Get the free Fixed Rate Mortgage

Show details

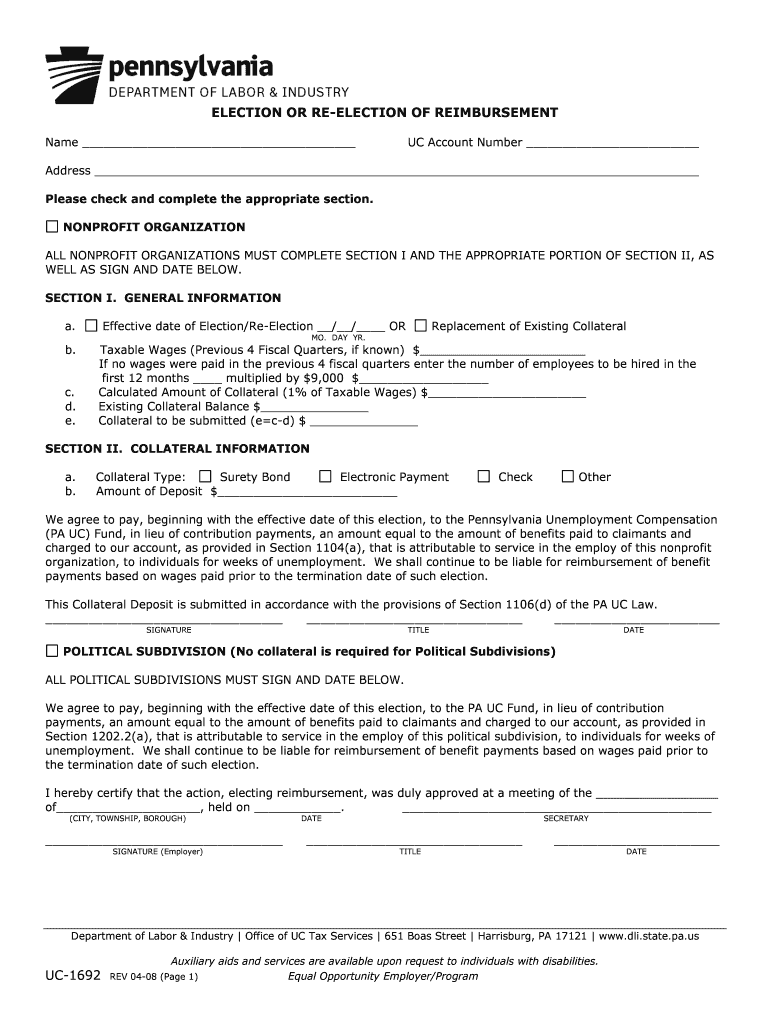

ELECTION OR REELECTION OF REIMBURSEMENT Name UC Account Number Address Please check and complete the appropriate section. NONPROFIT ORGANIZATION ALL NONPROFIT ORGANIZATIONS MUST COMPLETE SECTION I

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fixed rate mortgage

Edit your fixed rate mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fixed rate mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fixed rate mortgage online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fixed rate mortgage. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fixed rate mortgage

How to fill out fixed rate mortgage:

01

Begin by gathering all necessary documentation, including proof of income, assets, and debts.

02

Research and compare different mortgage lenders to find the best fixed rate mortgage options available.

03

Fill out the loan application form accurately and provide all requested information.

04

Provide any additional documentation required by the lender, such as tax returns or bank statements.

05

Submit the completed application and documents to the lender for processing.

06

Wait for the lender to review your application and conduct a thorough assessment of your financial situation.

07

If approved, carefully review the terms and conditions of the fixed rate mortgage offer, including the interest rate, repayment schedule, and any additional fees.

08

Seek professional guidance, such as from a real estate attorney or a mortgage broker, if needed, to ensure you fully understand the terms of the mortgage.

09

Sign the loan agreement if you are satisfied with the terms and conditions.

10

Make regular payments as outlined in the mortgage agreement to fulfill your financial obligation.

Who needs fixed rate mortgage:

01

Homebuyers who prefer stability in their monthly mortgage payments.

02

Individuals who plan to live in the same property for an extended period without the intention of selling or refinancing.

03

Those who want to accurately plan and budget their finances without the risk of fluctuating interest rates impacting their mortgage payments.

04

Borrowers who are risk-averse and do not want to be exposed to potential rate hikes or market volatility.

05

First-time homebuyers who may be more comfortable with the predictability and simplicity of a fixed rate mortgage.

06

Homeowners who currently have an adjustable rate mortgage and want to switch to a fixed rate to avoid potential payment increases in the future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fixed rate mortgage?

Fixed rate mortgage is a type of mortgage where the interest rate remains the same for the entire term of the loan.

Who is required to file fixed rate mortgage?

Individuals who are taking out a fixed rate mortgage are required to file the necessary paperwork with their lender.

How to fill out fixed rate mortgage?

To fill out a fixed rate mortgage, individuals need to provide their personal and financial information, as well as details about the property being purchased.

What is the purpose of fixed rate mortgage?

The purpose of a fixed rate mortgage is to provide borrowers with stability and predictability in their monthly mortgage payments.

What information must be reported on fixed rate mortgage?

Information such as the loan amount, interest rate, term of the loan, and details about the property being purchased must be reported on a fixed rate mortgage.

How do I make changes in fixed rate mortgage?

The editing procedure is simple with pdfFiller. Open your fixed rate mortgage in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit fixed rate mortgage straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing fixed rate mortgage.

How do I fill out fixed rate mortgage using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign fixed rate mortgage and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your fixed rate mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fixed Rate Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.