NY NYS-100 2011 free printable template

Show details

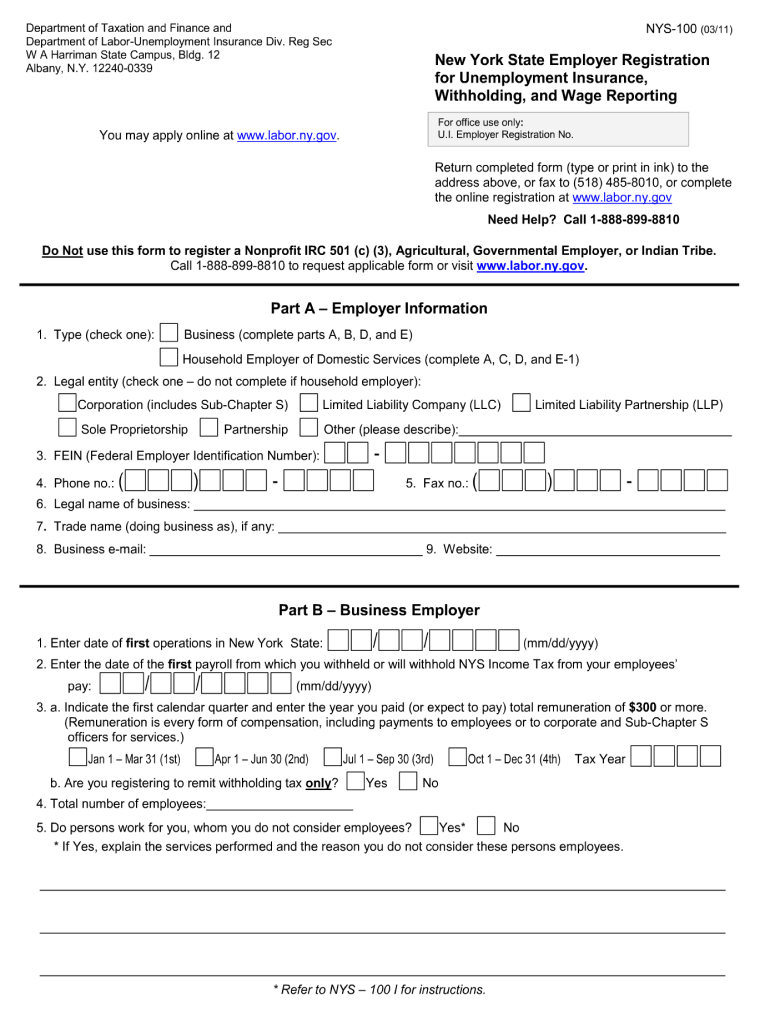

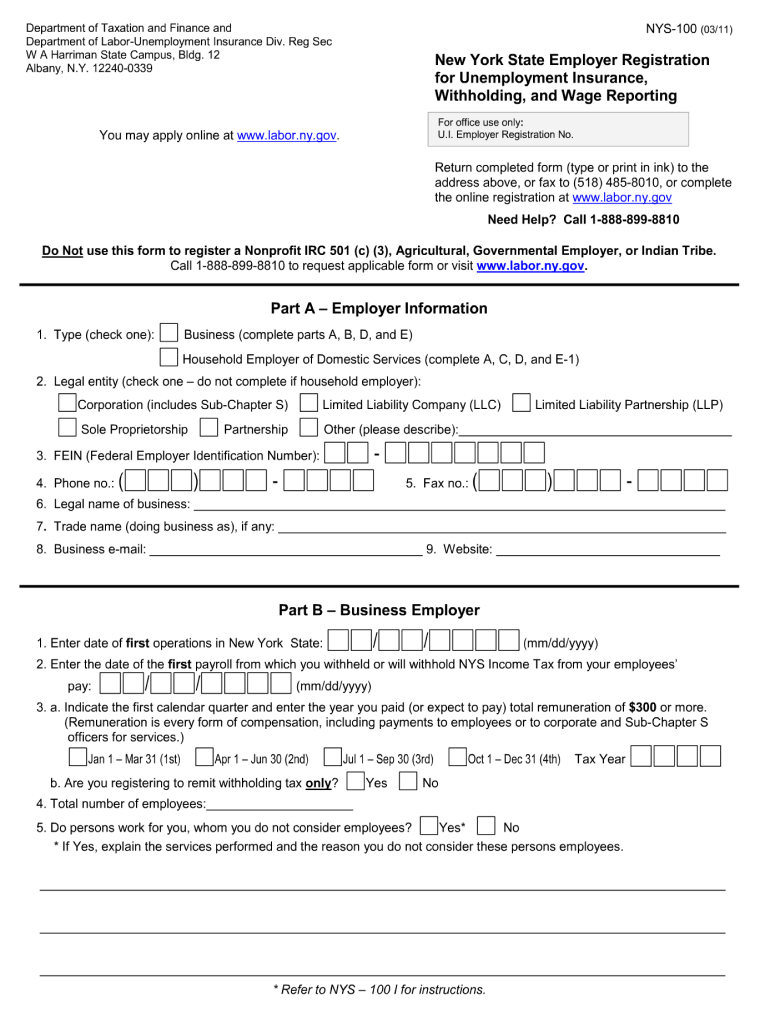

Department of Taxation and Finance and Department of Labor-Unemployment Insurance Div. Reg Sec W A Harriman State Campus, Bldg. 12 Albany, N.Y. 12240-0339 NYS-100 (03/11) New York State Employer Registration

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY NYS-100

Edit your NY NYS-100 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY NYS-100 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY NYS-100 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY NYS-100. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY NYS-100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY NYS-100

How to fill out NY NYS-100

01

Obtain the NYS-100 form from the New York State Board of Elections website or your local election office.

02

Fill out the section for your personal information, including your name, address, and date of birth.

03

Indicate your political affiliation by checking the appropriate box.

04

Review the voter registration eligibility requirements and confirm that you meet them.

05

Complete any additional sections that are relevant to your registration, such as identifying any previous voter registrations.

06

Sign and date the form.

07

Submit the form by mail or in person to your local Board of Elections office by the voter registration deadline.

Who needs NY NYS-100?

01

Individuals who are registering to vote in New York for the first time.

02

People who have changed their address or name since their last registration.

03

Anyone who wishes to update their political party affiliation.

Fill

form

: Try Risk Free

People Also Ask about

What is NY reemployment tax?

Employers pay . 075% of their quarterly wages subject to contribution to this fund. It goes on their Quarterly Combined Withholding, Wage Reporting and Unemployment Insurance Return (NYS-45).

How do I get my NYS unemployment tax documents?

How to get your 1099-G tax form. NYS DOL has mailed 1099-G tax forms to customers who were paid benefits in 2022, unless they previously opted to only receive their tax forms electronically. These forms were sent to customers' addresses on file. You can also receive your 1099-G online.

What is a NYS 100 form?

