Get the free First Colony Life Insurance Company (FCL) Genworth Life Insurance Company (GLIC) Gen...

Show details

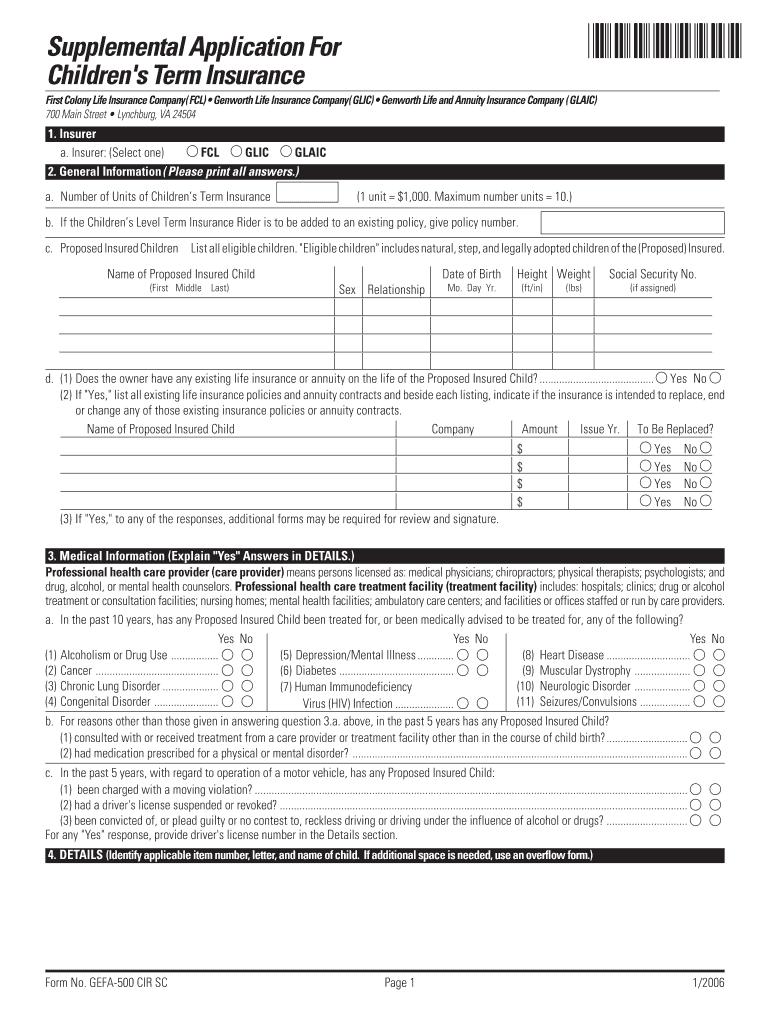

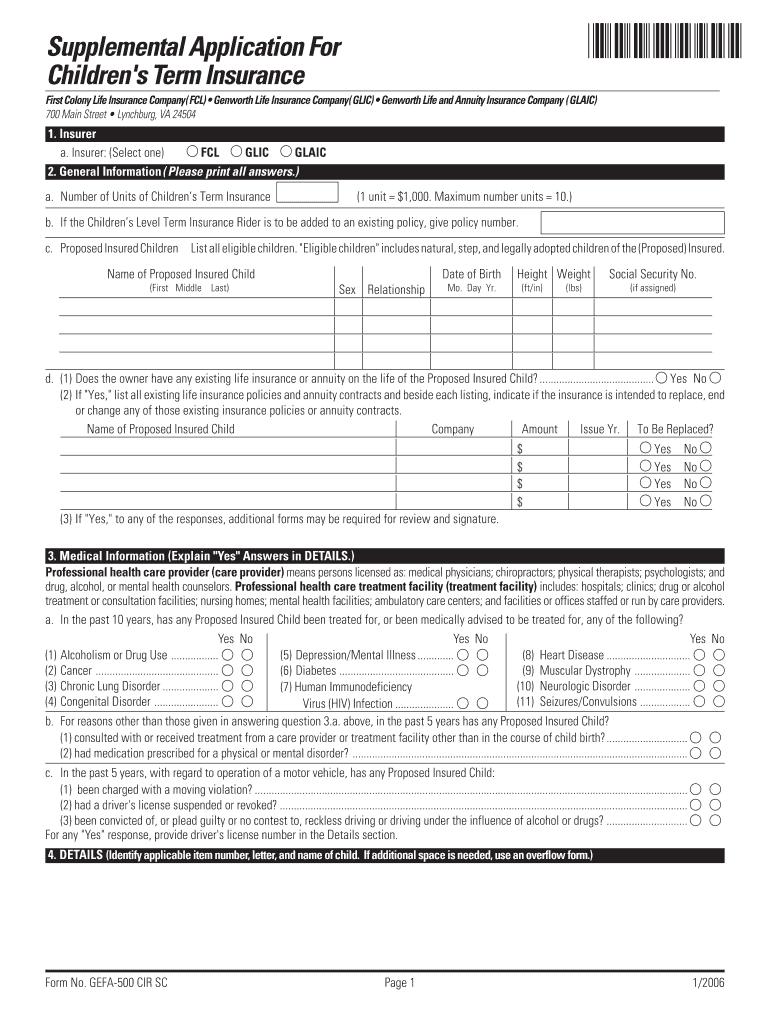

Supplemental Application For Children's Term Insurance First Colony Life Insurance Company (FCL) Gen worth Life Insurance Company (GLIB) Gen worth Life and Annuity Insurance Company (CLAIM) 700 Main

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign first colony life insurance

Edit your first colony life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your first colony life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing first colony life insurance online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit first colony life insurance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out first colony life insurance

How to fill out first colony life insurance:

01

Start by gathering all necessary personal information such as your full name, date of birth, social security number, and contact information.

02

Research and decide on the specific policy or coverage options that best suit your needs. First Colony Life Insurance offers various options, such as term life insurance or whole life insurance, so make sure to understand the differences and choose accordingly.

03

Contact a licensed insurance agent or visit the First Colony Life Insurance website to begin the application process. They will guide you through the necessary steps and help you understand any specific forms or documentation required.

04

Complete the application form accurately and provide all requested information, including details about your current health, lifestyle, and any pre-existing medical conditions. It is crucial to provide honest and precise answers to these questions to ensure accurate underwriting.

05

Include any additional documents that may be required, such as medical records or consent forms for a medical examination, if necessary.

06

Review your completed application thoroughly to ensure there are no errors or missing information. Double-check that all personal details, policy options, and declarations are correct.

07

Sign and submit your completed application to First Colony Life Insurance either electronically or by mail, depending on their preferred submission method.

08

Await the underwriting process, during which First Colony Life Insurance will review your application, assess your risk factors, and determine the premium rate for your policy. This process may involve further communication or requests for additional information or medical examinations.

Who needs first colony life insurance:

01

Individuals who want to protect their loved ones financially in the event of their death. Life insurance can provide a death benefit to beneficiaries, helping them cover various expenses such as funeral costs, mortgage payments, or children's education.

02

