Get the free COLLECTION AGENCY BOND APPLICATION - nj

Show details

Este documento proporciona instrucciones para completar la solicitud de fianza de la agencia de cobranza, un requisito indispensable para operar en Nueva Jersey según las leyes estatales. Incluye

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign collection agency bond application

Edit your collection agency bond application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your collection agency bond application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing collection agency bond application online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit collection agency bond application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

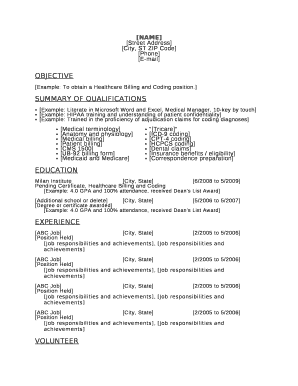

How to fill out collection agency bond application

How to fill out COLLECTION AGENCY BOND APPLICATION

01

Obtain the COLLECTION AGENCY BOND APPLICATION form from the relevant regulatory authority or their website.

02

Fill in your personal details including your name, address, and contact information.

03

Provide details about your business, including the name of your collection agency and its physical address.

04

Indicate the type of services your collection agency will provide and any relevant experience.

05

Include financial information as required, such as your business's financial statements or proof of income.

06

Review the application for completeness and accuracy.

07

Sign and date the application form.

08

Submit the completed application along with any required fees to the designated regulatory authority.

Who needs COLLECTION AGENCY BOND APPLICATION?

01

Any individual or business that intends to operate as a collection agency and requires a bond to comply with state or local regulations.

02

Professionals looking to legally collect debts on behalf of clients or businesses.

Fill

form

: Try Risk Free

People Also Ask about

What are three things that a debt collection agency cannot do?

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take.

How do I write a letter to a collection agency?

Dear debt collector, I am responding to your contact about collecting a debt. You contacted me by [phone/mail], on [date] and identified the debt as [any information they gave you about the debt]. I do not have any responsibility for the debt you're trying to collect.

What is a collection agency bond?

A collection agency bond is sometimes also called a debt collector bond, and it's a specific kind of surety bond, which guarantees that you will observe all the appropriate rules and regulations of your profession in the conduct of your operations.

What is a collection bond?

A collection agency bond is sometimes also called a debt collector bond, and it's a specific kind of surety bond, which guarantees that you will observe all the appropriate rules and regulations of your profession in the conduct of your operations.

How do I fill out a bond application?

How to Fill Out a Surety Bond Form Bond Number. The bond number is the unique identification number assigned to your bond. Bond Premium. This is the cost of your bond, typically calculated as a percentage of your bond coverage. Principal Name. Surety Name. State of Incorporation. Obligee Name. Bond Amount. Bond Obligation.

How much does a $75000 bond cost?

Bail bond fees usually range from 7% to 10% of the total bail. So, for a $75,000 bail, the cost could be between $5,250 and $7,500. In California, bail bond fees are often 10% of the total bail amount. This is set by the California Department of Insurance.

What happens when an agency bond is called?

Investors generally face reinvestment risk if their callable bond gets called, as they'll likely need to invest those funds into a lower-yielding bond. Callable agency bonds tend to be issued with slightly higher yields than noncallable bonds to compensate for call and reinvestment risk.

What is the downside of agency bonds?

What Are the Risks of Agency Debt? Like other bonds, agency bonds are subject to interest rate risk, meaning that they lose market value if marketwide interest rates increase. This is because prospective buyers could earn more money by buying new issues at a higher interest rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is COLLECTION AGENCY BOND APPLICATION?

A Collection Agency Bond Application is a formal request made by a collection agency to obtain a surety bond, which serves as a guarantee that the agency will operate in compliance with legal and ethical standards.

Who is required to file COLLECTION AGENCY BOND APPLICATION?

Collection agencies that operate in jurisdictions requiring licensing and bonding must file a Collection Agency Bond Application to obtain a surety bond as part of their licensing process.

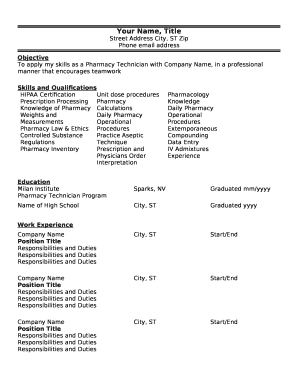

How to fill out COLLECTION AGENCY BOND APPLICATION?

To fill out a Collection Agency Bond Application, applicants need to provide their business details, legal entity information, financial information, and may need to disclose the types of debts they collect, along with any personal background information of the agency's owners or officers.

What is the purpose of COLLECTION AGENCY BOND APPLICATION?

The purpose of the Collection Agency Bond Application is to ensure that collection agencies are financially responsible and to protect consumers from unethical practices by providing a financial recourse should the agency fail to comply with applicable laws.

What information must be reported on COLLECTION AGENCY BOND APPLICATION?

The Collection Agency Bond Application typically requires reporting details such as the agency's name, address, business structure, financial statement, previous ownership experience, and any legal or regulatory issues faced by the agency.

Fill out your collection agency bond application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Collection Agency Bond Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.