Unemployment Insurance, Withholding and Wage Reporting form. Use the NYS 100 form to register for Unemployment Insurance, withholding and wage reporting if you are a: • Business Employer, or • Household Employer of domestic services.

How do I get a NY withholding identification number?

You can register by: applying online through New York Business Express (see Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting for Business Employer (NYS 100), or. calling the Department of Labor at 1 888 899-8810 or (518) 457-4179.

How do I get a copy of my 1099 from unemployment ny by phone?

Call the Telephone Claims Center at 888-209-8124. After you select your language, follow the prompts to obtain your 1099 form. You will need the PIN you established when you filed your claim.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NY NYS-100 online?

pdfFiller has made it easy to fill out and sign NY NYS-100. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I edit NY NYS-100 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit NY NYS-100.

How do I fill out NY NYS-100 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign NY NYS-100 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is NY NYS-100?

The NY NYS-100 is a form used by employers in New York State to report information about employment and payroll taxes. It is primarily used for filing wage reporting data.

Who is required to file NY NYS-100?

Employers in New York State that have employees and are subject to unemployment insurance requirements are required to file the NY NYS-100 form.

How to fill out NY NYS-100?

To fill out the NY NYS-100, employers must provide accurate information about their business, employee wages, and the amount of taxes withheld. Detailed instructions are available on the form itself or through the New York State Department of Taxation and Finance.

What is the purpose of NY NYS-100?

The purpose of the NY NYS-100 is to ensure that employers report wages and tax withholdings accurately to the state for the correct assessment of unemployment insurance taxes and other payroll-related obligations.

What information must be reported on NY NYS-100?

The NY NYS-100 requires reporting of the employer's information, employee details such as names and social security numbers, total wages paid, taxes withheld, and any other applicable payroll data.

Fill out your NY NYS-100 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY NYS-100 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.