Get the free PhDTax Policy. PhD Program

Show details

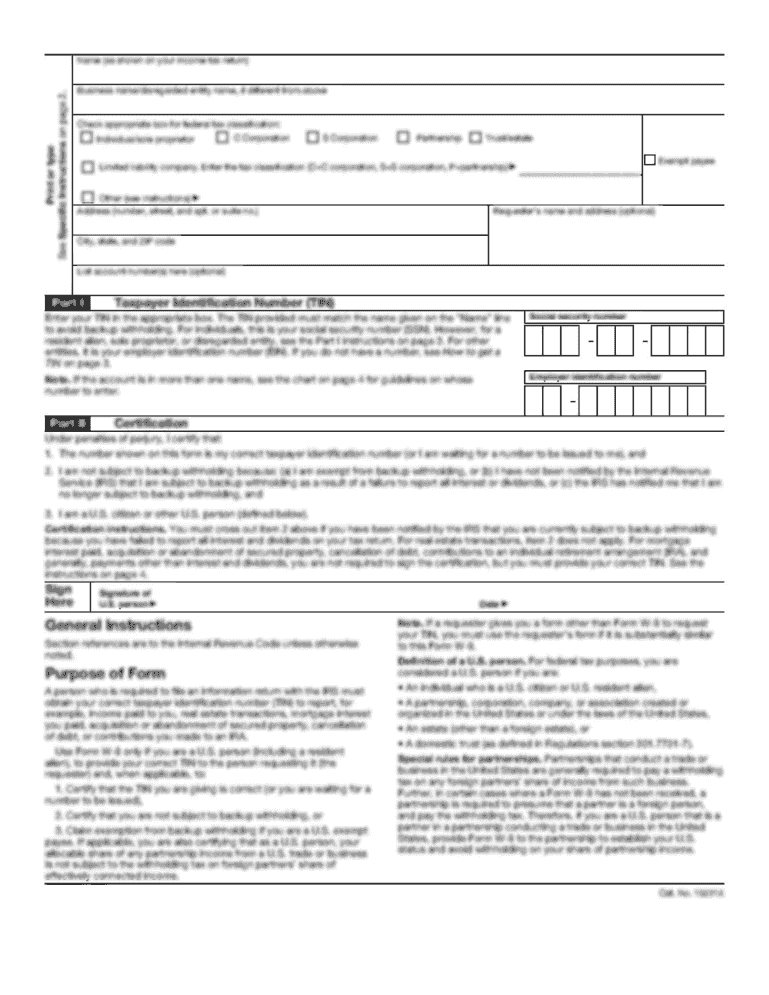

Department of Economics African Tax Institute 20152017 PhD Program in Tax Policy PhD: Tax Policy Leading Minds 20152017 PhD Program in Tax Policy The PhD Program in Tax Policy is offered over a threader

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign phdtax policy phd program

Edit your phdtax policy phd program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your phdtax policy phd program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit phdtax policy phd program online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit phdtax policy phd program. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out phdtax policy phd program

How to Fill out PhdTax Policy PhD Program:

01

Start by reviewing the requirements and qualifications for the PhdTax policy PhD program. Ensure that you meet all the necessary prerequisites and have the necessary educational background.

02

Research the program thoroughly to understand the core courses, electives, and any specializations offered. This will help you tailor your application and make you stand out as a strong candidate.

03

Gather all the required documents such as transcripts, letters of recommendation, statement of purpose, CV, and any additional materials specified by the program. Make sure to thoroughly proofread and edit your documents before submission.

04

Complete the application form accurately and ensure that you have provided all the necessary information. Double-check for any errors or missing information before finalizing the submission.

05

Pay the application fee as required. This fee may vary depending on the institution and program. Be sure to follow the payment instructions provided by the university.

06

Submit your application before the deadline. It is recommended to submit it well in advance to avoid any potential last-minute issues or technical difficulties.

07

After submitting your application, you may be required to complete an interview or additional assessments. Prepare for these by researching common interview questions and practicing your responses.

08

Stay proactive and follow up with the admissions office regarding the status of your application. It is important to demonstrate your interest and commitment to the program.

Who needs PhdTax Policy PhD Program:

01

Individuals who are passionate about taxation and have a strong interest in policy research and analysis.

02

Professionals working in the field of taxation who are looking to further enhance their knowledge and skills in tax policy.

03

Graduates with a relevant background in accounting, economics, or law who seek a specialized advanced degree in tax policy.

04

Academics or researchers who aspire to contribute to the development and improvement of tax policies through rigorous research and analysis.

05

Individuals interested in pursuing careers in government agencies, international organizations, think tanks, or academia with a focus on tax policy and its implications.

Remember to research and carefully consider whether the PhdTax policy PhD program aligns with your career goals, interests, and aspirations before pursuing it.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send phdtax policy phd program for eSignature?

Once you are ready to share your phdtax policy phd program, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I execute phdtax policy phd program online?

pdfFiller has made it simple to fill out and eSign phdtax policy phd program. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit phdtax policy phd program straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing phdtax policy phd program right away.

What is phdtax policy phd program?

The phdtax policy phd program is a tax policy specifically designed for individuals enrolled in a PhD program.

Who is required to file phdtax policy phd program?

Individuals enrolled in a PhD program are required to file the phdtax policy phd program.

How to fill out phdtax policy phd program?

To fill out the phdtax policy phd program, individuals need to provide information about their income, expenses, and any tax credits or deductions they may be eligible for.

What is the purpose of phdtax policy phd program?

The purpose of the phdtax policy phd program is to ensure that individuals in a PhD program are accurately reporting their income and taking advantage of any available tax benefits.

What information must be reported on phdtax policy phd program?

Information such as income from stipends, grants, scholarships, as well as any research or teaching assistant income must be reported on the phdtax policy phd program.

Fill out your phdtax policy phd program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Phdtax Policy Phd Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.