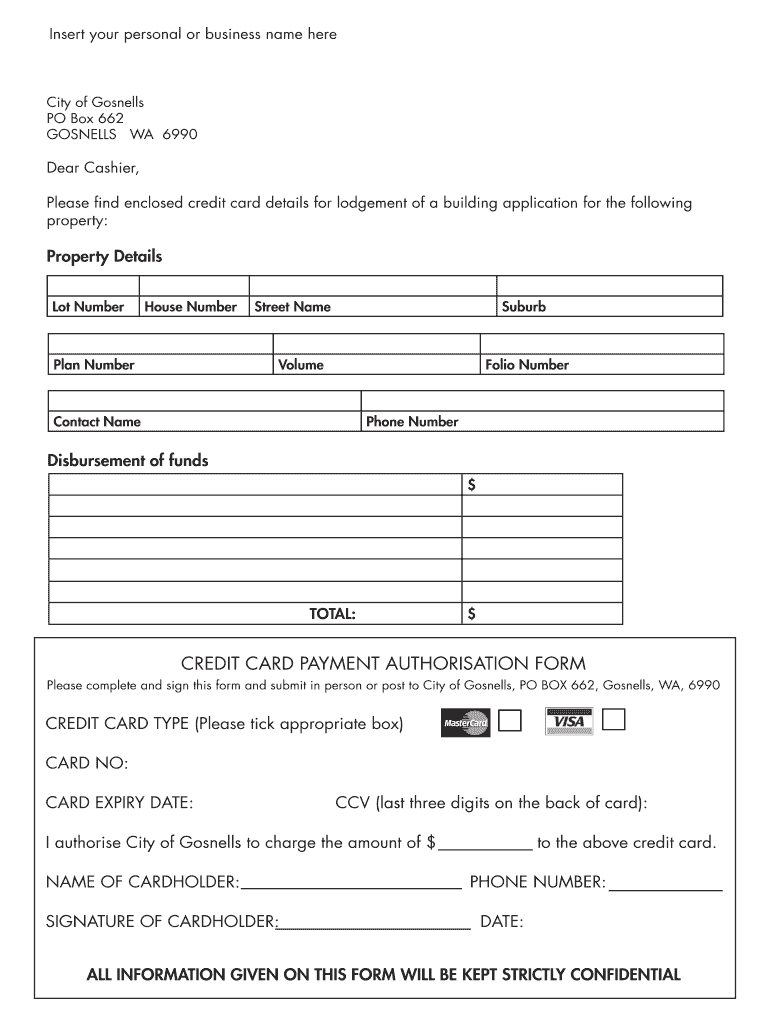

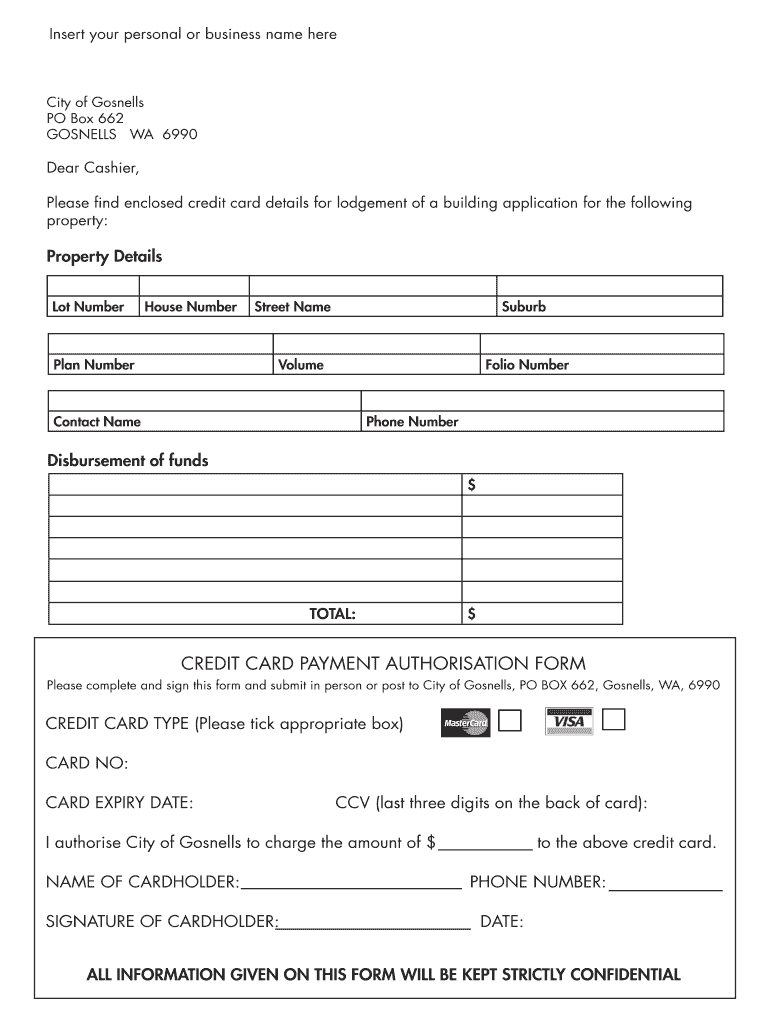

Insert your personal or business name here City of Gospels PO Box 662 GOSPELS WA 6990 Dear Cashier, Please find enclosed credit card details for judgement of a building application for the following

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card payment authorisation

Edit your credit card payment authorisation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card payment authorisation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit card payment authorisation online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit credit card payment authorisation. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card payment authorisation

How to fill out credit card payment authorisation:

01

Begin by gathering all the necessary information. This typically includes the credit card number, expiration date, security code, and billing address associated with the credit card.

02

Next, locate the credit card payment authorisation form. This form is usually provided by the merchant or service provider who requires the payment. It may be available online or as a physical document.

03

Carefully read the instructions provided on the credit card payment authorisation form. Ensure that you understand all the terms, conditions, and any additional information required for the payment.

04

Fill in the requested information on the form accurately. Double-check the credit card details to avoid any errors or mistakes that could result in the payment being declined or delayed.

05

If necessary, provide any additional information requested on the form. This could include the purpose of the payment, any special instructions, or specific authorization details required by the merchant or service provider.

06

Review the completed credit card payment authorisation form to verify that all the details are correct. Make sure to sign and date the form as required.

07

If submitting the form electronically, follow the provided instructions to securely transmit the credit card payment authorisation to the merchant or service provider. Ensure that you are using a secure and trusted platform to protect your credit card information.

08

If submitting a physical form, consider sending it using a reliable and traceable method, such as certified mail or a reputable courier service. This will help ensure that the form reaches its intended recipient safely.

09

Keep a copy of the filled-out credit card payment authorisation form for your records. It can serve as proof of payment authorization and can be useful in case of any disputes or issues that may arise in the future.

Who needs credit card payment authorisation?

01

Businesses and merchants who accept credit card payments may require customers to provide credit card payment authorisation. This is to ensure that the payment is authorized and legitimate.

02

