NY SH 810 2012-2025 free printable template

Show details

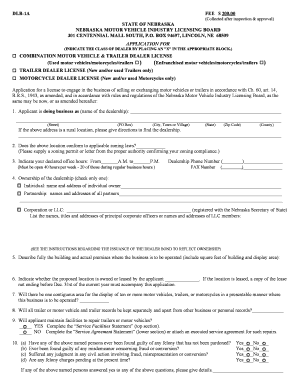

Labor Department Use Only New York State Department of Labor Division of Safety and Health License & Certification Unit, Room 161A State Campus Building 12 Albany, NY 12240 (518) 457-2735 Control

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign new york blaster form

Edit your NY SH 810 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY SH 810 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY SH 810 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY SH 810. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out NY SH 810

How to fill out NY SH 810

01

Obtain a copy of the NY SH 810 form from the NY State Department of Health website or your local health department.

02

Fill in your personal information, including your name, address, and contact details in the designated fields.

03

Indicate the purpose of the submission by selecting the appropriate category or box.

04

Provide any required details regarding your qualifications or reasons for completing the form.

05

Review the form for accuracy and completeness to ensure all necessary information is included.

06

Sign and date the form in the designated area.

07

Submit the completed form as instructed, either by mail or electronically, depending on the submission guidelines.

Who needs NY SH 810?

01

The NY SH 810 form is required for individuals seeking to apply for or renew their certification as a home health aide or personal care aide in New York State.

02

It is also necessary for employers of home health aides and personal care aides to document compliance with state regulations.

Fill

form

: Try Risk Free

People Also Ask about

How long do you have to file for unemployment after losing your job in New York?

Overview of New York State Unemployment Insurance You should file a claim for unemployment within the first week that you lose your job to begin receiving benefits as soon as possible.

What disqualifies you from unemployment in ny?

You may be denied benefits if you: Were fired because you violated a company policy, rule or procedure, such as absenteeism or insubordination. Quit your job without good cause, such as a compelling personal reason.

What is the fax number for NYS DOL Pua?

If you can, please try faxing your documents to (518) 457-9378.

What is the fax number for the ny State Department of Labor?

Fax: (518) 457-9378. Be sure that your Social Security number appears at the top right hand corner on all pages. Save your fax confirmation sheet as we do not confirm the receipt of a fax or written correspondence.

How many hours straight can you legally work in NY?

The Ten-Hour Rule If an employee works more than ten hours in a single day or works a split shift, a New York Labor Law requires that the employer pay an extra hour for each hour in excess of ten hours that an employee works. For example, if an employee works eleven hours, their employer must pay them for twelve hours.

What are NY State Labor Rules?

The basic rights all workers in New York state have are the right to be paid at least the minimum wage, to be fairly compensated for overtime work, the right to sick and safe leave, to enjoy a workplace free of harassment, discrimination, and job hazards, and the right to have days of rest and scheduled work breaks.

What is the minimum wage in Westchester NY 2023?

The state's minimum wage will increase to $17 per hour in New York City, Long Island and Westchester County over the next three years and $16 farther north as part of New York's final budget deal.

How many hours is full time in NYS labor?

Full Time or Part Time Generally, Employers define full-time Employees as those who work at least 35-40 hours during a seven-day workweek. Employers may choose to provide benefits, such as paid time off, only to full time Employees.

How many hours can you work in New York State without a break?

Employers in New York State must provide all employees time off for meals, after working a certain number of hours. In general, employers must provide at least 30 minutes of unpaid time off if an employee works more than 6 hours. The Meal Period Guidelines outline the requirements.

What is the abbreviation for New York State Department of Labor?

The New York State Department of Labor (DOL) The Local Workforce Development Board (LWDB)

What is the NYS Department Labor Number?

If you have not received a response to your request within 7 business days, please call the NYS Department of Labor at (518) 485-1283.

How do I talk to a live person at NYS Department of Labor?

New York State Department of Labor Contact Center: 800-833-3000, available Monday-Friday from 8:30 AM to 4:30 PM. Press 2 to speak with a representative.

What is New York State Labor Number?

Call our hotline toll-free at (888) 598-2077. Your call can be made anonymously.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NY SH 810 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your NY SH 810 into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit NY SH 810 online?

The editing procedure is simple with pdfFiller. Open your NY SH 810 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my NY SH 810 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your NY SH 810 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is NY SH 810?

NY SH 810 is a New York State form used for reporting the sales and use tax on certain purchases made by exempt organizations.

Who is required to file NY SH 810?

Exempt organizations, such as nonprofit entities and government agencies, that make tax-exempt purchases are required to file NY SH 810.

How to fill out NY SH 810?

To fill out NY SH 810, organizations need to provide information such as their exempt organization certificate number, the details of the purchases, and a calculation of the exempt sales tax.

What is the purpose of NY SH 810?

The purpose of NY SH 810 is to enable exempt organizations to report their tax-exempt purchases to comply with New York State tax regulations.

What information must be reported on NY SH 810?

The information that must be reported on NY SH 810 includes the name and address of the exempt organization, the exempt organization certificate number, descriptions of the purchased items, and the total amount of tax-exempt purchases.

Fill out your NY SH 810 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY SH 810 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.