Get the free Going Out of Business Sale bApplicationb

Show details

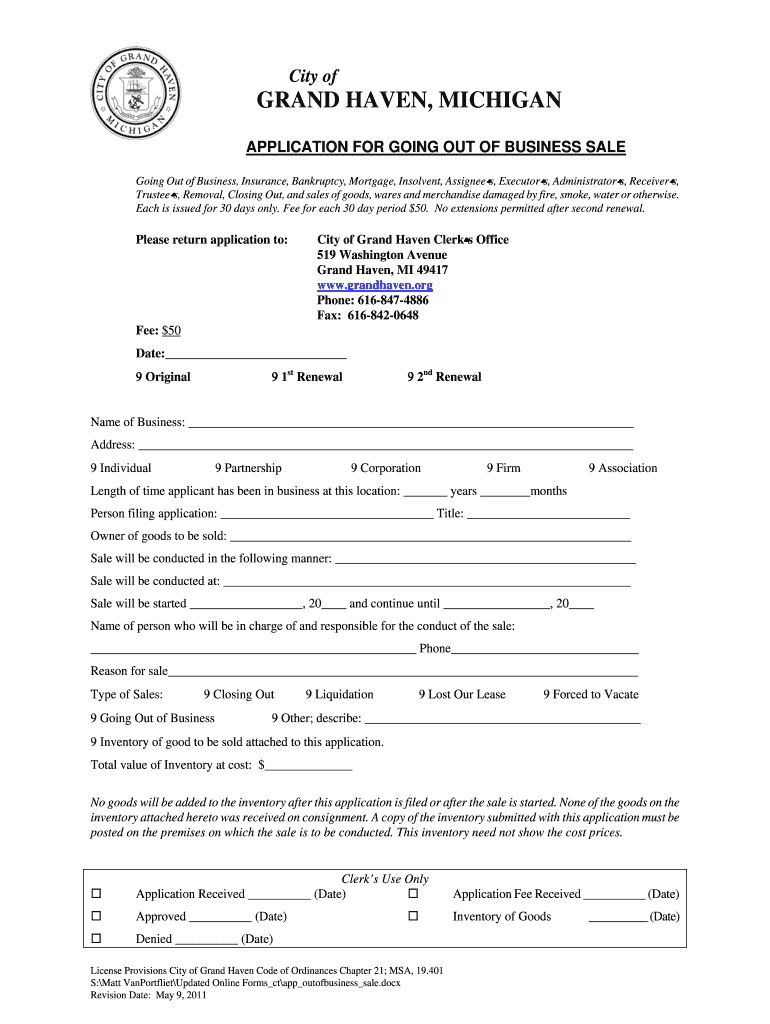

City of GRAND HAVEN, MICHIGAN APPLICATION FOR GOING OUT OF BUSINESS SALE Going Out of Business, Insurance, Bankruptcy, Mortgage, Insolvent, Assignees, Executors, Administrators, Receivers, Trustees,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign going out of business

Edit your going out of business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your going out of business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit going out of business online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit going out of business. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out going out of business

Point-by-point instructions on how to fill out going out of business:

01

Gather all the necessary information and documents: Start by collecting any financial records, tax forms, permits, licenses, and any other relevant paperwork related to your business.

02

Determine the reason for going out of business: Identify the primary reason for closing your business, whether it's due to financial difficulties, retirement, a partnership dissolution, or any other factor. This information may be required on the official forms.

03

Research legal obligations: Familiarize yourself with the legal obligations specific to your industry, as well as any local, state, or federal regulations regarding closing a business. This step will ensure that you fulfill all necessary requirements.

04

Notify stakeholders: Inform all relevant parties about your decision to close the business, including employees, customers, suppliers, and creditors. Provide them with appropriate notice and guidance regarding the termination or transfer of any ongoing contracts, employment agreements, or outstanding debts.

05

Develop a plan for winding-down operations: Create a detailed plan outlining the steps you'll take to wind down your business operations in an orderly manner. Include considerations like notifying clients, selling assets, resolving outstanding debts, and terminating leases or contracts. This plan will help you stay organized throughout the process.

06

Determine your assets and liabilities: Conduct a comprehensive inventory of your business assets, such as equipment, inventory, intellectual property, and any outstanding accounts receivable. Simultaneously, evaluate your business liabilities, including outstanding loans, debts, tax obligations, and unresolved legal matters.

07

Settle financial obligations: Prioritize settling outstanding financial obligations to creditors, suppliers, and employees. Pay off debts, issue appropriate refunds or credits, and ensure that all payroll taxes, income taxes, and sales taxes are paid according to legal requirements.

08

Liquidate or transfer assets: If necessary, sell or liquidate your business assets, such as inventory, equipment, or property, to recoup any remaining value. Alternatively, consider transferring certain assets to another entity or individual if possible and appropriate.

09

Complete required forms and filings: Fill out any necessary forms, such as dissolution or termination documents, with the appropriate government agencies. These may include state department of corporations, tax authorities, and local licensing bodies. Ensure that you provide accurate and up-to-date information.

10

Seek professional assistance if needed: If you're unsure about any aspect of the process or feel overwhelmed, don't hesitate to seek professional guidance. Consult with a lawyer, accountant, or business advisor who specializes in closing or liquidating businesses.

Who needs going out of business?

01

Business owners: Owners who have made the decision to close their business for various reasons, such as financial challenges, retirement, or a change in career focus.

02

Investors and partners: Individuals or entities that have invested in the business or hold ownership shares may need to know about the decision to go out of business.

03

Creditors and lenders: These individuals or institutions who have granted loans or extended credit to the business need to be informed about the closing to ensure appropriate repayment arrangements or negotiations occur.

04

Employees: It is essential to inform employees about the business's closure so they can make appropriate plans for their career and livelihood.

05

Customers and clients: Customers and clients who regularly engage with the business should be notified to allow them to make alternative arrangements for their needs and avoid any disruptions of service or product availability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify going out of business without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your going out of business into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit going out of business online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your going out of business to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I fill out going out of business on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your going out of business. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your going out of business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Going Out Of Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.