Get the free or "surplus lines" insurers

Show details

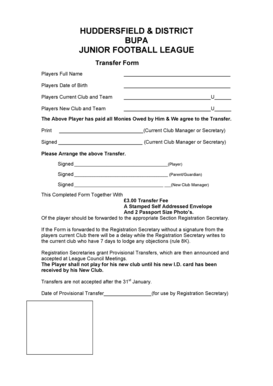

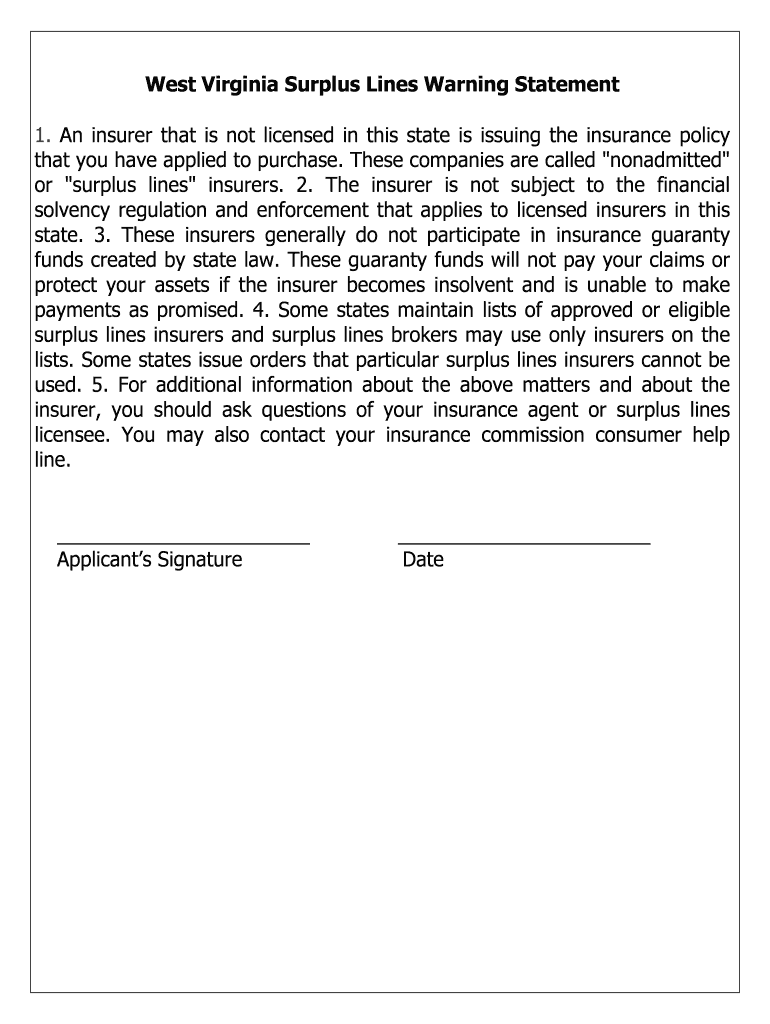

West Virginia Surplus Lines Warning Statement 1. An insurer that is not licensed in this state is issuing the insurance policy that you have applied to purchase. These companies are called nonadmitted

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign or quotsurplus linesquot insurers

Edit your or quotsurplus linesquot insurers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your or quotsurplus linesquot insurers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit or quotsurplus linesquot insurers online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit or quotsurplus linesquot insurers. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out or quotsurplus linesquot insurers

How to fill out or "surplus lines" insurers:

01

Start by gathering all relevant information: Before filling out surplus lines insurers, you need to collect all the necessary details related to the insurance coverage you are seeking. This may include information about the property or risk being insured, the desired coverage limits, and any specific requirements or conditions.

02

Research and choose a surplus lines insurer: These types of insurers are typically not licensed to operate in all states, which means they provide coverage for risks that standard insurers may not cover. Therefore, it is crucial to do your research and find a surplus lines insurer that is reliable, reputable, and authorized to operate in your state. Check with your insurance agent or the Department of Insurance for a list of approved surplus lines insurers.

03

Fill out the application form: Once you have selected a surplus lines insurer, you will need to fill out the application form provided by the insurer. This form will ask for detailed information about the insured property or risk, your desired coverage, and other relevant information. Take the time to thoroughly read and understand each question before providing accurate and complete answers.

04

Provide any necessary supporting documents: In some cases, the surplus lines insurer may require additional documents or evidence to support your application. This may include photographs, appraisals, inspection reports, or any other relevant documentation. Make sure to provide these documents as requested, as they can help the insurer accurately assess the risk and provide an appropriate quote.

05

Submit the completed application form: Once you have filled out the application form and gathered all supporting documents, review everything for accuracy and completeness. Make sure you have answered all the questions correctly and attached any requested documents. Then, submit the application to the surplus lines insurer as instructed. Some insurers may allow online submission, while others may require physical copies to be mailed or faxed.

Who needs surplus lines insurers:

01

Businesses with unique or high-risk exposures: Surplus lines insurers provide coverage for risks that standard insurers may not cover due to their unique or high-risk nature. Therefore, businesses that operate in specialized industries or face uncommon risks often turn to surplus lines insurers to obtain the necessary coverage.

02

Individuals or businesses in states with limited coverage options: In certain states, there may be limited options for obtaining certain types of insurance coverage. Surplus lines insurers can fill this gap and provide coverage that may not be available through licensed insurers in those states.

03

Organizations requiring customized coverage: Surplus lines insurers often offer flexible and customizable insurance solutions. This can be beneficial for organizations with specific coverage needs or those that require tailored policies that go beyond the scope of standard insurance offerings.

Overall, surplus lines insurers cater to those seeking coverage for unique risks, facing limitations in their state's insurance market, or requiring specialized policies. It is essential to thoroughly research, understand the requirements, and choose a reputable surplus lines insurer when considering this type of coverage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is or quotsurplus linesquot insurers?

Surplus lines insurers are insurers that underwrite risks that standard insurance companies are unwilling or unable to insure.

Who is required to file or quotsurplus linesquot insurers?

Insurance companies that provide surplus lines insurance coverage are required to file.

How to fill out or quotsurplus linesquot insurers?

To fill out surplus lines insurers, insurance companies must report specific information about the coverage provided.

What is the purpose of or quotsurplus linesquot insurers?

The purpose of surplus lines insurers is to cover risks that are not eligible for coverage from standard insurance companies.

What information must be reported on or quotsurplus linesquot insurers?

Information such as policy details, insured parties, and premium amounts must be reported on surplus lines insurers.

How do I edit or quotsurplus linesquot insurers in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing or quotsurplus linesquot insurers and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I sign the or quotsurplus linesquot insurers electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your or quotsurplus linesquot insurers and you'll be done in minutes.

Can I create an electronic signature for signing my or quotsurplus linesquot insurers in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your or quotsurplus linesquot insurers and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your or quotsurplus linesquot insurers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Or Quotsurplus Linesquot Insurers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.