Get the free Federal Brownfield Tax Incentive Application for Property Eligibility Statement - de...

Show details

This form is used to apply for a property eligibility statement under the Federal Brownfield Tax Incentive, requiring documentation of hazardous substance release or threat for properties not listed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal brownfield tax incentive

Edit your federal brownfield tax incentive form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal brownfield tax incentive form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing federal brownfield tax incentive online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit federal brownfield tax incentive. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal brownfield tax incentive

How to fill out Federal Brownfield Tax Incentive Application for Property Eligibility Statement

01

Gather necessary property information including location, size, and historical usage.

02

Obtain current environmental site assessments or reports indicating contamination.

03

Complete the application form, ensuring each section is filled out accurately.

04

Attach relevant documentation, such as site assessments and proof of ownership.

05

Review the application for completeness and accuracy.

06

Submit the application to the appropriate state agency or federal authority overseeing Brownfields.

Who needs Federal Brownfield Tax Incentive Application for Property Eligibility Statement?

01

Property owners of contaminated sites seeking tax incentives for cleanup and redevelopment.

02

Developers looking to rehabilitate brownfield properties.

03

Local governments aiming to incentivize the revitalization of contaminated areas.

04

Investors interested in environmentally safe and financially beneficial projects.

Fill

form

: Try Risk Free

People Also Ask about

What is the brownfields tax incentive?

The Brownfields Tax Incentive first passed as part of the Taxpayer Relief Act of 1997. It allowed taxpayers to deduct remediation expenditures for the cleanup of a property if the property was used for trade, business, or producing income.

What is an EPA brownfield grant?

The U.S. Environmental Protection Agency (EPA)'s Brownfield Funding [exit DNR] supports assessment and cleanup of contaminated properties through assessment, multipurpose and revolving loan fund grants. Job training and technical assistance grants are also available.

Can you sell brownfield tax credits?

The guaranteed return stemming from the tax credit can attract private banks not normally interested in housing or brownfields projects. A non-profit can sell the tax credits to investors or syndicators and become the principal partner in the project.

What is the purpose of the brownfield program?

The Brownfields Program provides information on topics relating to brownfields cleanup and redevelopment, helps community groups respond to brownfields opportunities and challenges, conducts research on the legal and policy issues associated with brownfields, and convenes key stakeholders for discussions on key issues

Can you sell brownfield tax credits?

The guaranteed return stemming from the tax credit can attract private banks not normally interested in housing or brownfields projects. A non-profit can sell the tax credits to investors or syndicators and become the principal partner in the project.

What does brownfield mean in real estate?

The federal government defines brownfields as “abandoned, idled or underused industrial and commercial properties where expansion or redevelopment is complicated by real or perceived environmental contamination.”

What is a qualifying property for the investment tax credit?

Investment credit property is any depreciable or amortizable property that qualifies for the qualifying advanced coal project credit, qualifying gasification project credit, qualifying advanced energy project credit, advanced manufacturing investment credit, energy credit, or rehabilitation credit.

What is the brownfield tax incentive?

The Brownfields Tax Incentive first passed as part of the Taxpayer Relief Act of 1997. It allowed taxpayers to deduct remediation expenditures for the cleanup of a property if the property was used for trade, business, or producing income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

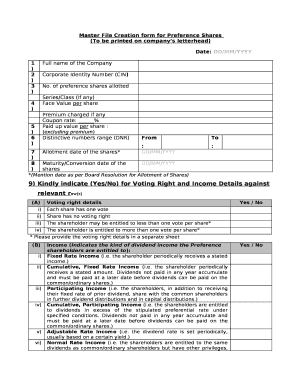

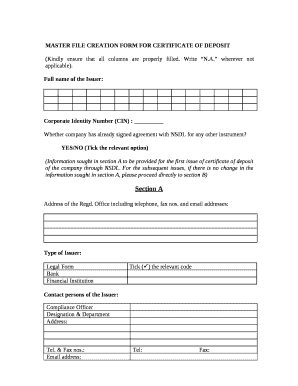

What is Federal Brownfield Tax Incentive Application for Property Eligibility Statement?

The Federal Brownfield Tax Incentive Application for Property Eligibility Statement is a document used to determine if a property qualifies for tax incentives related to the cleanup of brownfield sites, which are properties that may have hazardous substances, pollutants, or contaminants.

Who is required to file Federal Brownfield Tax Incentive Application for Property Eligibility Statement?

Property owners or developers seeking to claim tax incentives for the cleanup of brownfield properties are required to file the Federal Brownfield Tax Incentive Application for Property Eligibility Statement.

How to fill out Federal Brownfield Tax Incentive Application for Property Eligibility Statement?

To fill out the application, property owners must provide specific details about the property, including its location, current and past uses, and any known contamination issues. Necessary supporting documentation must also be included to substantiate the claim.

What is the purpose of Federal Brownfield Tax Incentive Application for Property Eligibility Statement?

The purpose of the application is to facilitate the evaluation of a property’s eligibility for federal tax incentives aimed at encouraging the cleanup and redevelopment of contaminated brownfield sites, thereby promoting environmental remediation and economic revitalization.

What information must be reported on Federal Brownfield Tax Incentive Application for Property Eligibility Statement?

Information that must be reported includes property identification details, descriptions of existing contamination, past uses of the property, and any environmental assessments or clean-up plans that have been executed or are planned.

Fill out your federal brownfield tax incentive online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Brownfield Tax Incentive is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.