Service providers, such as hotels, rental car agencies, or airlines, often request credit card payment authorisation to secure bookings or reservations. It helps protect them against potential cancellations or no-shows.

03

Online retailers and e-commerce platforms may ask for credit card payment authorisation as part of their customer verification process. This helps reduce the risk of fraudulent transactions and ensures that the payment is authorized by the cardholder.

04

Some government agencies or organizations may require credit card payment authorisation for specific services or fees. This helps streamline the payment process and ensures that the correct amount is charged to the credit card.

05

Individuals using a credit card on behalf of someone else, such as a family member or friend, may need to provide credit card payment authorisation. This is to confirm that they have permission to use the card and make the payment on behalf of the cardholder.

Overall, credit card payment authorisation is commonly required by various businesses, service providers, and organizations to ensure secure and authorized payments are made using credit cards.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is credit card payment authorisation?

Credit card payment authorisation is the process of obtaining approval from the card issuer to make a transaction using a credit card.

Who is required to file credit card payment authorisation?

Merchants or businesses that accept credit card payments are required to file credit card payment authorisation.

How to fill out credit card payment authorisation?

To fill out credit card payment authorisation, merchants need to input the necessary transaction details and obtain approval from the card issuer.

What is the purpose of credit card payment authorisation?

The purpose of credit card payment authorisation is to ensure that the cardholder has sufficient funds to cover the transaction before it is processed.

What information must be reported on credit card payment authorisation?

The information required on credit card payment authorisation includes the cardholder's name, card number, expiration date, transaction amount, and authorization code.

How do I fill out credit card payment authorisation using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign credit card payment authorisation and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit credit card payment authorisation on an iOS device?

Use the pdfFiller mobile app to create, edit, and share credit card payment authorisation from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Can I edit credit card payment authorisation on an Android device?

You can make any changes to PDF files, like credit card payment authorisation, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your credit card payment authorisation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Payment Authorisation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.