Get the free SBA Form 1010B - AIT - sbaonline sba

Show details

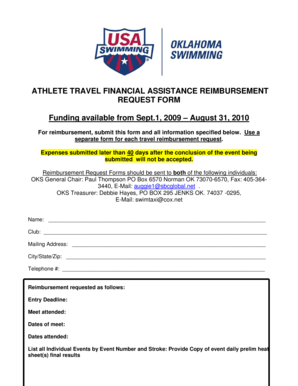

This form is utilized for the application to the SBA 8(a) Business Development Program specifically for businesses owned by American Indian tribes. It collects essential information regarding business

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sba form 1010b

Edit your sba form 1010b form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba form 1010b form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sba form 1010b online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sba form 1010b. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sba form 1010b

How to fill out SBA Form 1010B - AIT

01

Begin by downloading the SBA Form 1010B - AIT from the SBA website.

02

Fill out the applicant section with your name, address, and contact information.

03

Provide details about your business, including the legal structure, business size, and the type of business.

04

Include your annual revenue and net profit information in the financial section.

05

Provide details about your business's purpose and how the funds will be used.

06

Include information about any existing loans or debts your business has.

07

Sign the application and ensure that all required documentation is attached.

08

Review the form for accuracy and submit it as directed in the instructions.

Who needs SBA Form 1010B - AIT?

01

Small business owners seeking funding or financial assistance from the SBA.

02

Entrepreneurs looking to provide a detailed description of their business for loan applications.

03

Businesses in need of specific assistance outlined in the funding programs offered by the SBA.

Fill

form

: Try Risk Free

People Also Ask about

What is SBA Form 147?

Use this form to document key loan information such as the loan number, the interest rate, the lender, and the borrower.

What disqualifies you from getting an SBA loan?

What Disqualifies You From Getting an SBA Loan? The three primary disqualifiers for an SBA loan include a poor credit history, insufficient collateral or equity investment, and lack of a solid business plan. These factors can signal to lenders a high risk of default, making loan approval less likely.

Does SBA loan have to be paid back?

If you stop paying on your loan, it will go into default. Defaulting on an SBA loan can have serious consequences for your business and personal finances. It's best to address any financial difficulties early on and explore all options for repayment to avoid defaulting on your loan.

Which SBA loan is easiest to get approved for?

The easiest SBA loan to get approved for is typically an SBA Express loan, as lenders have more leeway to approve applicants on their own. However, these loans have lower maximum guarantees from the SBA than standard 7(a) loans, which can mean less favorable terms for businesses.

Who fills out SBA Form 1919?

To receive a 7(a) loan, small businesses must fill out Form 1919. A copy of the form must be filled out by each principal stakeholder or owner who controls at least 20% of the business, trustors, and anyone hired to run the business' general operations.

What is form 147 used for?

Form 147C, also known as the IRS Letter 147C, is a document the IRS sends to businesses or entities to confirm their Taxpayer Identification Number (TIN) or Employer Identification Number (EIN). It verifies the business name, address, and TIN/EIN registered with the IRS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SBA Form 1010B - AIT?

SBA Form 1010B - AIT is a form used by the Small Business Administration for assessing the financial condition and operational capacity of small businesses applying for assistance or loan guarantees.

Who is required to file SBA Form 1010B - AIT?

Small businesses seeking financial assistance or loan guarantees from the Small Business Administration are required to file SBA Form 1010B - AIT.

How to fill out SBA Form 1010B - AIT?

To fill out SBA Form 1010B - AIT, applicants should provide detailed information about their business operations, financial statements, and any relevant data requested in the form, ensuring all sections are completed accurately.

What is the purpose of SBA Form 1010B - AIT?

The purpose of SBA Form 1010B - AIT is to collect necessary information to evaluate the creditworthiness and operational viability of small businesses applying for SBA assistance.

What information must be reported on SBA Form 1010B - AIT?

Information that must be reported on SBA Form 1010B - AIT includes business financial data, ownership structure, business history, and projections of revenue and expenses.

Fill out your sba form 1010b online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba Form 1010b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.