Breadwinners or individuals with dependents who rely on their income to maintain their quality of life. Life insurance can replace lost income, allowing loved ones to continue paying bills, covering everyday expenses, and maintaining financial stability.

03

Business owners or partners who want to ensure the continued operation of their business in case of their death. Life insurance can provide funds to buy out a deceased partner's shares or support the business during a critical transition period.

04

Individuals with outstanding debts, such as mortgages or student loans. Life insurance can help pay off these debts, preventing them from becoming a financial burden on surviving family members.

05

Individuals who want to leave a financial legacy or provide for future generations. Life insurance can be part of an estate planning strategy, ensuring that beneficiaries receive a tax-free inheritance.

In conclusion, filling out first colony life insurance involves gathering personal information, selecting the appropriate policy, completing the application accurately, and submitting it to First Colony Life Insurance. Various individuals, such as those with dependents, debts, or a desire to protect their loved ones financially, may find first colony life insurance beneficial.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is first colony life insurance?

First Colony Life Insurance is a type of insurance policy that pays a benefit upon the death of the insured.

Who is required to file first colony life insurance?

Individuals who have purchased a first colony life insurance policy are required to file the insurance claim upon the insured's death.

How to fill out first colony life insurance?

To fill out first colony life insurance, the policyholder or beneficiary needs to contact the insurance company, provide necessary documents such as death certificate, and submit a claim form.

What is the purpose of first colony life insurance?

The purpose of first colony life insurance is to provide financial protection to the policyholder's beneficiaries in case of the insured's death.

What information must be reported on first colony life insurance?

Information such as the insured's personal details, policy number, cause of death, and beneficiary information must be reported on first colony life insurance.

Can I create an electronic signature for signing my first colony life insurance in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your first colony life insurance and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out the first colony life insurance form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign first colony life insurance and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete first colony life insurance on an Android device?

On an Android device, use the pdfFiller mobile app to finish your first colony life insurance. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your first colony life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

First Colony Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.